counting class I am learning to find accounting rate of return. To solve for this I subtracted net cash flow- the salvage value divided by the initial investment. Have I done somethin

counting class I am learning to find accounting rate of return. To solve for this I subtracted net cash flow- the salvage value divided by the initial investment. Have I done somethin

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 1MAD: San Lucas Corporation is considering investment in robotic machinery based upon the following...

Related questions

Topic Video

Question

In my accounting class I am learning to find accounting

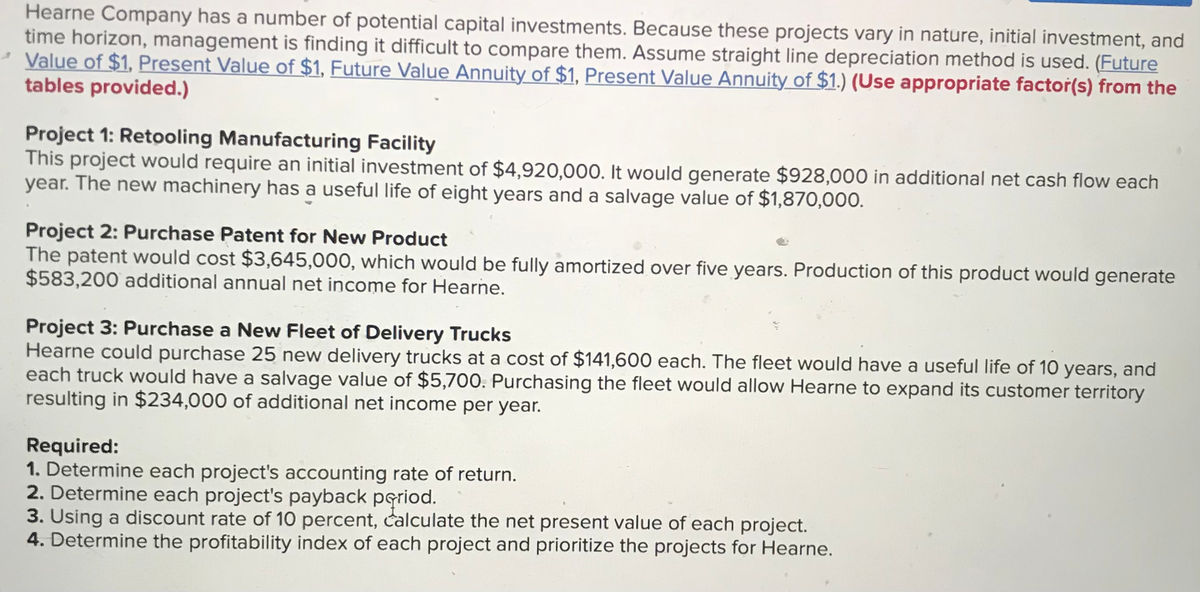

Transcribed Image Text:Hearne Company has a number of potential capital investments. Because these projects vary in nature, initial investment, and

time horizon, management is finding it difficult to compare them. Assume straight line depreciation method is used. (Future

Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the

tables provided.)

Project 1: Retooling Manufacturing Facility

This project would require an initial investment of $4,920,000. It would generate $928,000 in additional net cash flow each

year. The new machinery has a useful life of eight years and a salvage value of $1,870,000.

Project 2: Purchase Patent for New Product

The patent would cost $3,645,000, which would be fully amortized over five years. Production of this product would

$583,200 additional annual net income for Hearne.

generate

Project 3: Purchase a New Fleet of Delivery Trucks

Hearne could purchase 25 new delivery trucks at a cost of $141,600 each. The fleet would have a useful life of 10 years, and

each truck would have a salvage value of $5,700. Purchasing the fleet would allow Hearne to expand its customer territory

resulting in $234,000 of additional net income per year.

Required:

1. Determine each project's accounting rate of return.

2. Determine each project's payback pgriod.

3. Using a discount rate of 10 percent, calculate the net present value of each project.

4. Determine the profitability index of each project and prioritize the projects for Hearne.

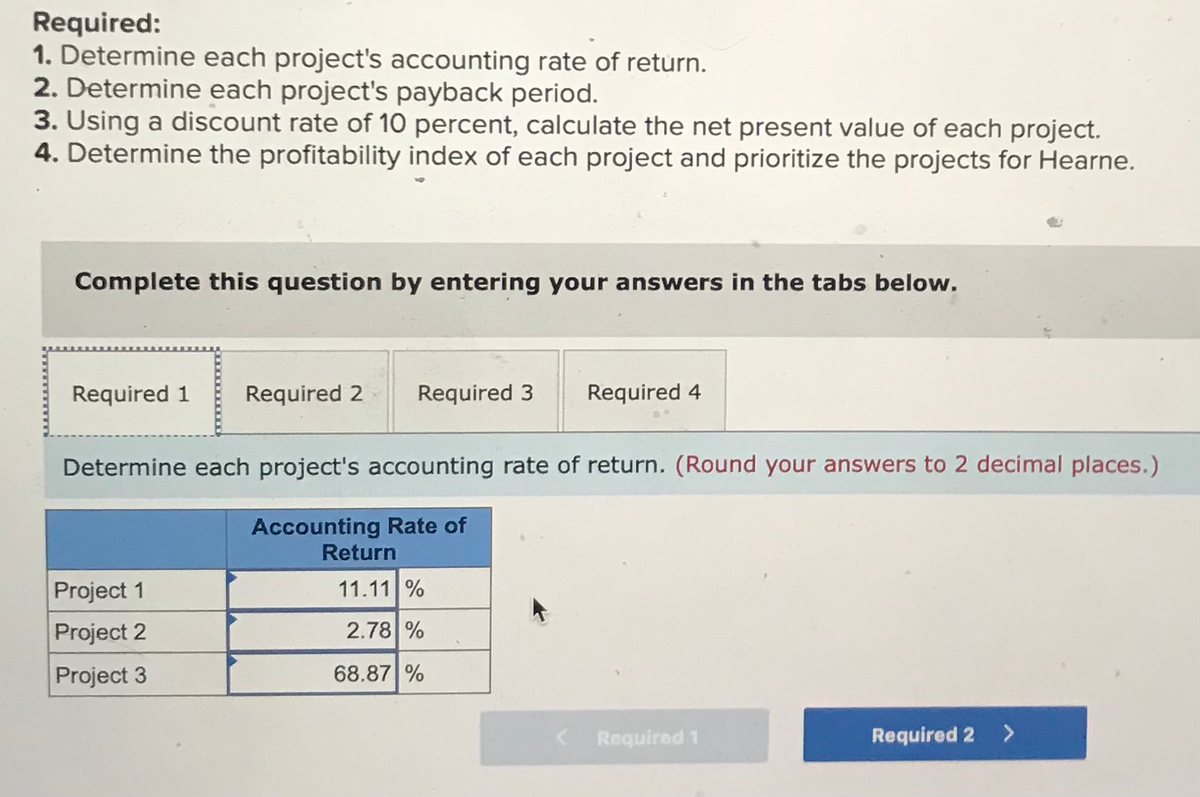

Transcribed Image Text:Required:

1. Determine each project's accounting rate of return.

2. Determine each project's payback period.

3. Using a discount rate of 10 percent, calculate the net present value of each project.

4. Determine the profitability index of each project and prioritize the projects for Hearne.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Determine each project's accounting rate of return. (Round your answers to 2 decimal places.)

Accounting Rate of

Return

Project 1

11.11 %

Project 2

2.78 %

Project 3

68.87 %

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College