Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 6E

Required:

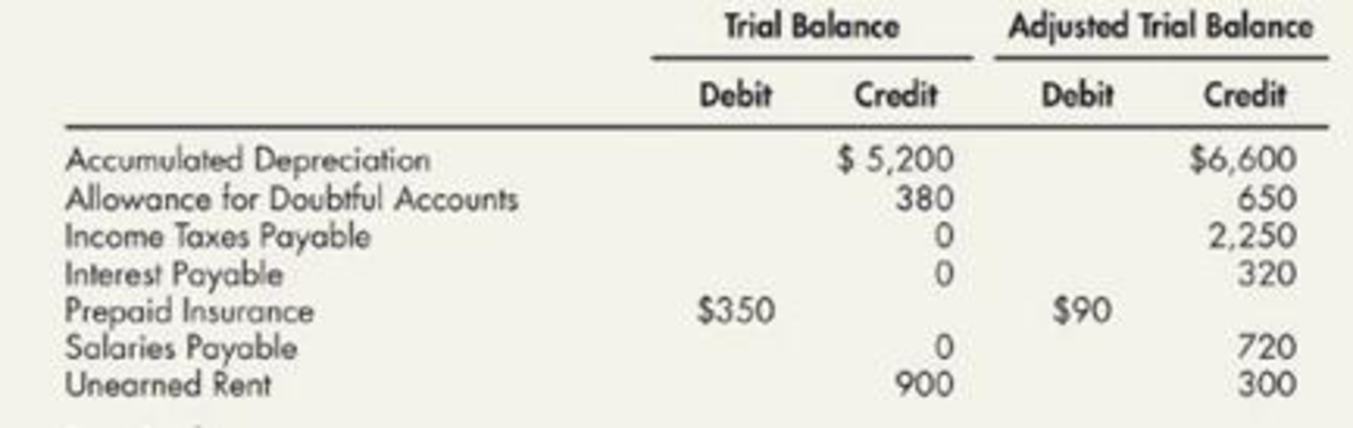

Next Level Prepare the adjusting entry that caused the change in each account balance.

Expert Solution & Answer

Trending nowThis is a popular solution!

Chapter 3 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 3 - What is the primary purpose of an accounting...Ch. 3 - What is the relationship between the accounting...Ch. 3 - Show the expanded accounting equation using the 10...Ch. 3 - Explain and distinguish between a transaction; an...Ch. 3 - Explain how the accounting equation organizes...Ch. 3 - What is the difference between a permanent and a...Ch. 3 - Prob. 7GICh. 3 - Why is it advantageous to a company to initially...Ch. 3 - What is a perpetual inventory accounting system?...Ch. 3 - Give examples of transactions that: a. Increase an...

Ch. 3 - Give examples of transactions that: a. Increase...Ch. 3 - Prob. 12GICh. 3 - Prob. 13GICh. 3 - Prob. 14GICh. 3 - Prob. 15GICh. 3 - Explain and provide examples of deferrals,...Ch. 3 - Prob. 17GICh. 3 - Prob. 18GICh. 3 - Prob. 19GICh. 3 - Prob. 20GICh. 3 - Prob. 21GICh. 3 - What are the major financial statements of a...Ch. 3 - Prob. 23GICh. 3 - Prob. 24GICh. 3 - Prob. 25GICh. 3 - Prob. 26GICh. 3 - Prob. 27GICh. 3 - Prob. 28GICh. 3 - Prob. 29GICh. 3 - What is cash-basis accounting? What must a company...Ch. 3 - On May 1, Johnson Corporation purchased inventory...Ch. 3 - On January 1, Tolson Company purchased a building...Ch. 3 - On July 1, Friler Company purchased a 1-year...Ch. 3 - Prob. 4RECh. 3 - Garcia Company rents out a portion of its building...Ch. 3 - Prob. 6RECh. 3 - Goldfinger Corporation had account balances at the...Ch. 3 - Prob. 8RECh. 3 - For the current year, Vidalia Company reported...Ch. 3 - Use the information in RE3-6, (a) assuming Ringo...Ch. 3 - (Appendix 3.1) Vickelly Company uses cash-basis...Ch. 3 - Financial Statement Interrelationship Draw a...Ch. 3 - Journal Entries Mead Company uses a perpetual...Ch. 3 - Journal Entries The following are selected...Ch. 3 - Adjusting Entries Your examination of Sullivan...Ch. 3 - Adjusting Entries The following are several...Ch. 3 - Adjusting Entries The following partial list of...Ch. 3 - Basic Income Statement The following are selected...Ch. 3 - Periodic Inventory System Raynolde Company uses a...Ch. 3 - Closing Entries Lloyd Bookstore shows the...Ch. 3 - Financial Statements Turtle Company has prepared...Ch. 3 - Worksheet for Service Company Whitaker Consulting...Ch. 3 - Worksheet, Including Inventory Surian Motors...Ch. 3 - Reversing Entries On December 31, 2019, Kellams...Ch. 3 - Special Journals The following are several...Ch. 3 - (Appendix 3.1) Cash-Basis Accounting Puntarelli...Ch. 3 - Adjusting Entries The following information is...Ch. 3 - Prob. 2PCh. 3 - Adjusting Entries Sarah Companys trial balance on...Ch. 3 - Prob. 4PCh. 3 - Errors in Financial Statements At the end of the...Ch. 3 - Journal Entries, Posting, and Trial Balance Luke...Ch. 3 - Effects of Errors: During the current accounting...Ch. 3 - Financial Statements Mackenzie Inc. uses a...Ch. 3 - Prob. 9PCh. 3 - Worksheet Victoria Company has the following...Ch. 3 - Worksheet Devlin Company has prepared the...Ch. 3 - Comprehensive On November 30, 2019. Davis Company...Ch. 3 - Reversing Entries Thomas Company entered into two...Ch. 3 - Reversing Entries On December 31, 2019, Mason...Ch. 3 - Adjusting Entries At the end of 2019, Richards...Ch. 3 - Prob. 16PCh. 3 - Comprehensive (Appendix 3.1) Dawson OConnor is the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- POSTING ADJUSTING ENTRIES Two adjusting entries are in the following general journal. Post these adjusting entries to the four general ledger accounts. The following account numbers were taken from the chart of accounts: 141, Supplies; 219, Wages Payable; 511, Wages Expense; and 523, Supplies Expense. If you are not using the working papers that accompany this text, enter the following balances before posting the entries: Supplies, 200 Debit; and Wages Expense, 1,200 Debit.arrow_forwardWORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO DETERMINE ADJUSTING ENTRIES The partial work sheet shown below is taken from the books of Stark Street Computers, a business owned by Logan Cowart, for the year ended December 31, 20--. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted trial balance and the trial balance. 2. Journalize the adjusting entries in a general journal.arrow_forwardPOSTING ADJUSTING ENTRIES Two adjusting entries are shown in the following general journal. Post these adjusting entries to the four general ledger accounts. The following account numbers were taken from the chart of accounts: 145, Prepaid Insurance; 183.1, Accumulated DepreciationCleaning Equipment; 541, Depreciation ExpenseCleaning Equipment; and 535, Insurance Expense. If you are not using the working papers that accompany this text, enter the following balances before posting the entries: Prepaid Insurance, 960 Debit; Accumulated DepreciationCleaning Equipment, 870 Credit.arrow_forward

- Use the following account T-balances (assume normal balances) and correct balance information to make the December 31 adjusting journal entries.arrow_forwardReconstruction of Adjusting Entries from Unadjusted and Adjusted Trial Balances Following are the unadjusted and adjusted trial balances for Power Corp. on May 31: Required Reconstruct the adjusting entries that were made on Powers books at the end of May. By how much would Powers net income for May have been overstated or understated (indicate which) if these adjusting entries had not been recorded?arrow_forwardWORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO DETERMINE ADJUSTING ENTRIES The partial work sheet shown below is taken from the books of Burnside Auto Parts, a business owned by Barbara Davis, for the year ended December 31, 20--. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted trial balance and the trial balance. 2. Journalize the adjusting entries in a general journal.arrow_forward

- Prepare an adjusted trial balance from the following account information, considering the adjustment data provided (assume accounts have normal balances). Adjustments needed: Physical count of supplies inventory remaining at end of period, $2,150 Taxes payable at end of period, $3,850arrow_forwardThe ledger accounts after adjusting entries for Cortez Services are presented below. a. Journalize the following closing entries and number as steps 1 through 4. b. What is the new balance of J. Cortez, Capital after closing? Show your calculations.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. depreciation on fixed assets, $ 8,500 B. unexpired prepaid rent, $12,500 C. remaining balance of unearned revenue, $555arrow_forward

- Balance Sheet without Amounts The following is an alphabetical list of all of While Limnology Companys adjusted trial balance accounts as of December 31, 2019: Required: Prepare White Limnologys balance sheet (without amounts) in proper format.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forwardFrom the following Company S adjusted trial balance, prepare the following: A. Income Statement B. Retained Earnings Statement C. Balance Sheet (simple—unclassified) D. Closing journal entries E. Post-Closing Trial Balancearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY