ar value, authorized 1,043,000 shares, 321,000 shares issued and outstanding $3,210,000 Paid-in capital in excess of par—common stock 562,000 Retained earnings 624,000 During the current year, the following transactions occurred. 1. The company issued to the stockholders 109,000 rights. Ten rights are needed to buy one share of stock at $30. The rights were void after 30 da

ar value, authorized 1,043,000 shares, 321,000 shares issued and outstanding $3,210,000 Paid-in capital in excess of par—common stock 562,000 Retained earnings 624,000 During the current year, the following transactions occurred. 1. The company issued to the stockholders 109,000 rights. Ten rights are needed to buy one share of stock at $30. The rights were void after 30 da

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 22E: Statement of stockholders equity The stockholders equity T accounts of I-Cards Inc. for the year...

Related questions

Question

The

| Common stock, $10 par value, authorized 1,043,000 shares, 321,000 shares issued and outstanding | $3,210,000 | |

| Paid-in capital in excess of par—common stock | 562,000 | |

| 624,000 |

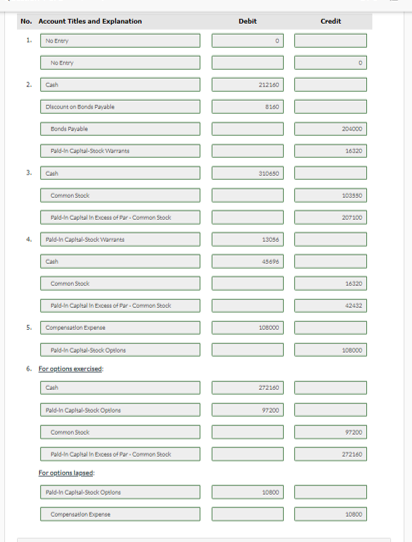

During the current year, the following transactions occurred.

| 1. | The company issued to the stockholders 109,000 rights. Ten rights are needed to buy one share of stock at $30. The rights were void after 30 days. The market price of the stock at this time was $32 per share. | |

| 2. | The company sold to the public a $204,000, 10% bond issue at 104. The company also issued with each $100 bond one detachable stock purchase warrant, which provided for the purchase of common stock at $28 per share. Shortly after issuance, similar bonds without warrants were selling at 96 and the warrants at $8. | |

| 3. | All but 5,450 of the rights issued in (1) were exercised in 30 days. | |

| 4. | At the end of the year, 80% of the warrants in (2) had been exercised, and the remaining were outstanding and in good standing. | |

| 5. | During the current year, the company granted stock options for 10,800 shares of common stock to company executives. The company, using a fair value option-pricing model, determines that each option is worth $10. The option price is $28. The options were to expire at year-end and were considered compensation for the current year. | |

| 6. | All but 1,080 shares related to the stock-option plan were exercised by year-end. The expiration resulted because one of the executives failed to fulfill an obligation related to the employment contract. |

Transcribed Image Text:No. Account Titles and Explanation

Debit

Credit

1.

No Erery

No Erery

2.

Cash

212160

Dlacount on Bond Payable

Bordi Payable

20000

Pald-n Capital-Sock Warranta

16320

3.

Cash

Commen Seack

Paldin Capital in Eces of Par- Common Seock

207100

4.

Pald-in Captal-Sock Warranta

13056

Cash

4596

Common Sock

16320

Pald-in Capital in bcess of Par- Common Stock

42432

5.

Compenation Eperee

108000

Pald-in Capial-Sock Oprions

108000

6. For oetions eercised

Cah

2720

Pald-n Capltal-Shock Opelone

97200

Common Sock

97200

Pald-in Capltal in Ecess of Par- Common Stock

272140

Eor entions leand

Pald-in Caphal-Sock Opelone

10800

Compensatlon bperse

10800

Transcribed Image Text:(b)

Prepare the stockholders' equity section of the balance sheet at the end of the current year. Assume that retained earnings at the

end of the current year is $771,000.

Sheridan Inc.

Balance Sheet

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning