* Andrea Marie Ondivilla will pay her debt by 6 payments of 3,600 followed by 4 payments of 2,600. If the rate is at 7% compounded semiannually, make an amortization table.

* Andrea Marie Ondivilla will pay her debt by 6 payments of 3,600 followed by 4 payments of 2,600. If the rate is at 7% compounded semiannually, make an amortization table.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter7: Using Consumer Loans

Section: Chapter Questions

Problem 4FPE: Calculating single-payment loan amount due at maturity. Stanley Price plans to borrow 8,000 for five...

Related questions

Question

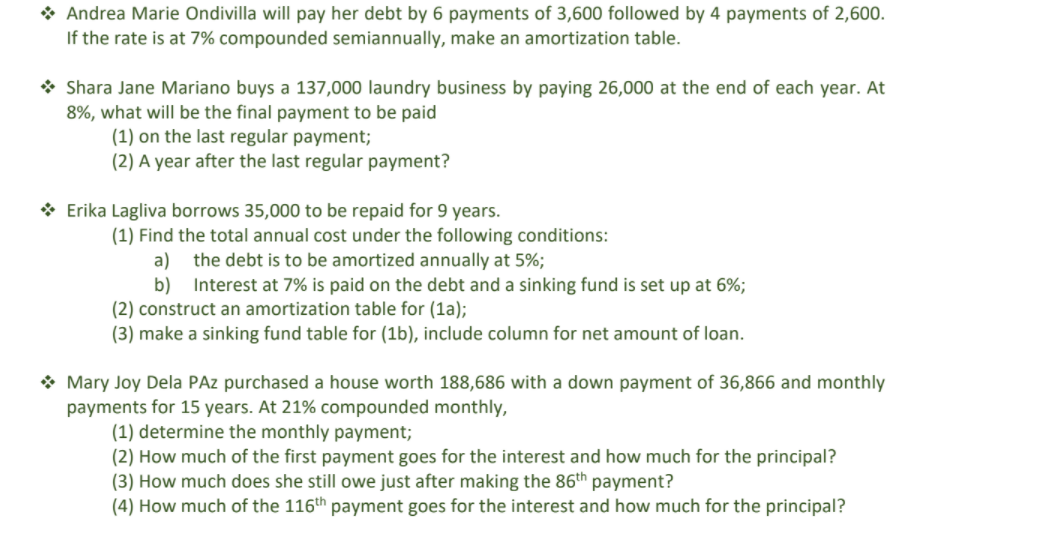

Transcribed Image Text:* Andrea Marie Ondivilla will pay her debt by 6 payments of 3,600 followed by 4 payments of 2,600.

If the rate is at 7% compounded semiannually, make an amortization table.

* Shara Jane Mariano buys a 137,000 laundry business by paying 26,000 at the end of each year. At

8%, what will be the final payment to be paid

(1) on the last regular payment;

(2) A year after the last regular payment?

* Erika Lagliva borrows 35,000 to be repaid for 9 years.

(1) Find the total annual cost under the following conditions:

a) the debt is to be amortized annually at 5%;

b) Interest at 7% is paid on the debt and a sinking fund is set up at 6%;

(2) construct an amortization table for (1a);

(3) make a sinking fund table for (1b), include column for net amount of loan.

* Mary Joy Dela PAz purchased a house worth 188,686 with a down payment of 36,866 and monthly

payments for 15 years. At 21% compounded monthly,

(1) determine the monthly payment;

(2) How much of the first payment goes for the interest and how much for the principal?

(3) How much does she still owe just after making the 86th payment?

(4) How much of the 116th payment goes for the interest and how much for the principal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT