dule C, Transportatio Meals And ertainment, Margaret started her own business in the current year and will report a profit for her first year. Her results of operatic Gross income $45,000 Expenses: Travel $1,000 Contribution to Presidential Election Campaign $100 Transportation (5,427 miles evenly throughout the year, using standard mileage method) Entertainment in total $4,200

dule C, Transportatio Meals And ertainment, Margaret started her own business in the current year and will report a profit for her first year. Her results of operatic Gross income $45,000 Expenses: Travel $1,000 Contribution to Presidential Election Campaign $100 Transportation (5,427 miles evenly throughout the year, using standard mileage method) Entertainment in total $4,200

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 62BPSB

Related questions

Question

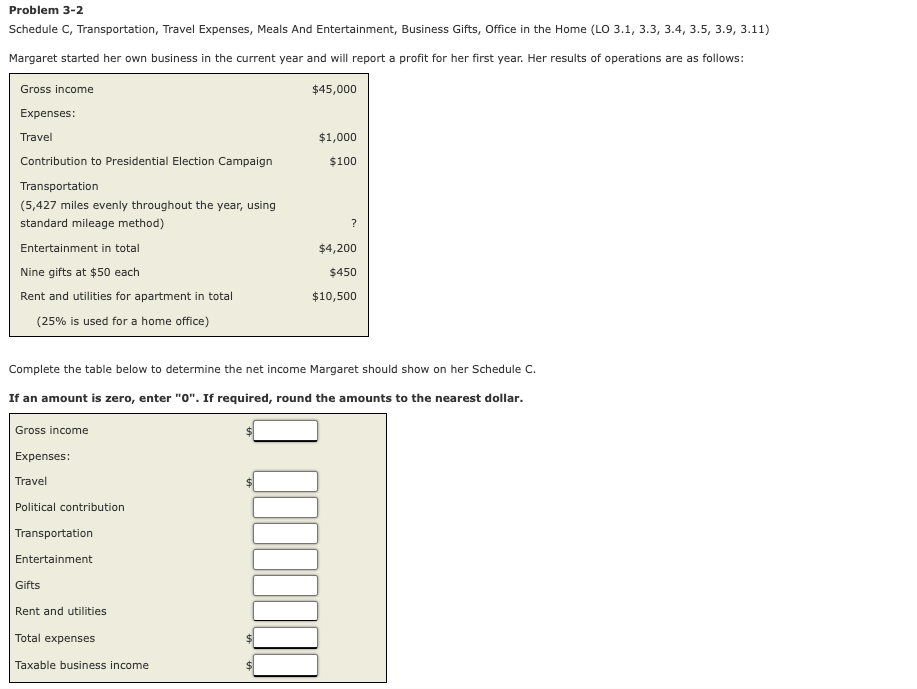

Transcribed Image Text:Problem 3-2

Schedule C, Transportation, Travel Expenses, Meals And Entertainment, Business Gifts, Office in the Home (LO 3.1, 3.3, 3.4, 3.5, 3.9, 3.11)

Margaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows:

Gross income

$45,000

Expenses:

Travel

$1,000

Contribution to Presidential Election Campaign

$100

Transportation

(5,427 miles evenly throughout the year, using

standard mileage method)

Entertainment in total

$4,200

Nine gifts at $50 each

$450

Rent and utilities for apartment in total

$10,500

(25% is used for a home office)

Complete the table below to determine the net income Margaret should show on her Schedule C.

If an amount is zero, enter "0". If required, round the amounts to the nearest dollar.

Gross income

Expenses:

Travel

Political contribution

Transportation

Entertainment

Gifts

Rent and utilities

Total expenses

Taxable business income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,