You wish to buy a house. The market value of the house is $650,000 and you have saved $120,000 as a deposit. (i) What are your monthly repayments if the loan is for 30 years to be repaid on a monthly basis and the interest rate on the loan is 7% per annum nominal? (ii)What is the total amount of interest you expect to pay on the loan? Suppose that after 4 years, interest rates fall to 6.5% per annum nominal. If you re-finance loan, how much will you save in interest payments? Also assume that the new loan will for a period of 26 years.

You wish to buy a house. The market value of the house is $650,000 and you have saved $120,000 as a deposit. (i) What are your monthly repayments if the loan is for 30 years to be repaid on a monthly basis and the interest rate on the loan is 7% per annum nominal? (ii)What is the total amount of interest you expect to pay on the loan? Suppose that after 4 years, interest rates fall to 6.5% per annum nominal. If you re-finance loan, how much will you save in interest payments? Also assume that the new loan will for a period of 26 years.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PA: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Please explain part b of the question step by step through formula, not excel

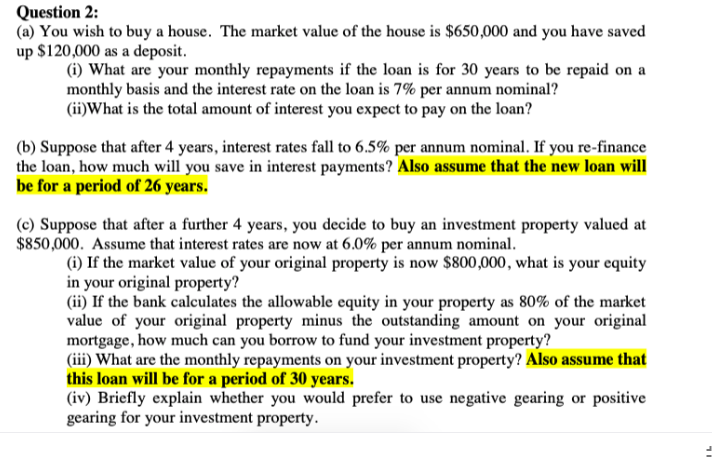

Transcribed Image Text:Question 2:

(a) You wish to buy a house. The market value of the house is $650,000 and you have saved

up $120,000 as a deposit.

(i) What are your monthly repayments if the loan is for 30 years to be repaid on a

monthly basis and the interest rate on the loan is 7% per annum nominal?

(ii)What is the total amount of interest you expect to pay on the loan?

(b) Suppose that after 4 years, interest rates fall to 6.5% per annum nominal. If you re-finance

the loan, how much will you save in interest payments? Also assume that the new loan will

be for a period of 26 years.

(c) Suppose that after a further 4 years, you decide to buy an investment property valued at

$850,000. Assume that interest rates are now at 6.0% per annum nominal.

(i) If the market value of your original property is now $800,000, what is your equity

in your original property?

(ii) If the bank calculates the allowable equity in your property as 80% of the market

value of your original property minus the outstanding amount on your original

mortgage, how much can you borrow to fund your investment property?

(iii) What are the monthly repayments on your investment property? Also assume that

this loan will be for a period of 30 years.

(iv) Briefly explain whether you would prefer to use negative gearing or positive

gearing for your investment property.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning