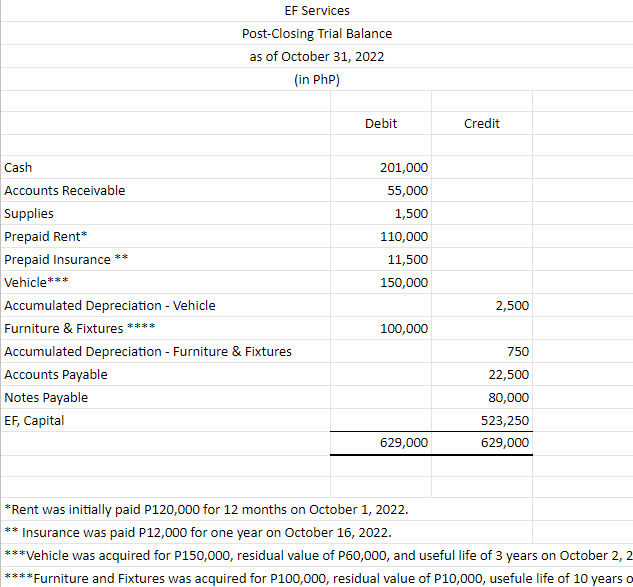

Answer number 4-5 EF is a service provider. During the month of November 2022, he completed the following transactions. Nov-0: Purchase supplies, P15,000 2 Paid P10,000 for business permit, DTI registration, BIR registration, and other permits and licenses. 2 Billed client for service rendered, P15,000 2 The owner withdrew P30,000 for personal use 3 Received cash from client for service rendered, P25,000 5 Billed client for service rendered, P35,000 6 Purchase supplies from National Bookstore, P12,000 14 Received cash from previously billed customer, P10,000 15 Paid P7,500 salary to employee 16 Paid accounts payable, P22,000 20 Received bill from advertiser, P5,000 25 Billed client for service rendered, P35,000 28 Paid mechanic for repairs and maintenance of vehicle, P5,000 30 Received cash from client for service rendered, P15,000 30 Paid P7,500 salary to employee 30 Received utility bills, meralco P5,500, water district P800, telephone P2,500 30 The owner withdrew P30,000 for personal use Data for adjustment 1 Supplies on hand, P500 2 Rent 3 Insurance 4 Vehicle - depreciation 5 Furniture & Fixtures - Depreciation 6 unbilled customer, P5,000 7 unpaid workers, P15,000

Answer number 4-5

EF is a service provider. During the month of November 2022, he completed the following transactions. Nov-0: Purchase supplies, P15,000 2 Paid P10,000 for business permit, DTI registration, BIR registration, and other permits and licenses. 2 Billed client for service rendered, P15,000 2 The owner withdrew P30,000 for personal use 3 Received cash from client for service rendered, P25,000 5 Billed client for service rendered, P35,000 6 Purchase supplies from National Bookstore, P12,000 14 Received cash from previously billed customer, P10,000 15 Paid P7,500 salary to employee 16 Paid accounts payable, P22,000 20 Received bill from advertiser, P5,000 25 Billed client for service rendered, P35,000 28 Paid mechanic for repairs and maintenance of vehicle, P5,000 30 Received cash from client for service rendered, P15,000 30 Paid P7,500 salary to employee 30 Received utility bills, meralco P5,500, water district P800, telephone P2,500 30 The owner withdrew P30,000 for personal use Data for adjustment 1 Supplies on hand, P500 2 Rent 3 Insurance 4 Vehicle -

Step by step

Solved in 3 steps