Project 1 Project 2 Initial Outlay (10) $12,000,000 $16,000,000 Annual Cash Flows (CF) $3,200,000 $5,150,000 Life of system 7 years 5 years Notes: 1) All cash flows are after tax and depreciation. 2) A discount rate of 13% is estimated as the risk in both of these projects.

Project 1 Project 2 Initial Outlay (10) $12,000,000 $16,000,000 Annual Cash Flows (CF) $3,200,000 $5,150,000 Life of system 7 years 5 years Notes: 1) All cash flows are after tax and depreciation. 2) A discount rate of 13% is estimated as the risk in both of these projects.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 4BE: Internal rate of return A project is estimated to cost 463,565 and provide annual net cash flows of...

Related questions

Question

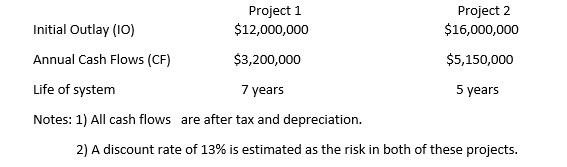

- Your client is investigating two start-up companies that operate in the same construction sector in Australia. These two companies are investigating similar projects (not both) in which they will invest. However, your client is not sure which is better and has sent the relevant details to you to advise. The characteristics of the two projects are given below:

(picture)

Your client wishes you to provide detailed calculations indicating which project you believe to be the best. The client will then decide whether to invest into the company looking to invest in the project

Transcribed Image Text:Project 1

$12,000,000

Project 2

$16,000,000

Initial Outlay (10)

Annual Cash Flows (CF)

$3,200,000

$5,150,000

Life of system

7 years

5 years

Notes: 1) All cash flows are after tax and depreciation.

2) A discount rate of 13% is estimated as the risk in both of these projects.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub