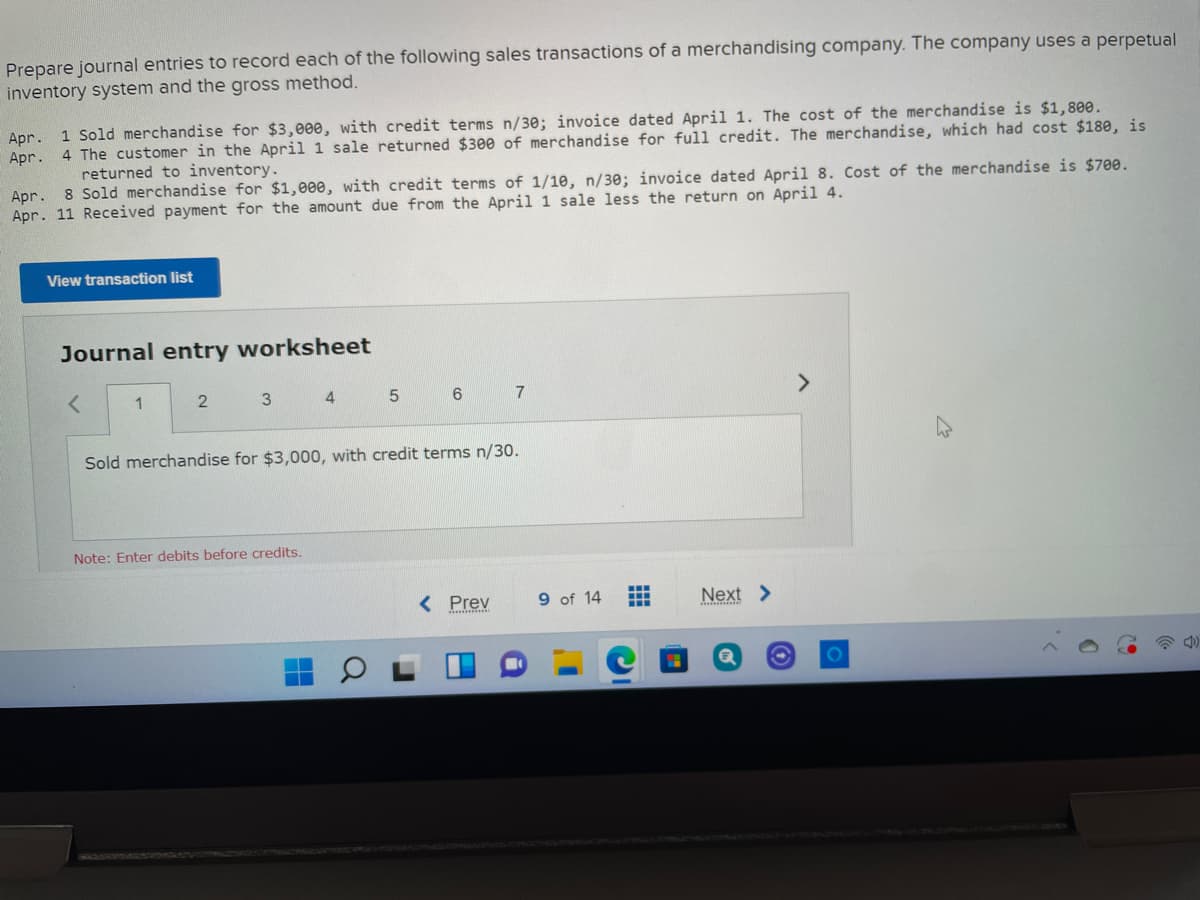

Prepare journal entries to record each of the following sales transactions of a merchandising company. The company uses a perpe nventory system and the gross method. Apr. 1 Sold merchandise for $3,000, with credit terms n/30; invoice dated April 1. The cost of the merchandise is $1,800. Apr. 4 The customer in the April 1 sale returned $300 of merchandise for full credit. The merchandise, which had cost $180, is returned to inventory. Apr. 8 Sold merchandise for $1,000, with credit terms of 1/1e, n/30; invoice dated April 8. Cost of the merchandise is $700e. Apr. 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet

Q: Salaries and wages payable $1,700 Notes payable (long-term) $1,700 Salaries and wages expense 51,800...

A: Formula: Net income = Total revenues - Total Expenses.

Q: Grateful Enterprises had the following income before tax provision and effective annual tax rate for...

A: Income tax expense is the amount of income tax which is to be paid taxation authority. It is calcula...

Q: Prepare the journal entry to record Autumn Company's issuance of 63,000 shares of no-par value commo...

A: For no par value shares issued, there is no discount or premium is recorded as the par value for the...

Q: Solve the following problems 1. if it takes 6 cups of flour to make 48 cupcakes, calculate how much...

A: Answer: According to the question, 6 cups of flour is required to make 48 cupcakes.

Q: Fixed Cost per Month Cost per Car Washed Cleaning supplies $ 0.80 Electricity $ 1,200 $ 0.15 Maint...

A: Solution: Lavage Rapide Revenue and spending Variances For the month ended August 31 Partic...

Q: The Department and Board may remove a license limitation as soon as the next license cycle begins. i...

A: The Department and Board mar remove a license limitation if after reviewing the petitioner they dete...

Q: On January 1, the Matthews Band pays $65,800 for sound equipment. The band estimates it will use thi...

A: Depreciation means fall in the value of assets due to its usage, wear and tear and with efflux of ti...

Q: The partners' proht and los sharing ratio is 2:35, respectively 8, V. AND S PARTNERSHIP Balance Shee...

A: The partnership comes into existence when two or more persons agree to do the business and further s...

Q: GO RUSH Co.'s check register shows the following entries for the month of December: Date Checks...

A: Bank Reconciliation Statement is the statement in the tabular format that shows the difference in ea...

Q: During the year ended 30 June 2021, Game Ltd rents office space from its parent Mayne Ltd for S150 0...

A: In consolidation, inter-company transactions are eliminated through worksheet entry. This entry is n...

Q: Jacaranda Builders is undertaking an analysis of supplier costs in order to evaluate the relative co...

A: The method or technique of costing which is used in those manufacturing units which are continuously...

Q: Explain the steps necessary to calculate and record LIFO Reserve, and consequential Write-Down under...

A: LIFO reserve refers to the inventory method which is defined as the difference among what the ending...

Q: Madrid Company plans to issue 8% bonds with a par value of $4,000,000. The company sells $3,600,000 ...

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal....

Q: The matching concept helps managers provide for more effective operations because it suggests Group ...

A: Ans. Matching concept ensures that all the cost and revenue belonging to a period should be recognis...

Q: Identify the following users as either External users or Internal users. a. Distribution managers b....

A: Internal users are the people who run, manage, and operate the day-to-day operations of a company's ...

Q: Which of the following statements represents Margin of Safety (units)? O a. Expected sales (units) l...

A: Solution: The margin of safety represent sales level that generates profits. Therefore margin of saf...

Q: Which of the following is not a period cost? Group of answer choices Sales commissions. Public relat...

A: Cost can be divided in to different groups including period cost, product cost etc. Period cost are ...

Q: 1. Based on the above information, prepare a bank reconciliation for the Wisconsin Company. 2. Prepa...

A: A bank reconciliation statement is prepared to identify the reason for differences between the balan...

Q: Use the 2016 marginal tax rates to compute the tax owed by the following person. A single woman with...

A: Income tax payable is an obligation by the tax payer to the government on the taxable income. Income...

Q: The ABC Company had the following transactions in 2021, the first year of its operations: 1. Issued ...

A:

Q: Using a statement of Cash flow for the year ended 31st December 2019, write a report to the Managing...

A: Statement of cash flow is the part of financial statements which is used to show the movement of cas...

Q: Prepare correcting entries as of December 31, 2020 7. The delivery expense of P 1,800 incurred on Oc...

A: When transactions occur as part of the business operations of a company, records will be made accord...

Q: Sale of short-term stock investments Cash collections from customers Purchase of used equipment Depr...

A: The cash flow from investing activities include the cash flow from sale or purchase of fixed assets,...

Q: The ABC Company had the following transactions in 2021, the first year of its operations: 1. Issued ...

A: Financial Statements - Financial Statements included income Statement, Statement of Retained Earning...

Q: Acquired a press at an invoice price of P2,000,000 subject to a 5% cash discount which was taken. Co...

A: Total increase in equipment account Particulars Amount in P Invoice price of press 2,000,000 ...

Q: A company has provided the following data: Sales Sales price Variable cost Fixed cost If the dollar ...

A: There are two type of costs incurred in the business. One is fixed costs and other is variable costs...

Q: What is the book value of the equipment at the end of 5 years if it was bought at P870,000, salvage ...

A: Purchase Cost of Equipment P8,70,000.00 Less: Salvage Value P90,000.00 Depreciable Value (P87000...

Q: On January 15, Ross Furniture, Inc., accepts a $5,000, 180-day, 10 percent note from a customer at t...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: On May 3, Zirbal Corporation purchased 4,000 shares of its own stock for $36,000 cash. On November 4...

A: sometime companies purchase share of their own stock from other stock holder of the company. such r...

Q: Explain the different sources of finance for funding working capital or short term finance requireme...

A: Working capital is that part of the firm's total capital which is required for financing short term ...

Q: calculate the cost they pay for the purchase.

A: Cost of purchase refers to the amount paid by a company to the manufacturer or seller of a product t...

Q: Riverton Corp., which began business at the start of the current year, had the following data: Plan...

A: The income statement shows the net income or net loss of the company. It is calculated by deducting ...

Q: The plant assets section of the comparative balance sheets of Anders Company is reported below. ANDE...

A: To determine the cash received from the sale of the asset we will use the book value figure of the a...

Q: Cost of Goods Sold Gross Sales Net Ending Profit Beg Inventory Purchases Inventory Net Sales returns...

A: Net sales is calculated as adjustment to gross sales for sales discounts and sales returns.

Q: Differentiate Fund Theory-Based Financial Statements from Fund Accounting-Based Financial Statements...

A: Note: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered o...

Q: Rantzow-Lear Company buys and sells debt securities expecting to earn profits on short-term differen...

A: Bonds: Bonds indicate fixed-income financial instruments issued by Corporates, any government, and M...

Q: The TimpRiders LP has operated a motorcycle dealership for a number of years. Lance is the limited p...

A: Introduction Partners basis is the partners interest in partner ship, partnership tax law often refe...

Q: Big Trucks INC. is a company that provides car rental services. The company's fleet is mostly made u...

A: Replacement cost is the cost that is incurred by the company by replacing the old asset with the new...

Q: lech Co. and Robpotics CO. are joint

A: Techa Co has its own business as well as it has joint venture ...

Q: 1. Prepare the journal entry to record Tamas Company's issuance of 5,000 shares of $100 par value, 7...

A: Solution... 1. Cash received on issuance = 5,000 shares * $102 per share = $510,000 Par value...

Q: E15.22) Supplier Activities Classify the following supplier-related activities as either unit level,...

A:

Q: On December 22, Travis Company purchased merchandise on account from a supplier for $7,500, terms 2/...

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in...

Q: EARNINGS PER TEFINEO Earnings per share example is a small preferred shareholders, Cheerful Merchand...

A: Net income $122,200 Preferred dividend $17,000 Earnings available to common stockholders $122,20...

Q: In the manufacture of 9,600 units of a product, direct materials cost incurred was $177,300, direct ...

A: Lets understand the basics. Conversion cost is a cost of converting raw material into finished goods...

Q: Selling Land for $50,000 more then what the business originally purchased the Land for would result ...

A: Selling land for a price greater than its acquisition cost would result in a net profit. Statement ...

Q: Salaries and wages payable $1,700 Notes payable (long-term) $1,700 Salaries and wages expense 51,800...

A: The income statement is one of the important financial statement of the business which records the r...

Q: M Corp. has an employee benefit plan for compensated absences that gives each employee 15 paid vacat...

A: Short-term employee benefits are those expenses that are expected to be paid within twelve months af...

Q: Vancouver Catch, Inc., processes salmon for various distributors and it uses the weighted- average m...

A: Solution Equivalent units of production It is the number of Completed units of an item that a compa...

Q: Homestead Crafts, a distributor of handmade gifts, operates out of owner Emma Finn's house. At the e...

A: Total units in period-end inventory = Units of product on hand + Number of units in Van + Number of ...

Q: On December 31, 2020, Berclair Inc. had 225 million shares of common stock and 4 million shares of 9...

A: Earning Per Share (EPS): Net profit divided by the number of common shares issued and outstanding is...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Review the following transactions and prepare any necessary journal entries for Lands Inc. A. On December 10, Lands Inc. contracts with a supplier to purchase 450 plants for its merchandise inventory, on credit, for $12.50 each. Credit terms are 4/15, n/30 from the invoice date of December 10. B. On December 28, Lands pays the amount due in cash to the supplier.Review the following transactions and prepare any necessary journal entries for Tolbert Enterprises. A. On April 7, Tolbert Enterprises contracts with a supplier to purchase 300 water bottles for their merchandise inventory, on credit, for $10 each. Credit terms are 2/10, n/60 from the invoice date of April 7. B. On April 15, Tolbert pays the amount due in cash to the supplier.The following transactions relate to Hawkins, Inc., an office store wholesaler, during June of this year. Terms of sale are 2/10, n/30. The company is located in Los Angeles, California. June 1Sold merchandise on account to Hendrix Office Store, invoice no. 1001, 451.20. The cost of the merchandise was 397.06. 3Bought merchandise on account from Krueger, Inc., invoice no. 845A, 485.15; terms 1/10, n/30; dated June 1; FOB San Diego, freight prepaid and added to the invoice, 15 (total 500.15). 10Sold merchandise on account to Ballard Stores, invoice no. 1002, 2,483.65. The cost of the merchandise was 2,235.29. 13Bought merchandise on account from Kennedy, Inc., invoice no. 4833, 2,450.13; terms 2/10, n/30; dated June 11; FOB San Francisco, freight prepaid and added to the invoice, 123 (total 2,573.13). 18Sold merchandise on account to Lawson Office Store, invoice no. 1003, 754.99. The cost of the merchandise was 671.94. 20Issued credit memo no. 33 to Lawson Office Store for merchandise returned, 103.25. The cost of the merchandise was 91.89. 25Bought merchandise on account from Villarreal, Inc., invoice no. 4R32, 1,552.30; terms net 30; dated June 18; FOB Santa Rosa, freight prepaid and added to the invoice, 84 (total 1,636.30). 30Received credit memo no. 44 for merchandise returned to Villarreal, Inc., for 224.50. Required Record the transaction in the general journal using the perpetual inventory system. If using Working Papers, use pages 25 and 26.

- The following transactions were completed by Nelsons Boutique, a retailer, during July. Terms of sales on account are 2/10, n/30, FOB shipping point. July 3Received cash from J. Smith in payment of June 29 invoice of 350, less cash discount. 6Issued Ck. No. 1718, 742.50, to Designer, Inc., for invoice. no. 2256, recorded previously for 750, less cash discount of 7.50. July 9Sold merchandise in the amount of 250 on a credit card. Sales tax on this sale is 6%. The credit card fee the bank deducted for this transaction is 5. 10Issued Ck. No. 1719, 764.40, to Smart Style, Inc., for invoice no. 1825, recorded previously on account for 780. A trade discount of 25% was applied at the time of purchase, and Smart Style, Inc.s credit terms are 2/10, n/30. 12Received 180 cash in payment of June 20 invoice from R. Matthews. No cash discount applied. 18Received 1,575 cash in payment of a 1,500 note receivable and interest of 75. 21Voided Ck. No. 1720 due to error. 25Received and paid utility bill, 152; Ck. No. 1721, payable to City Utilities Company. 31Paid wages recorded previously for the month, 2,586, Ck. No. 1722. Required 1. Journalize the transactions for July in the cash receipts journal, the general journal (for the transaction on July 9th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.Gomez Company sells electrical supplies on a wholesale basis. The balances of the accounts as of April 1 have been recorded in the general ledger in your Working Papers and CengageNow. The following transactions took place during April of this year: Apr. 1 Sold merchandise on account to Myers Company, invoice no. 761, 570.40. 5 Sold merchandise on account to L. R. Foster Company, invoice no. 762, 486.10. 6 Issued credit memo no. 50 to Myers Company for merchandise returned, 40.70. 10 Sold merchandise on account to Diaz Hardware, invoice no. 763, 293.35. 14 Sold merchandise on account to Brooks and Bennett, invoice no. 764, 640.16. 17 Sold merchandise on account to Powell and Reyes, invoice no. 765, 582.12. 21 Issued credit memo no. 51 to Brooks and Bennett for merchandise returned, 68.44. 24 Sold merchandise on account to Ortiz Company, invoice no. 766, 652.87. 26 Sold merchandise on account to Diaz Hardware, invoice no. 767, 832.19. 30 Issued credit memo no. 52 to Diaz Hardware for damage to merchandise, 98.50. Required 1. Record these sales of merchandise on account in the sales journal. If using Working Papers, use page 39. Record the sales returns and allowances in the general journal. If using Working Papers, use page 74. 2. Immediately after recording each transaction, post to the accounts receivable ledger. 3. Post the amounts from the general journal daily. Post the sales journal amount as a total at the end of the month: Accounts Receivable 113, Sales 411, Sales Returns and Allowances 412. 4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable controlling account with the total of the schedule of accounts receivable.Mays Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Mays Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales and purchase of merchandise are as follows: Jan. 2Bought nine Matte Nail Color Kits from Mejia, Inc., 450, invoice no. 4521, dated January 1; terms 2/10, n/30; FOB shipping point, freight prepaid and added to the invoice, 87.50 (total 537.50). 5Bought 30 Perfume Cocktail Rings from Braun, Inc., 1,200, invoice no. 37A, dated January 3; terms 2/10, n/30; FOB destination. 8Sold two Matte Nail Color Kits on account to J. Herbert, sales slip no. 113, 110, plus sales tax of 8.80, total 118.80. 11Received credit memo no. 455 from Braun, Inc., for merchandise returned, 315.25. 18Bought 15 Eye Palettes from Vargas, Inc., 660, invoice no. 910, dated January 14; terms net 30; FOB destination. 23Sold four Eye Palettes on account to T. Cantrell, sales slip no. 114, 200, plus sales tax of 16, total 216. 26Issued credit memo no. 12 to T. Cantrell for merchandise returned, 50 plus 4 sales tax, total 54. Required 1. If using Working Papers, open the following accounts in the accounts receivable ledger and record the balances as of January 1: T. Cantrell, 86.99; J. Hebert, 63.47. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 2. If using Working Papers, open the following accounts in the accounts payable ledger and record the balances as of January 1: Braun, Inc., 513.20; Mejia, Inc., 113.40; Vargas, Inc., 67.15. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 3. If using Working Papers, record the January 1 balances in the general ledger as given: Accounts Receivable 113 controlling account, 150.46; Accounts Payable 212 controlling account, 693.75; Sales Tax Payable 214, 237.89. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 4. Record the transactions in the general journal. If using Working Papers, begin on page 17. 5. Post the entries to the general ledger and accounts receivable ledger or accounts payable ledger as appropriate. 6. Prepare a schedule of accounts receivable. 7. Prepare a schedule of accounts payable. 8. Compare the totals of the schedules with the balances of the controlling accounts.

- West Bicycle Shop uses a three-column purchases journal. The company is located in Topeka, Kansas. In addition to a general ledger, the company also uses an accounts payable ledger. Transactions for January related to the purchase of merchandise are as follows: Jan. 4 Bought fifty 10-speed bicycles from Nielsen Company, 4,775, invoice no. 26145, dated January 3; terms net 60 days; FOB Topeka. 7 Bought tires from Barton Tire Company, 792, invoice no. 9763, dated January 5; terms 2/10, n/30; FOB Topeka. 8 Bought bicycle lights and reflectors from Gross Products Company, 384, invoice no. 17317, dated January 6; terms net 30 days; FOB Topeka. 11 Bought hand brakes from Bray, Inc., 470, invoice no. 291GE, dated January 9; terms 1/10, n/30; FOB Kansas City, freight prepaid and added to the invoice, 36 (total 506). 19 Bought handle grips from Gross Products Company, 96.50, invoice no. 17520, dated January 17; terms net 30 days; FOB Topeka. 24 Bought thirty 5-speed bicycles from Nielsen Company, 1,487, invoice no. 26942, dated January 23; terms net 60 days; FOB Topeka. 29 Bought knapsacks from Davila Manufacturing Company, 304.80, invoice no. 762AC, dated January 26; terms 2/10, n/30; FOB Topeka. 31 Bought locks from Lamb Safety Net, 415.47, invoice no. 27712, dated January 26; terms 2/10, n/30; FOB Dodge City, freight prepaid and added to the invoice, 22 (total 437.47). Required 1. If using Working Papers, open the following accounts in the accounts payable ledger and record the January 1 balances, if any, as given: Barton Tire Company, 156; Bray, Inc.; Davila Manufacturing Company, 82.88; Gross Products Company; Lamb Safety Net, 184.20; Nielsen Company. For the accounts having balances, write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow or CLGL. 2. If using Working Papers, record the balance of 423.08 in the Accounts Payable 212 controlling account as of January 1. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow or CLGL. 3. Record the transactions in the purchases journal. If using Working Papers, begin on page 81. 4. Post to the accounts payable ledger daily. Skip this step if using CLGL. 5. Post to the general ledger at the end of the month. Skip this step if using CLGL. 6. Prepare a schedule of accounts payable, and compare the balance of the Accounts Payable controlling account with the total of the schedule of accounts payable.Guardian Services Inc. had the following transactions during the month of April: a. Record the June purchase transactions for Guardian Services Inc. in the following purchases journal format: b. What is the total amount posted to the accounts payable and office supplies accounts from the purchases journal for April? c. What is the April 30 balance of the Officemate Inc. creditor account assuming a zero balance on April 1?Bay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted trial balance (shown on the next page) at the end of the fiscal year. Merchandise inventories at the beginning of the year were as follows: Book Department, 53,410; Software Department, 23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar): Sales Salary Expense (payroll register): Book Department, 45,559; Software Department, 35,629 Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, 7,851; Software Department, 2,682 Store Supplies Expense (requisitions): Book Department, 205; Software Department, 199 Miscellaneous Selling Expense (volume of gross sales): Book Department, 240; Software Department, 110 Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet Bad Debts Expense (volume of gross sales): Book Department, 1,029; Software Department, 441 Miscellaneous General Expense (volume of gross sales): Book Department, 364; Software Department, 156 Required Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.

- Shirleys Beauty Store records sales and purchase transactions in the general journal. In addition to a general ledger, Shirleys Beauty Store also uses an accounts receivable ledger and an accounts payable ledger. Transactions for January related to the sales and purchase of merchandise are as follows: Jan. 3Bought 30 Mango Bath and Shower Gels from Madden, Inc., 660, invoice no. 3487, dated January 1; terms 2/10, n/30; FOB shipping point, freight prepaid and added to the invoice, 125.43 (total 785.43). 4Bought ten Beauty Candle Travel Sets from Calhoun Candles, Inc., 420, invoice no. 4513, dated January 1; terms net 45; FOB destination. 12Sold four Mango Bath and Shower Gels on account to R. Kielman, sales slip no. 1456, 120, plus sales tax of 9.60, total 129.60. 13Received credit memo no. 8715 from Calhoun Candles, Inc., for merchandise returned, 84. 21Bought five Winter Skin Essentials Kits from Whitney and Waters, 197.50, invoice no. A875, dated January 18; terms 2/15, n/45; FOB destination. 25Sold three Winter Skin Essentials on account to A. Benner, sales slip no. 1457, 135.75, plus sales tax of 10.86, total 146.61. 27Issued credit memo no. 33 to A. Benner for merchandise returned, 45.25 plus 3.62 sales tax, total 48.87. Required 1. If using Working Papers, open the following accounts in the accounts receivable ledger and record the balances as of January 1: A. Benner, 45.77; R. Kielman, 175.39. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 2. If using Working Papers, open the following accounts in the accounts payable ledger and record the balances as of January 1: Calhoun Candles, Inc., 355.23; Madden, Inc., 573.15; Whitney and Waters, 50.25. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 3. If using Working Papers, record the January 1 balances in the general ledger as given: Accounts Receivable 113 controlling account, 221.16; Accounts Payable 212 controlling account, 978.63; Sales Tax Payable 214, 128.45. Write Balance in the Item column and place a check mark in the Post. Ref. column. Skip this step if using CengageNow. 4. Record the transactions in the general journal. If using Working Papers, begin on page 25. 5. Post the entries to the general ledger and accounts receivable ledger or accounts payable ledger as appropriate. 6. Prepare a schedule of accounts receivable. 7. Prepare a schedule of accounts payable. 8. Compare the totals of the schedules with the balances of the controlling accounts.The following transactions were completed by Nelsons Hardware, a retailer, during September. Terms on sales on account are 1/10, n/30, FOB shipping point. Sept. 4Received cash from M. Alex in payment of August 25 invoice of 275, less cash discount. 7Issued Ck. No. 8175, 915.75, to Top Tools, Inc., for invoice. no. 2256, recorded previously for 925, less cash discount of 9.25. 10Sold merchandise in the amount of 175 on a credit card. Sales tax on this sale is 8%. The credit card fee the bank deducted for this transaction is 5. 11Issued Ck. No. 8176, 653.40, to Snap Tools, Inc. for invoice no. 726, recorded previously on account for 660. A trade discount of 15% was applied at the time of purchase, and Snap Tools, Inc.s credit terms are 1/10, n/45. 15Received 95 cash in payment of August 20 invoice from N. Johnson. No cash discount applied. 19Received 1,165 cash in payment of a 1,100 note receivable and interest of 65. 22Voided Ck. No. 8177 due to error. 26Received and paid telephone bill, 62; Ck. No. 8178, payable to Southern Telephone Company. 30Paid wages recorded previously for the month, 3,266, Ck. No. 8179. Required 1. Journalize the transactions for September in the cash receipts journal, the general journal (for the transaction on Sept. 10th), or the cash payments journal as appropriate. Assume the periodic inventory method is used. 2. If you are using Working Papers, total and rule the journals. Prove the equality of debit and credit totals.Review the following transactions, and prepare any necessary journal entries for Sewing Masters Inc. A. On October 3, Sewing Masters Inc. purchases 800 yards of fabric (Fabric Inventory) at $9.00 per yard from a supplier, on credit. Terms of the purchase are 1/5, n/40 from the invoice date of October 3. B. On October 8, Sewing Masters Inc. purchases 300 more yards of fabric from the same supplier at an increased price of $9.25 per yard, on credit. Terms of the purchase are 5/10, n/20 from the invoice date of October 8. C. On October 18, Sewing Masters pays cash for the amount due to the fabric supplier from the October 8 transaction. D. On October 23, Sewing Masters pays cash for the amount due to the fabric supplier from the October 3 transaction.