apital Investment Appraisal s the company's Financial Analyst, you have been tasked to attend a high-level tradeshow in plumbia. The purpose is to view and purchase two heavy duty machines to use in the oduction, bottling and packaging of the company's new line of soda pops. The projected net shflows for two (2) machinery the company is considering investing in are as follows. Predicted Cash Flows ears Machine A: The Mega Star2022 Machine B: Turbo Mac2022 SUSD SUSD ($25 million) 3 million ($20 million) 2 million 4 million 4 million 5 million 4 million 6 million 8 million 7 million 6 million 8 million 11 million 9 million 8 million 7 million 6 million 6 million 5 million 6 million 3 million equired A. Utilize capital investment appraisal techniques to determine which Machine should be pursued for the selected period based on the initial cost of $25 million and $20 million respectively, and a cost of capital of 10%.

apital Investment Appraisal s the company's Financial Analyst, you have been tasked to attend a high-level tradeshow in plumbia. The purpose is to view and purchase two heavy duty machines to use in the oduction, bottling and packaging of the company's new line of soda pops. The projected net shflows for two (2) machinery the company is considering investing in are as follows. Predicted Cash Flows ears Machine A: The Mega Star2022 Machine B: Turbo Mac2022 SUSD SUSD ($25 million) 3 million ($20 million) 2 million 4 million 4 million 5 million 4 million 6 million 8 million 7 million 6 million 8 million 11 million 9 million 8 million 7 million 6 million 6 million 5 million 6 million 3 million equired A. Utilize capital investment appraisal techniques to determine which Machine should be pursued for the selected period based on the initial cost of $25 million and $20 million respectively, and a cost of capital of 10%.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 5E: Cash payback period for a service company Janes Clothing Inc. is evaluating two capital investment...

Related questions

Question

Capital Investment Appraisal

Transcribed Image Text:Capital Investment Appraisal

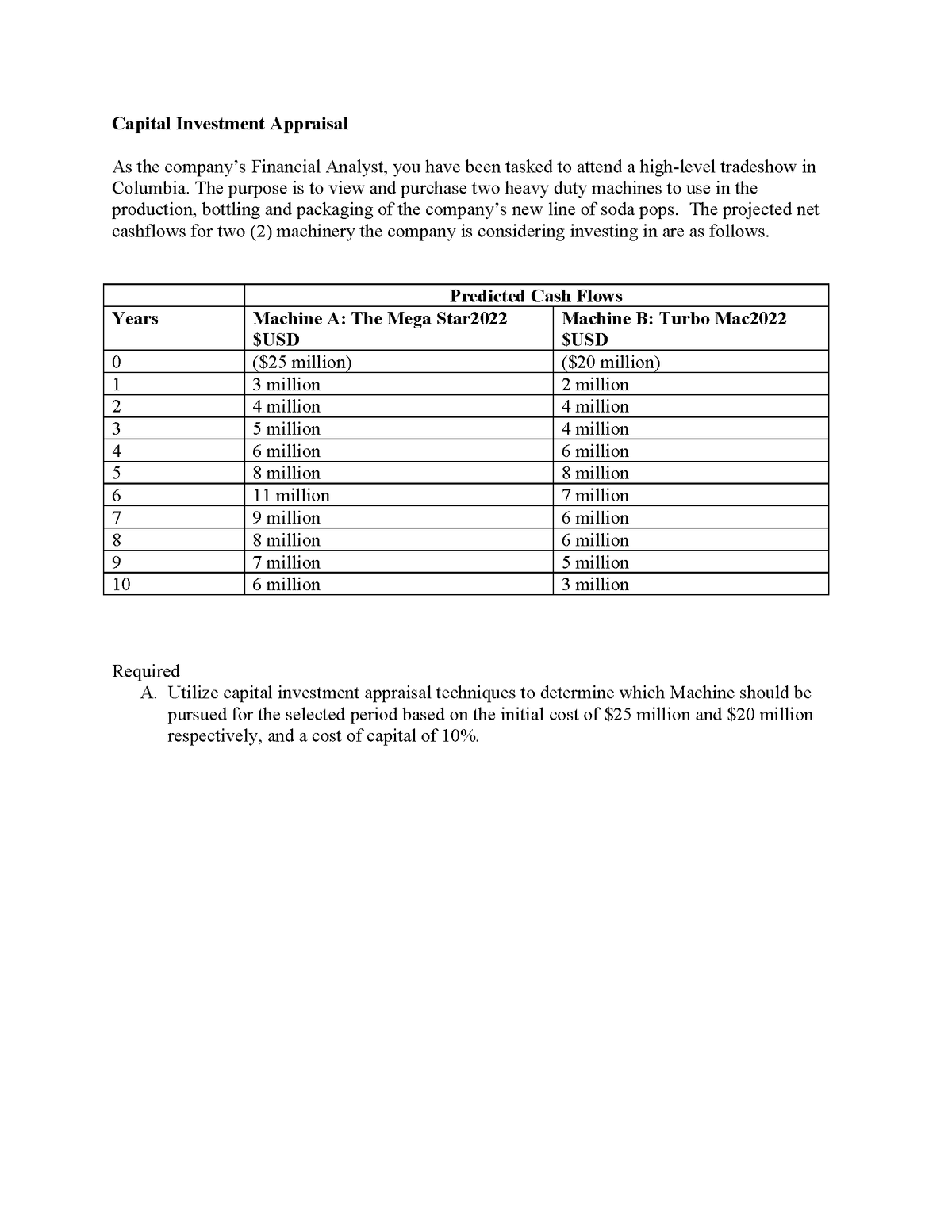

As the company's Financial Analyst, you have been tasked to attend a high-level tradeshow in

Columbia. The purpose is to view and purchase two heavy duty machines to use in the

production, bottling and packaging of the company's new line of soda pops. The projected net

cashflows for two (2) machinery the company is considering investing in are as follows.

Predicted Cash Flows

Years

Machine A: The Mega Star2022

$USD

Machine B: Turbo Mac2022

$USD

($25 million)

($20 million)

1

3 million

2 million

2

4 million

4 million

3

5 million

4 million

6 million

8 million

7 million

6 million

5

8 million

6.

11 million

7

9 million

6 million

8 million

7 million

6 million

8

6 million

9.

5 million

10

3 million

Required

A. Utilize capital investment appraisal techniques to determine which Machine should be

pursued for the selected period based on the initial cost of $25 million and $20 million

respectively, and a cost of capital of 10%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning