Andrew invested X today in a savings bond that pays out P (principal plus interest) every quarter with first payout to be received 6 months from now. Assume that money is worth 9% payable monthly. P P P P 1/20 4/20 7/20 10/20 1/20 4/20 P P + 1 7/2010/20 (2 P P P P + 1/20 4/20 7/20 10/20 1/20 4/20 7/20 10/20 3

Andrew invested X today in a savings bond that pays out P (principal plus interest) every quarter with first payout to be received 6 months from now. Assume that money is worth 9% payable monthly. P P P P 1/20 4/20 7/20 10/20 1/20 4/20 P P + 1 7/2010/20 (2 P P P P + 1/20 4/20 7/20 10/20 1/20 4/20 7/20 10/20 3

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter7: Using Consumer Loans

Section: Chapter Questions

Problem 9FPE

Related questions

Question

look for exact amoun of current value and take note P = 5,000

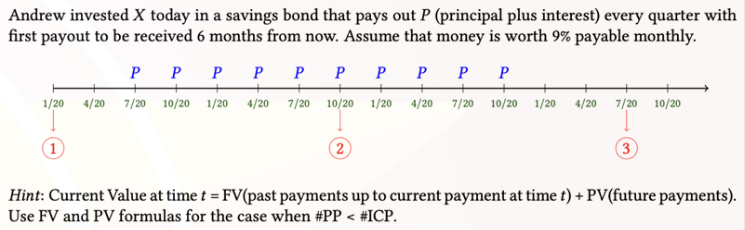

Transcribed Image Text:Andrew invested X today in a savings bond that pays out P (principal plus interest) every quarter with

first payout to be received 6 months from now. Assume that money is worth 9% payable monthly.

P

P

P

1/20 4/20 7/20 10/20 1/20 4/20

P P

7/20

1

P

P P P P

+

10/20 1/20 4/20 7/20 10/20 1/20 4/20 7/20 10/20

(2)

3

Hint: Current Value at time t = FV(past payments up to current payment at time t) + PV(future payments).

Use FV and PV formulas for the case when #PP < #ICP.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT