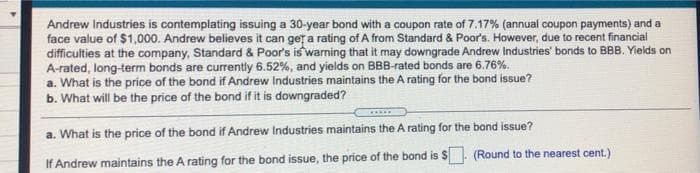

Andrew Industries is contemplating issuing a 30-year bond with a coupon rate of 7.17% (annual coupon payments) and a face value of $1,000. Andrew believes it can geț a rating of A from Standard & Poor's. However, due to recent financial difficulties at the company, Standard & Poor's is warning that it may downgrade Andrew Industries' bonds to BBB. Yields on A-rated, long-term bonds are currently 6.52%, and yields on BBB-rated bonds are 6.76%. a. What is the price of the bond if Andrew Industries maintains the A rating for the bond issue? b. What will be the price of the bond if it is downgraded? a. What is the price of the bond if Andrew Industries maintains the A rating for the bond issue? (Round to the nearest cent.) If Andrew maintains the A rating for the bond issue, the price of the bond is S

Andrew Industries is contemplating issuing a 30-year bond with a coupon rate of 7.17% (annual coupon payments) and a face value of $1,000. Andrew believes it can geț a rating of A from Standard & Poor's. However, due to recent financial difficulties at the company, Standard & Poor's is warning that it may downgrade Andrew Industries' bonds to BBB. Yields on A-rated, long-term bonds are currently 6.52%, and yields on BBB-rated bonds are 6.76%. a. What is the price of the bond if Andrew Industries maintains the A rating for the bond issue? b. What will be the price of the bond if it is downgraded? a. What is the price of the bond if Andrew Industries maintains the A rating for the bond issue? (Round to the nearest cent.) If Andrew maintains the A rating for the bond issue, the price of the bond is S

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 17P

Related questions

Question

4

Transcribed Image Text:Andrew Industries is contemplating issuing a 30-year bond with a coupon rate of 7.17% (annual coupon payments) and a

face value of $1,000. Andrew believes it can geț a rating of A from Standard & Poor's. However, due to recent financial

difficulties at the company, Standard & Poor's is warning that it may downgrade Andrew Industries' bonds to BBB. Yields on

A-rated, long-term bonds are currently 6.52%, and yields on BBB-rated bonds are 6.76%.

a. What is the price of the bond if Andrew Industries maintains the A rating for the bond issue?

b. What will be the price of the bond if it is downgraded?

a. What is the price of the bond if Andrew Industries maintains the A rating for the bond issue?

(Round to the nearest cent.)

If Andrew maintains the A rating for the bond issue, the price of the bond is $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,