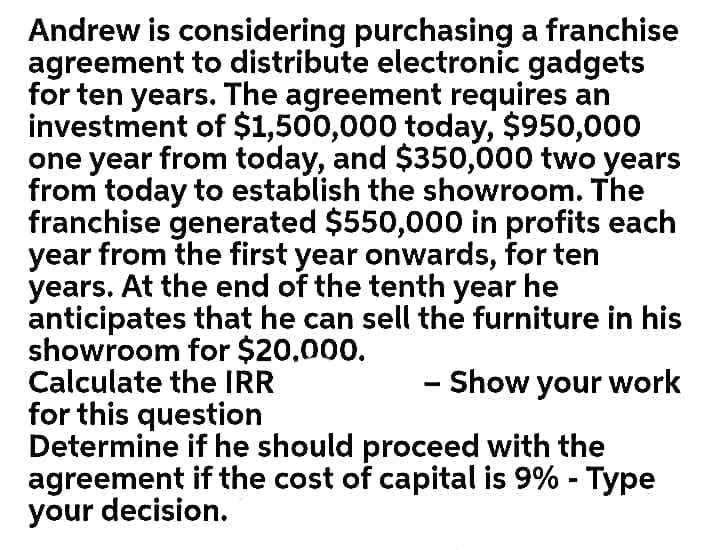

Andrew is considering purchasing a franchise agreement to distribute electronic gadgets for ten years. The agreement requires an investment of $1,500,000 today, $950,000 one year from today, and $350,000 two years from today to establish the showroom. The franchise generated $550,000 in profits each

Andrew is considering purchasing a franchise agreement to distribute electronic gadgets for ten years. The agreement requires an investment of $1,500,000 today, $950,000 one year from today, and $350,000 two years from today to establish the showroom. The franchise generated $550,000 in profits each

Chapter13: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 35P

Related questions

Question

E1

Transcribed Image Text:Andrew is considering purchasing a franchise

agreement to distribute electronic gadgets

for ten years. The agreement requires an

investment of $1,500,000 today, $950,000

one year from today, and $350,000 two years

from today to establish the showroom. The

franchise generated $550,000 in profits each

year from the first year onwards, for ten

years. At the end of the tenth year he

anticipates that he can sell the furniture in his

showroom for $20,000.

Calculate the IR

for this question

Determine if he should proceed with the

agreement if the cost of capital is 9% - Type

your decision.

- Show your work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College