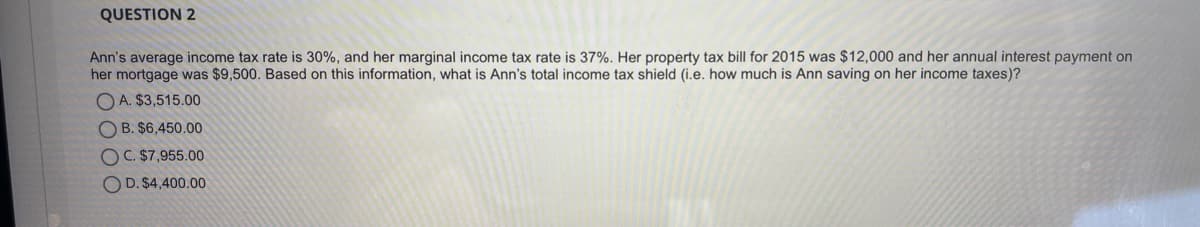

Ann's average income tax rate is 30%, and her marginal income tax rate is 37%. Her property tax bill for 2015 was $12,000 and her annual interest payment on her mortgage was $9,500. Based on this information, what is Ann's total income tax shield (i.e. how much is Ann saving on her income taxes)? OA. $3,515.00 O B. $6,450.00 OC. $7,955.00 OD.$4,400.00

Ann's average income tax rate is 30%, and her marginal income tax rate is 37%. Her property tax bill for 2015 was $12,000 and her annual interest payment on her mortgage was $9,500. Based on this information, what is Ann's total income tax shield (i.e. how much is Ann saving on her income taxes)? OA. $3,515.00 O B. $6,450.00 OC. $7,955.00 OD.$4,400.00

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:QUESTION 2

Ann's average income tax rate is 30%, and her marginal income tax rate is 37%. Her property tax bill for 2015 was $12,000 and her annual interest payment on

her mortgage was $9,500. Based on this information, what is Ann's total income tax shield (i.e. how much is Ann saving on her income taxes)?

O A. $3,515.00

O B. $6,450.00

OC. $7,955.00

O D. $4,400.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning