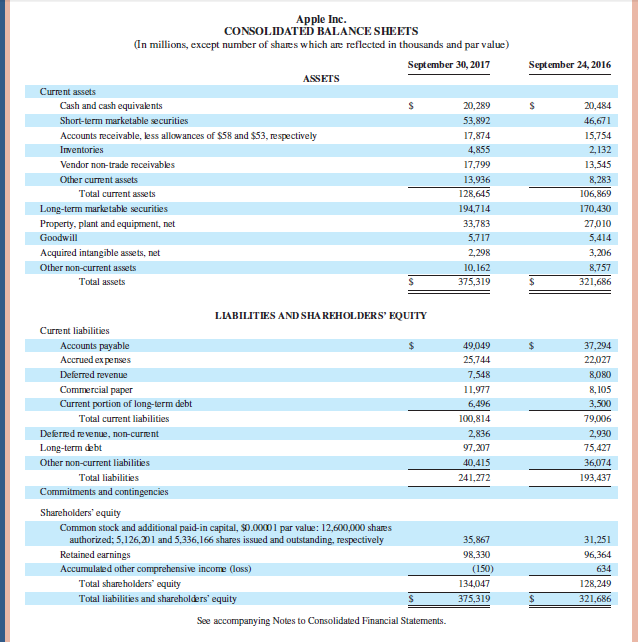

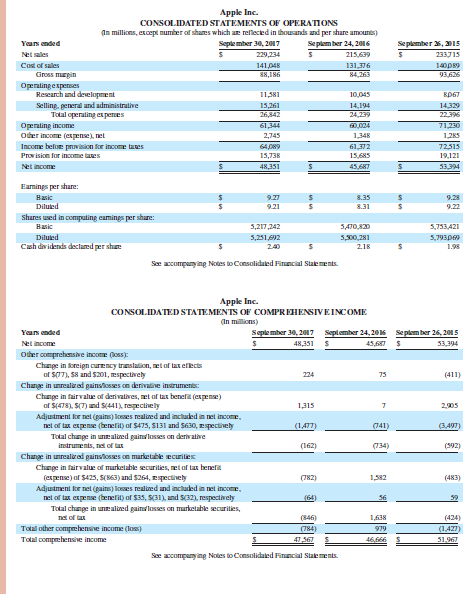

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 30, 2017 September 24, 2016 ASSETS Current assets Cash and cash equivaknts 20,289 20,484 Short-term marketable securities 53,892 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 Total current assets 128,645 106,869 Long-term marketabke securities 194,714 170,430 Property, plant and equipment, net 33,783 27010 Goodwill 5,717 5,414 Acquired intangible assets, net 2,298 3,206 Other non-current assets 10,162 8,757 Total assets 375,319 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Accrued ex penses 49,049 24 37,294 25,744 22,027 Deferred revenue 7,548 8,080 Commercial paper 11,977 8, 105 Current portion of long-term debt 6,496 3,500 Total current liabilities 100,814 79,006 2,930 75,427 Defered revenue, non-current 2,836 Long-term debt 97,207 Other non-current liabilities 40,415 36,074 Total liabilities 241,272 193,437 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, $0.0000 1 par value: 12,600,000 shares authorized; 5,126,2201 and 5,336,166 shares issued and outstanding, respectively 35,867 31,251 Retained earnings 98,330 96,364 Accumulated other comprehensive income (loss) (150) 634 Total shareholders equity 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS In millions, etcepi number of shares which ar rellected in thousands and per share amounts) Seple mber 30, 2017 Seplember 24, 2016 Seplember , 2015 Years ended Netales 229,234 215.699 233J15 Cost of sales Gross mrgin 141,048 88,186 131,376 84,263 140p9 93.626 Opernating expetses Rescarch and development Selling. general and administrative Total operating ex penes 11,581 10,045 15,261 26,842 14,194 24,239 14,329 22,396 71,230 Operating income Oter income (expense), net Income befor pruvision for income taes 61,344 60.024 2,745 1,348 1,285 64,09 15,738 61.372 72,515 19,121 Provision for income taes 15,685 Net income 48,351 45,687 53,394 Eamings per share: Hasic 9.27 8.35 9.28 Diluled 9.21 8.31 9.22 Shares used in computing camings per share: Basic 5,217,242 5,470,820 5,753,421 Dilued 5,251,692 5,500,281 2.18 5,793pe Csh davidends declamd per shae 240 1.98 See accompanying Notes to Consolidated Finuncial Stalements. Apple Inc. CONSOLIDATED STATEMENTIS OF COMPREHENSIVEINCOME (In millions) Yaars ended Seplember 30, 2017 September 24, 2016 Seplem ber 26, 2015 Net income 48,351 45,68 S 53,394 oder comprehensve income oss): Chnge in koreign curency traslation, et of tax efects of S7), S8 and $201, mspectively Change in unrealirod gainsloses on derivalive instruments: Chunge in fairvalue of derivatives, et of lax benefit (expene) of S(478). S(7) ad S(441), repectively Adjudment kr net (gains) loses realined and included in net incom, net of tax expene (benefit) of $475, $131 and S630, espectively Total change in unealied gainlosses on derivative instruments, net of ta 224 75 (411) 1,315 2,905 (1,477) (741) (162) (134) (592) Change in unrealizod gainsioses on marketable ecurilies Chnge in fairvalue of murketable securilies, met of tax benel (espense) of $425, S(B63) and $264, especively Adjustment ke net (gains) lonses realined and included in net incom, net of tax expense (benefil) af $35, S(31), and S(32), respectively Total change in unealied gainlosses on murketable securilies, net of tat Total other comprchensive income (los) Total compehensie income (782) 1,582 (483) (64) 56 59 (846) 1,638 (424) 979 (1.427 47,567 46.666 51,967 See accompunying Notes to Consolidated Finuncial Stalements.

Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 30, 2017 September 24, 2016 ASSETS Current assets Cash and cash equivaknts 20,289 20,484 Short-term marketable securities 53,892 46,671 Accounts receivable, less allowances of $58 and $53, respectively 17,874 15,754 Inventories 4,855 2,132 Vendor non-trade receivables 17,799 13,545 Other current assets 13,936 8,283 Total current assets 128,645 106,869 Long-term marketabke securities 194,714 170,430 Property, plant and equipment, net 33,783 27010 Goodwill 5,717 5,414 Acquired intangible assets, net 2,298 3,206 Other non-current assets 10,162 8,757 Total assets 375,319 321,686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Accrued ex penses 49,049 24 37,294 25,744 22,027 Deferred revenue 7,548 8,080 Commercial paper 11,977 8, 105 Current portion of long-term debt 6,496 3,500 Total current liabilities 100,814 79,006 2,930 75,427 Defered revenue, non-current 2,836 Long-term debt 97,207 Other non-current liabilities 40,415 36,074 Total liabilities 241,272 193,437 Commitments and contingencies Shareholders' equity Common stock and additional paid-in capital, $0.0000 1 par value: 12,600,000 shares authorized; 5,126,2201 and 5,336,166 shares issued and outstanding, respectively 35,867 31,251 Retained earnings 98,330 96,364 Accumulated other comprehensive income (loss) (150) 634 Total shareholders equity 134,047 128,249 Total liabilities and shareholders' equity 375,319 321,686 See accompanying Notes to Consolidated Financial Statements. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS In millions, etcepi number of shares which ar rellected in thousands and per share amounts) Seple mber 30, 2017 Seplember 24, 2016 Seplember , 2015 Years ended Netales 229,234 215.699 233J15 Cost of sales Gross mrgin 141,048 88,186 131,376 84,263 140p9 93.626 Opernating expetses Rescarch and development Selling. general and administrative Total operating ex penes 11,581 10,045 15,261 26,842 14,194 24,239 14,329 22,396 71,230 Operating income Oter income (expense), net Income befor pruvision for income taes 61,344 60.024 2,745 1,348 1,285 64,09 15,738 61.372 72,515 19,121 Provision for income taes 15,685 Net income 48,351 45,687 53,394 Eamings per share: Hasic 9.27 8.35 9.28 Diluled 9.21 8.31 9.22 Shares used in computing camings per share: Basic 5,217,242 5,470,820 5,753,421 Dilued 5,251,692 5,500,281 2.18 5,793pe Csh davidends declamd per shae 240 1.98 See accompanying Notes to Consolidated Finuncial Stalements. Apple Inc. CONSOLIDATED STATEMENTIS OF COMPREHENSIVEINCOME (In millions) Yaars ended Seplember 30, 2017 September 24, 2016 Seplem ber 26, 2015 Net income 48,351 45,68 S 53,394 oder comprehensve income oss): Chnge in koreign curency traslation, et of tax efects of S7), S8 and $201, mspectively Change in unrealirod gainsloses on derivalive instruments: Chunge in fairvalue of derivatives, et of lax benefit (expene) of S(478). S(7) ad S(441), repectively Adjudment kr net (gains) loses realined and included in net incom, net of tax expene (benefit) of $475, $131 and S630, espectively Total change in unealied gainlosses on derivative instruments, net of ta 224 75 (411) 1,315 2,905 (1,477) (741) (162) (134) (592) Change in unrealizod gainsioses on marketable ecurilies Chnge in fairvalue of murketable securilies, met of tax benel (espense) of $425, S(B63) and $264, especively Adjustment ke net (gains) lonses realined and included in net incom, net of tax expense (benefil) af $35, S(31), and S(32), respectively Total change in unealied gainlosses on murketable securilies, net of tat Total other comprchensive income (los) Total compehensie income (782) 1,582 (483) (64) 56 59 (846) 1,638 (424) 979 (1.427 47,567 46.666 51,967 See accompunying Notes to Consolidated Finuncial Stalements.

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 18P

Related questions

Question

Refer to Apple’s financial statements. Compute its profit margin for the years ended September 30, 2017, and September 24, 2016.

Transcribed Image Text:Apple Inc.

CONSOLIDATED BALANCE SHEETS

(In millions, except number of shares which are reflected in thousands and par value)

September 30, 2017

September 24, 2016

ASSETS

Current assets

Cash and cash equivaknts

20,289

20,484

Short-term marketable securities

53,892

46,671

Accounts receivable, less allowances of $58 and $53, respectively

17,874

15,754

Inventories

4,855

2,132

Vendor non-trade receivables

17,799

13,545

Other current assets

13,936

8,283

Total current assets

128,645

106,869

Long-term marketabke securities

194,714

170,430

Property, plant and equipment, net

33,783

27010

Goodwill

5,717

5,414

Acquired intangible assets, net

2,298

3,206

Other non-current assets

10,162

8,757

Total assets

375,319

321,686

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities

Accounts payable

Accrued ex penses

49,049

24

37,294

25,744

22,027

Deferred revenue

7,548

8,080

Commercial paper

11,977

8, 105

Current portion of long-term debt

6,496

3,500

Total current liabilities

100,814

79,006

2,930

75,427

Defered revenue, non-current

2,836

Long-term debt

97,207

Other non-current liabilities

40,415

36,074

Total liabilities

241,272

193,437

Commitments and contingencies

Shareholders' equity

Common stock and additional paid-in capital, $0.0000 1 par value: 12,600,000 shares

authorized; 5,126,2201 and 5,336,166 shares issued and outstanding, respectively

35,867

31,251

Retained earnings

98,330

96,364

Accumulated other comprehensive income (loss)

(150)

634

Total shareholders equity

134,047

128,249

Total liabilities and shareholders' equity

375,319

321,686

See accompanying Notes to Consolidated Financial Statements.

Transcribed Image Text:Apple Inc.

CONSOLIDATED STATEMENTS OF OPERATIONS

In millions, etcepi number of shares which ar rellected in thousands and per share amounts)

Seple mber 30, 2017

Seplember 24, 2016

Seplember , 2015

Years ended

Netales

229,234

215.699

233J15

Cost of sales

Gross mrgin

141,048

88,186

131,376

84,263

140p9

93.626

Opernating expetses

Rescarch and development

Selling. general and administrative

Total operating ex penes

11,581

10,045

15,261

26,842

14,194

24,239

14,329

22,396

71,230

Operating income

Oter income (expense), net

Income befor pruvision for income taes

61,344

60.024

2,745

1,348

1,285

64,09

15,738

61.372

72,515

19,121

Provision for income taes

15,685

Net income

48,351

45,687

53,394

Eamings per share:

Hasic

9.27

8.35

9.28

Diluled

9.21

8.31

9.22

Shares used in computing camings per share:

Basic

5,217,242

5,470,820

5,753,421

Dilued

5,251,692

5,500,281

2.18

5,793pe

Csh davidends declamd per shae

240

1.98

See accompanying Notes to Consolidated Finuncial Stalements.

Apple Inc.

CONSOLIDATED STATEMENTIS OF COMPREHENSIVEINCOME

(In millions)

Yaars ended

Seplember 30, 2017 September 24, 2016 Seplem ber 26, 2015

Net income

48,351

45,68 S

53,394

oder comprehensve income oss):

Chnge in koreign curency traslation, et of tax efects

of S7), S8 and $201, mspectively

Change in unrealirod gainsloses on derivalive instruments:

Chunge in fairvalue of derivatives, et of lax benefit (expene)

of S(478). S(7) ad S(441), repectively

Adjudment kr net (gains) loses realined and included in net incom,

net of tax expene (benefit) of $475, $131 and S630, espectively

Total change in unealied gainlosses on derivative

instruments, net of ta

224

75

(411)

1,315

2,905

(1,477)

(741)

(162)

(134)

(592)

Change in unrealizod gainsioses on marketable ecurilies

Chnge in fairvalue of murketable securilies, met of tax benel

(espense) of $425, S(B63) and $264, especively

Adjustment ke net (gains) lonses realined and included in net incom,

net of tax expense (benefil) af $35, S(31), and S(32), respectively

Total change in unealied gainlosses on murketable securilies,

net of tat

Total other comprchensive income (los)

Total compehensie income

(782)

1,582

(483)

(64)

56

59

(846)

1,638

(424)

979

(1.427

47,567

46.666

51,967

See accompunying Notes to Consolidated Finuncial Stalements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning