Apply the COGS equation used on the bottom of page 6-3 of the VLN to the following data set to answer the question: The company had $20,000 in beginning inventory and during the year purchased $200,000 worth of inventory. Ending inventory at the end of the period was $10,000, what was the cost of goods sold for the year? ____

Apply the COGS equation used on the bottom of page 6-3 of the VLN to the following data set to answer the question: The company had $20,000 in beginning inventory and during the year purchased $200,000 worth of inventory. Ending inventory at the end of the period was $10,000, what was the cost of goods sold for the year? ____

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 56P: The following selected information is taken from the financial statements of Arnn Company for its...

Related questions

Question

Apply the COGS equation used on the bottom of page 6-3 of the VLN to the

following data set to answer the question:

The company had $20,000 in beginning inventory and during the year purchased $200,000 worth of inventory. Ending

inventory at the end of the period was $10,000, what was the cost of goods sold for the year? ____

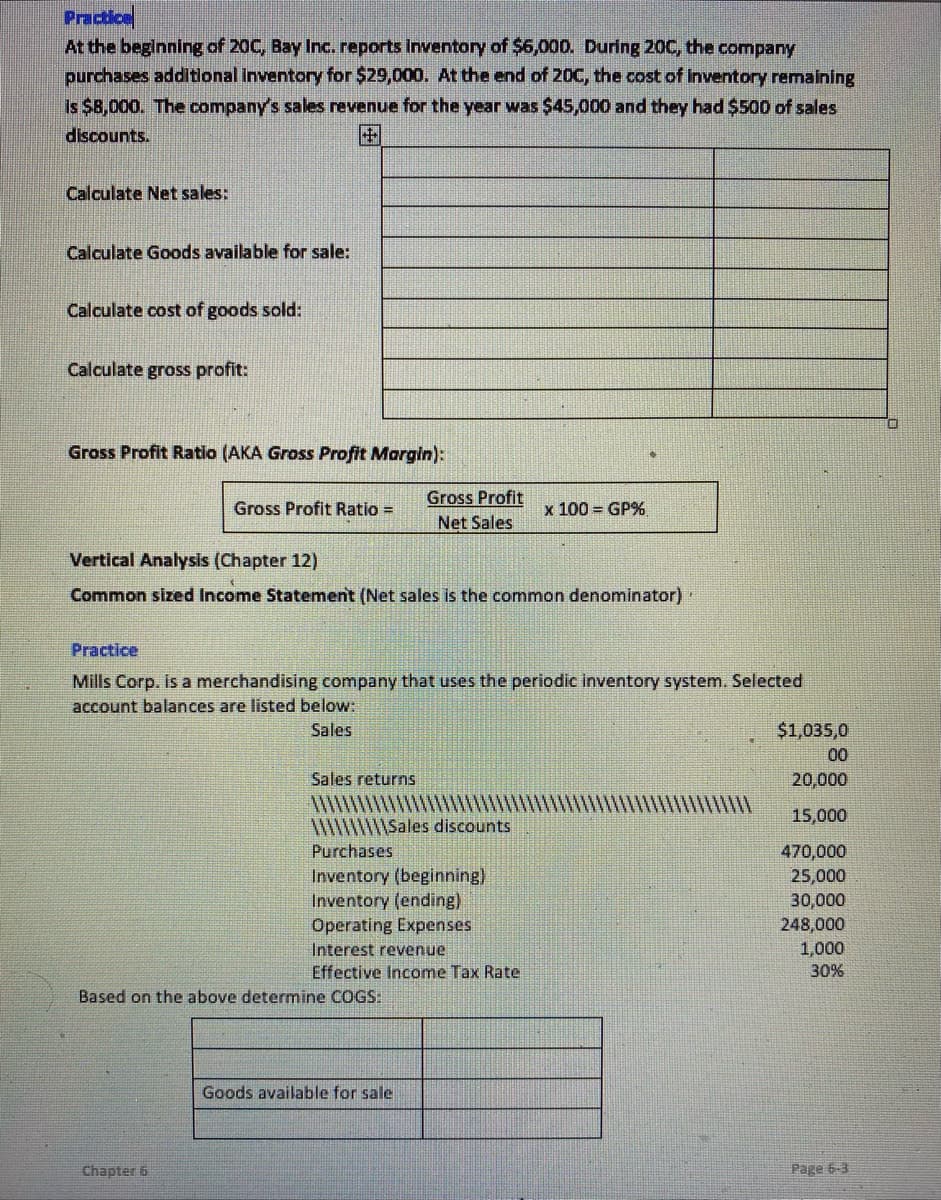

Transcribed Image Text:Practice

At the beginning of 20C, Bay Inc. reports Inventory of $6,000. During 20C, the company

purchases additional Inventory for $29,000. At the end of 20C, the cost of Inventory remaining

is $8,000. The company's sales revenue for the year was $45,000 and they had $500 of sales

discounts.

Calculate Net sales:

Calculate Goods available for sale:

Calculate cost of goods sold:

Calculate gross profit:

Gross Profit Ratio (AKA Gross Profit Margin):

Gross Profit

Gross Profit Ratio =

x 100 = GP%

Net Sales

Vertical Analysis (Chapter 12)

Common sized Income Statement (Net sales is the common denominator)·

Practice

Mills Corp. is a merchandising company that uses the periodic inventory system. Selected

account balances are listed below:

Sales

$1,035,0

00

Sales returns

20,000

15,000

W|w\Sales discounts

Purchases

470,000

25,000

Inventory (beginning)

Inventory (ending)

Operating Expenses

30,000

248,000

1,000

Interest revenue

Effective Income Tax Rate

30%

Based on the above determine COGS:

Goods available for sale

Chapter 6

Page 6-3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,