On January 1, Concord Corporation had 172000 shares of $10 par value common stock outstanding. On June 17, the company declared a 11% stock dividend to stockholders of record on June 20. Market value of the stock was $11 on June 17. The stock was distributed on June 30. The entry to record the transaction of June 30 would include a O credit to Common Stock for $189200. debit to Common Stock Dividends Distributable for $208120. O credit to Paid-in Capital in Excess of Par for $18920. O debit to Stock Dividends for $208120.

On January 1, Concord Corporation had 172000 shares of $10 par value common stock outstanding. On June 17, the company declared a 11% stock dividend to stockholders of record on June 20. Market value of the stock was $11 on June 17. The stock was distributed on June 30. The entry to record the transaction of June 30 would include a O credit to Common Stock for $189200. debit to Common Stock Dividends Distributable for $208120. O credit to Paid-in Capital in Excess of Par for $18920. O debit to Stock Dividends for $208120.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.4BE: Entries for stock dividends Alpine Energy Corporation has 1,500,000 shares of 40 par common stock...

Related questions

Question

100%

Transcribed Image Text:!

1

A

2

ption

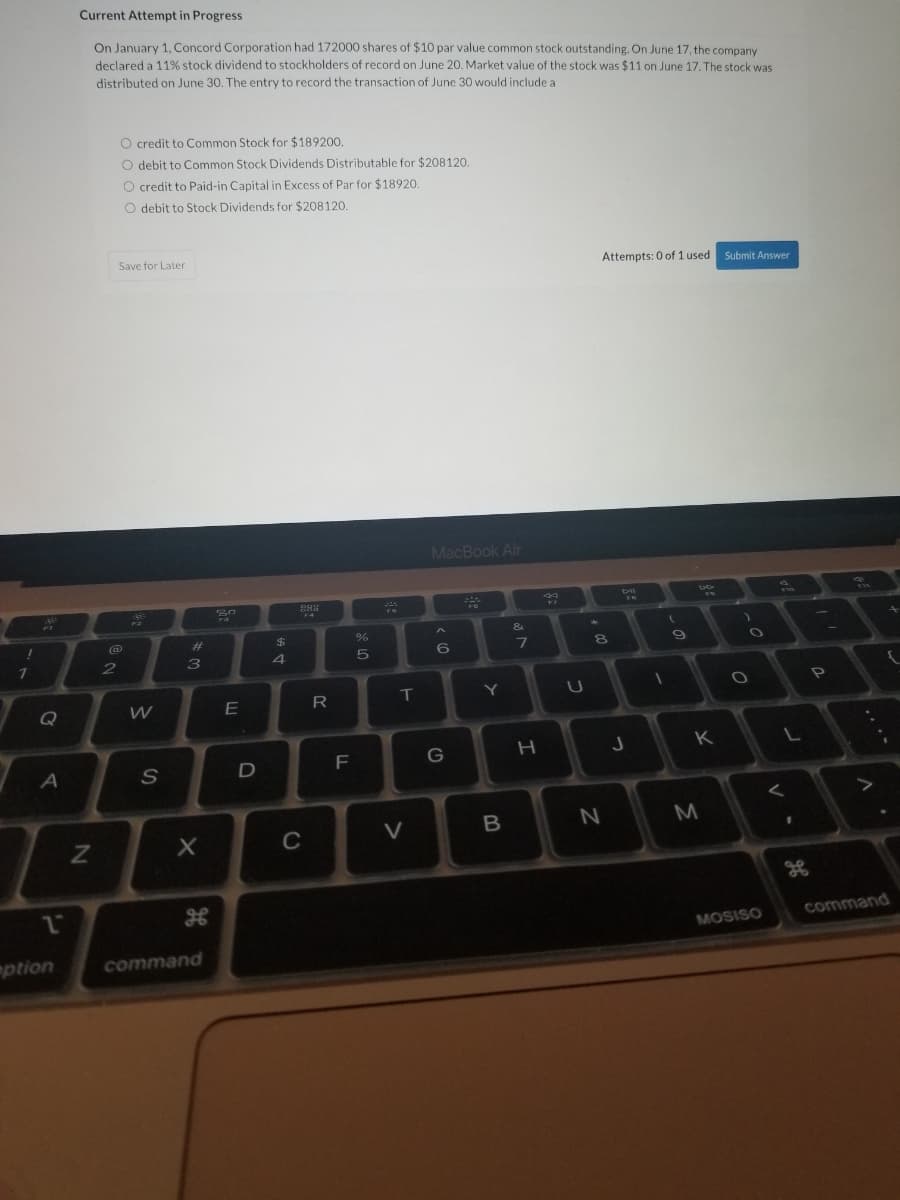

Current Attempt in Progress

On January 1, Concord Corporation had 172000 shares of $10 par value common stock outstanding. On June 17, the company

declared a 11% stock dividend to stockholders of record on June 20. Market value of the stock was $11 on June 17. The stock was

distributed on June 30. The entry to record the transaction of June 30 would include a

O credit to Common Stock for $189200.

O debit to Common Stock Dividends Distributable for $208120.

O credit to Paid-in Capital in Excess of Par for $18920.

O debit to Stock Dividends for $208120.

Save for Later

Attempts: 0 of 1 used Submit Answer

FIG

N

2

W

S

#3

X

command

80

E

D

$

4

888

F4

C

R

F

%

07 20

5

T

V

MacBook Air

A

&

10

6

G

Y

B

7

H

44

U

8

N

DI

J

(

1

.

9

K

M

)

O

MOSISO

V

L

26

-

P

-

^

command

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning