announc nto of

Q: Your savings account pays 6% annually. Assuming this interest rate remains constant, how much do you…

A: If the annual saving interest is 6%. let's say the amount invested is X So total amount after 4…

Q: The Trial Balance TBA Limited contained the following accounts (alphabetically) at December 31,…

A: Net profit means the difference between the income and expenses. Financial statement means the…

Q: A manufacturing company has budgeted a manufacturing level of 100,000 units. The manufacturing unit…

A: Variance costing is a method in the costing system under which various types of variances are…

Q: Required Accounting Entry Nature of Transaction Source Document Account Debited Account Credited 1.…

A: Source document are the document are the document that reveals the sources of the transactions.…

Q: Alpha Company uses the owns a 30% investment in Bravo's common stock. During 2021, Bravo reported…

A: The question is related to investment in Associates. The details are given regarding the same.

Q: How do "sales tax-free" days impact our government?

A: sale tax free day means there will be no tax on certain items for cetain period of times. all those…

Q: In rendering cash count the auditor observed that one of the items being presented by the custodian…

A: Audit refers to the examination as well as investigation of the accounting records and the financial…

Q: What is the purpose of the valuation allowance?

A: Valuation allowances are one of these nuances that let companies estimate the future benefits of…

Q: Example Given all the following costs for a consulting firm: C= RM2,024,000, c, = RM62/service hour,…

A: The breakeven point (BEP) is determined by dividing the fixed expense incurred during business…

Q: The income statement may include all of the following items except 1. Interest expense 2.…

A: Income statement comprises of Total revenue and all expenses that are related to the business.

Q: 6. Procter & Gamble has two manufacturing departments--Forming and Packaging. The company used the…

A: Lets understand the basics. Activity rate is required to calculate to allocate overhead cost to…

Q: a. Prepare a cash budget for September, October, November, and December. Enter all amounts as…

A: Introduction:- A cash budget shows estimation of cash inflows and outflows over a specific period of…

Q: Equipment Purchase price was $ 500000 on January 01, 2018. Salvage value at the end of the 10 Years…

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life years

Q: Complete Shadee's budgeted income statement for the months of May and June. Required information…

A: Budgeted income statement.

Q: You plan to invest in one of two home delivery pizza companies, High and Low, that were recently…

A: Earning per Share Earning per share is one of the important ratio tool which determine the value of…

Q: Current Attempt in Progress Blossom Company provides the following information about its defined…

A: Pension expenses- Pension expense is the amount that a company charges to expense in relation to its…

Q: Find the monthly payment (in $) and the total interest (in $) for a mortgage of $48,000 at 5% for 40…

A: Monthly payment = P x r x (1 + r)n/[(1 + r)n - 1] where, Principal (P) = 48,000 Monthly interest…

Q: Kator Co. is a manufacturer of industrial components. One of their products that is used as a…

A: The special order is acceptable if Total manufacturing variable costs can be covered from the price…

Q: Myers Corporation has the following data related to direct materials costs for November: actual cost…

A: Formula: Direct Material price variance = (Actual price per pound - Standard price per pound)*Actual…

Q: Prepare journal entries to record the following transactions. A. November 19, purchased merchandise…

A: Inventory is one of the important current asset of the business. It can be in the form of raw…

Q: purchased on January 01, 2019 for $600.000. The expected life is 8 years. salvage value is $10000.…

A: Lets understand the basics. Depreciation is a reduction in value of asset due to wear and tear,…

Q: AA and BB entered into a partnership on March 1, 2022, by investing the following assets: AA BB…

A: A partnership is an agreement between two or more partners where partners are agreed to work…

Q: NRP Toys sold 275,000 units at P37.50 per unit Variable cost=P17.50 pu (Mfg cost=14, Selling…

A: Breakeven sales quantity: =Fixed cost / Contribution per unit Cash breakeven sales quantity: =Cash…

Q: Exercise 7-14 Variable Costing Unit Product Cost and Income Statement; Break-Even Analysis (LO7-1,…

A: Contribution per unit = Selling price per unit - Variable cost per unit…

Q: s of P10 par value ordinary shares issued and outstan cember 10, 2020. This is payable on March…

A: When the dividends are declared by the board of directors to be paid to the shareholders, a journal…

Q: The following data summarize the operations during the year. A. Purchase of raw materials on…

A: There are two type of costs being incurred in business of manufacturing or purchases. These may be…

Q: Accounting Sleepy Ltd negotiated a purchase of land, building and equipment from Bambi Corp. The…

A: Depreciation: It is the method that is utilized to distribute the cost of a tangible or physical…

Q: A factory has decided to purchase some new équipment for P650, 000. The equipment will be kept for…

A: The depreciation expense is charged on fixed assets as reduced value of the fixed asset with usage…

Q: C.requires equilibrium of resources and the claims on those resources

A: Answer: The accounting is equation is called the balance sheet equation. According to the accounting…

Q: (ou are applying for a conventional mortgage from the Americana Bank. Your nonthly gross income is…

A: Gross Income- A mortgage loan can only finance movable property. Land, trees, buildings, and…

Q: Marie Company had a 10% P3,000,000 specific construction loan and 12% P25,000,000 general loan…

A: Cost of building will include the expenses incurred on the construction of building and interest on…

Q: Current Position Analysis The following items are reported on a company's balance sheet: Cash…

A: The ratio analysis helps to analyse the financial statements of the business with various elements…

Q: 500000 258000 250000 62000 Ending retained Earnings? Question 24) Sales Variable and fixed costs…

A: Formula: Ending Retained Earnings = Beginning retained Earnings + Net income - Dividends paid

Q: 9. Which of the following will not appear in a cash budget in the same month? A. Cash sales B.…

A: Cash budget is the estimation of cash receipts and cash payments for the particular period. It helps…

Q: 12. The units of Product PKO available for sale during the year were as follows: Apr 1 Apr 16 Apr 20…

A: Under FIFO method, it is assumed that units purchased first will be sold first. Total units sold= 60…

Q: Exercise 5-12 Equivalent Units; Assigning Costs; Cost Reconciliation-Weighted-Average Method (LO5-2,…

A: A cost reconciliation statement is a document that reconciles the profits or losses reported by cost…

Q: ava Lake Inc. bottles and distributes sp ake reacquired 38,700 shares of its con C. sold 33,500 of…

A: Journal is the book of original entry in which all the financial transactions of the business are…

Q: Wolseley Manufacturing Corporation manufactures various electronics products and follows a…

A: ABC stands for Activity based costing which allocates the overhead as well as indirect costs to the…

Q: On January 2, 2021, the Jackson Company purchased equipment to be used in its manufacturing process.…

A: ANSWER 1)Purchase date of Equipment =January 2,2021 Estimated life of equipment=8 Estimated residual…

Q: With respect to its new product launch, Ernst and Anderson Manufacturing Ltd has gathered the…

A: Variable cost are the costs that changes with the change in the output level. Like direct material…

Q: Question 1 Consider that ABC Company has two options: Sell the old equipment for $400,000 and…

A: Option A: Sell the old equipment and purchase the new equipment with $300,000($700,000-$400,000),…

Q: Helen started a computer programming business (12/2016), Helen’s Programming Service. The following…

A: The financial statements of the business including income statement, balance sheet are prepared from…

Q: The City of Kastle purchased a vehicle for the parks department. If the operations of the parks…

A: As the asset is finance by general revenue hence it is part of general fund. Governmental activities…

Q: Exercise 10-24 (Algo) Interest capitalization [L010-7] On January 1, 2021, the Highlands Company…

A: Expenditure×Weight=Average

Q: The present value of the net cash flows for Product A is $65,145 while the cost of the initial…

A: The question is based on the concept of Financial Management. Profitability index is the ratio of…

Q: On October 01, 2000, Mr Alberto opened a computer rental shop. The following transactions occurred…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: You are a mortgage broker at Interamerican Bank. One of your clients, Bill Cramer, has submitted an…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: Corrections of errors in prior period are included in A. Other comprehensive income B. Net income…

A: Introduction:- Prior period expenses are occurred in the current period as a result of errors in the…

Q: What is an unrecognized tax benefit and how does it affect a company's current income tax expense?

A: The Meaning of Income Tax: FASB defines income tax as a tax on earnings. It is measured in terms of…

Q: Canadian tax principles-2 Lester Inc. has 220,000 common shares outstanding. All of these shares…

A: Answer: Lester inc. owns 220,000 issued common stock. All of these stocks was sold for $13 per, for…

Step by step

Solved in 2 steps

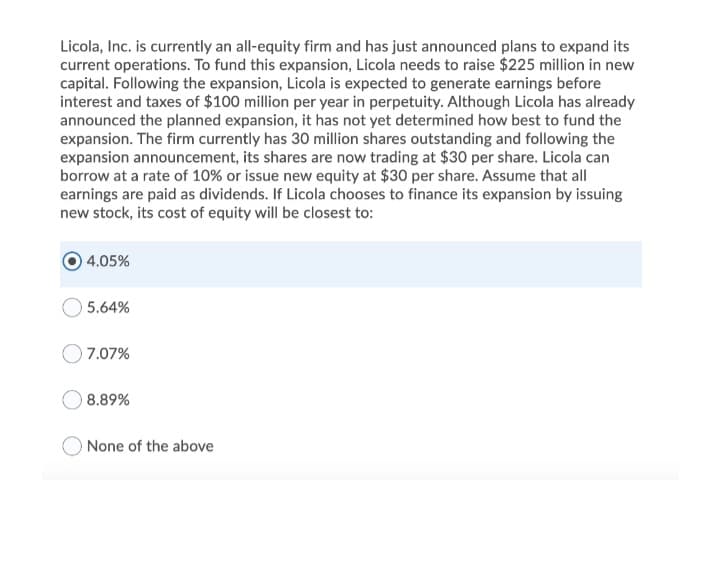

- The finance manager of the GZA Ltd is considering a recapitalization plan that would convert GZA from its current all-equity capital structure to one including substantial financial leverage. -GZA now has 10,000,000 ordinary shares outstanding, which are selling for $15 each, and the company’s EBIT is expected to be $12,000,000 per year for the foreseeable future. -The recapitalization proposal is to issue $60,000,000 worth of long-term, perpetual debt at an annual interest rate of 3.0% and use the proceeds to repurchase 4,000,000 ordinary shares worth $60,000,000. Assume perfect capital markets with no market frictions such as corporate or personal income taxes. Calculate the earnings per share and expected return on equity for GZA’s shareholders under both the current all-equity capital structure and under the recapitalization plan.The finance manager of the GZA Ltd is considering a recapitalization plan that would convert GZA from its current all-equity capital structure to one including substantial financial leverage. -GZA now has 10,000,000 ordinary shares outstanding, which are selling for $15 each, and the company’s EBIT is expected to be $12,000,000 per year for the foreseeable future. -The recapitalization proposal is to issue $60,000,000 worth of long-term, perpetual debt at an annual interest rate of 3.0% and use the proceeds to repurchase 4,000,000 ordinary shares worth $60,000,000. Assume perfect capital markets with no market frictions such as corporate or personal income taxes. Calculate the breakeven level of EBIT where the earnings per share are the same under the current and proposed capital structures.Halfdome believes that its optimal capital structure consists of 55% common equity and 45% debt, and its tax rate is 25%. Halfdome must raise additional capital to fund its upcoming expansion. The firm will have $4 million of retained earnings with a cost of . New common stock in an amount up to $8 million would have a cost of . Furthermore, Halfdome can raise up to $4 million of debt at an interest rate of and an additional $5 million of debt at . The CFO estimates that a proposed expansion would require an investment of $8.2 million. What is the weighted average cost of capital (WACC) for the last dollar raised to complete the expansion? (Assume that cost of debt is 9% and cost of equity is 12.5%). 12.69% 8.45% 10.32% 9.91% None of the above

- Your employer, a midsized human resources management company, is considering expansion into related fields, including the purchase of Biggerstaff & McDonand (B&M), a privately held company owned by two friends, each with 5 million shares of stock. B&M currently has free cash flow of $24 million, which is expected to grow at a constant rate of 5%. B&M’s financial statements report short-term investments of $100 million, debt of $200 million, and preferred stock of $50 million. B&M’s weighted average cost of capital (WACC) is 11%. Use B&M’s data and the free cash flow valuation model to answer the following questions: What is its estimated intrinsic value of equity? What is its estimated intrinsic stock price per share?Your employer, a midsized human resources management company, is considering expansion into related fields, including the purchase of Biggerstaff & McDonand (B&M), a privately held company owned by two friends, each with 5 million shares of stock. B&M currently has free cash flow of $24 million, which is expected to grow at a constant rate of 5%. B&M’s financial statements report short-term investments of $100 million, debt of $200 million, and preferred stock of $50 million. B&M’s weighted average cost of capital (WACC) is 11%. Use B&M’s data and the free cash flow valuation model to answer the following questions: What is the estimated value of operations? What is the estimated total corporate value? (this is the entity value.) What is its estimated intrinsic value of equity? What is its estimated intrinsic stock price per share?You are working for an imports-exports company. In the current financial year, your company has a net income of $851,000 and plans to use a part of it as retained earnings for a new project which will cost $500,000 next year. The company's stock is currently listed and actively traded on ASX. Required: a) Calculate the amount of net income available for the company to pay dividends to current shareholders if it maintains a capital structure of 46% in debt funding and 54% in equity funding, assuming residual dividend theory applies. b) Your company is going to pay an annual dividend of $5 per share and extra dividend of $2 per share in 4 weeks. The standard process of settlement in ASX is T+2. If tomorrow is the ex-dividend date, when is the record date for dividend payment? calculate the ex-dividend price if today's market price is $43.5, given the dividend tax rate is 13%. c) Your company needs to make a payment of AUD 245,000 to a partner in Tokyo. If the direct…

- IMB has 1 million outstanding shares, currently trading at $10 each, and it is all-equity financed. Current earnings are $2 million, which also provide the company’s current cash holdings. At the next board meeting, the directors will be discussing whether to implement a new investment project, not yet known to the public. The project costs $1 million and it will generate expected earnings of $.5 million a year, in perpetuity starting one year from now. The appropriate discount rate for the project is 10%. If the project is not undertaken, the firm will pay a dividend of $2 a share. If the project is implemented, the firm must decide how to finance it. The board is considering two options: i) to finance the investment project by retaining earnings and paying only $1 dividend per share; ii) to keep the dividend at $2 per share, and to finance the project by issuing new equity. Shares are issued ex-dividend. Capital markets are perfect (no taxes).Icarus Airlines is proposing to go public, and you have been given the task of estimating the value of its equity. Management plans to maintain debt at 27% of the company’s present value, and you believe that at this capital structure the company’s debt holders will demand a return of 5% and stockholders will require 12%. The company is forecasting that next year’s operating cash flow (depreciation plus profit after tax at 21%) will be $65 million and that investment in plant and net working capital will be $27 million. Thereafter, operating cash flows and investment expenditures are forecast to grow in perpetuity by 4% a year. a. What is the total value of Icarus? b. What is the value of the company’s equity? (For all the requirements, do not round intermediate calculations. Enter your answers in millions rounded to 1 decimal place.)Kohwe Corporation plans to issue equity to raise $50 million to finance a new investment. After making the investment, Kohwe expects to earn free cash flows of $10 million each year. Kohwe currently has 5 million shares outstanding, and has no other assets or opportunities. Suppose the appropriate discount rate for Kohwe's future free cash flows is 8%, and the only capital market imperfections are corporate taxes and financial distress costs. a. What is the NPV of Kohwe's investment? b. What is Kohwe's share price today? Suppose Kohwe borrows the $50 million instead. The finn will pay interest only on this loan each year, and maintain an outstanding balance of $40 million on the loan. Suppose that Kohwe's corporate tax rate is 35%, and expected free cash flows are still $9 million each year. c. What is Kohwe's share price today if the investment is financed with debt? Now suppose that with leverage, Kohwe's expected free cash flows wiH decline to $8 million per year due…

- Gemini, Inc., an all-equity firm, is considering a $1.7 million investment that will be depreciated according to the straight-line method over its four-year life. The project is expected to generate earnings before taxes and depreciation of $595,000 per year for four years. The investment will not change the risk level of the firm. The company can obtain a four-year, 9.5 percent loan to finance the project from a local bank. They will receive the total amount needed for investment ($1.7 million at time 0 and all principal will be repaid in one balloon payment at the end of the fourth year (similar to a bond). Every year the company would need to pay interest (@9.5%). If the company finances the project entirely with equity, the firm’s cost of capital would be 13 percent. The corporate tax rate is 30 percent. Calculate the cash flows and NPV for the two cases:Icarus Airlines is proposing to go public, and you have been given the task of estimating the value of its equity. Management plans to maintain debt at 20% of the company’s present value, and you believe that at this capital structure the company’s debt holders will demand a return of 8% and stockholders will require 11%. The company is forecasting that next year’s operating cash flow (depreciation plus profit after tax at 21%) will be $58 million and that investment in plant and net working capital will be $20 million. Thereafter, operating cash flows and investment expenditures are forecast to grow in perpetuity by 4% a year. a. What is the total value of Icarus? b. What is the value of the company’s equity?Icarus Airlines is proposing to go public, and you have been given the task of estimating the value of its equity. Management plans to maintain debt at 30% of the company's present value, and you believe that at this capital structure the company's debtholders will demand a return of 6% and stockholders will require 11%. The company is forecasting that next year's operating cash flow (depreciation plus profit after tax at 21%) will be $68 million and that investment in plant and net working capital will be $30 million. Thereafter, operating cash flows and investment expenditures are forecast to grow in perpetuity by 4% a year. What is the total value of Icarus? What is the value of the company's equity?