Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2024, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $32,500 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10%.

Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2024, and Arctic received a note from Seneca indicating that Seneca will pay Arctic $32,500 on a future date. Unless informed otherwise, assume that Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10%.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 12P: Hamlet Corporation purchases computer equipment at a price of 100,000 on January 1, 2019, paying...

Related questions

Question

Give me correct answer with explanation.

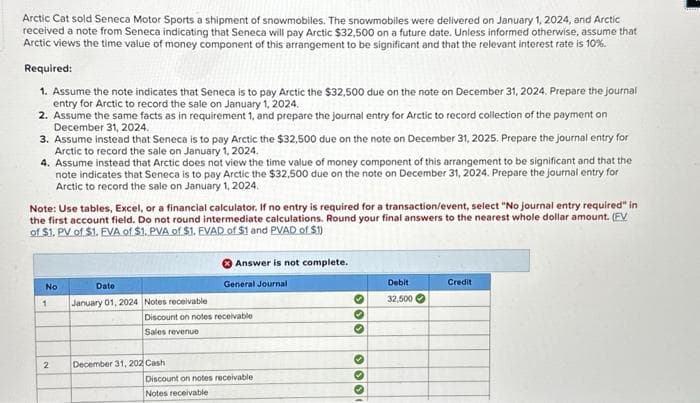

Transcribed Image Text:Arctic Cat sold Seneca Motor Sports a shipment of snowmobiles. The snowmobiles were delivered on January 1, 2024, and Arctic

received a note from Seneca indicating that Seneca will pay Arctic $32,500 on a future date. Unless informed otherwise, assume that

Arctic views the time value of money component of this arrangement to be significant and that the relevant interest rate is 10%.

Required:

1. Assume the note indicates that Seneca is to pay Arctic the $32,500 due on the note on December 31, 2024. Prepare the journal

entry for Arctic to record the sale on January 1, 2024.

2. Assume the same facts as in requirement 1, and prepare the journal entry for Arctic to record collection of the payment on

December 31, 2024.

3. Assume instead that Seneca is to pay Arctic the $32,500 due on the note on December 31, 2025. Prepare the journal entry for

Arctic to record the sale on January 1, 2024.

4. Assume instead that Arctic does not view the time value of money component of this arrangement to be significant and that the

note indicates that Seneca is to pay Arctic the $32,500 due on the note on December 31, 2024. Prepare the journal entry for

Arctic to record the sale on January 1, 2024.

Note: Use tables, Excel, or a financial calculator. If no entry is required for a transaction/event, select "No journal entry required" in

the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. (EV

of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1)

No

1

Date

January 01, 2024 Notes receivable

Answer is not complete.

General Journal

Debit

Credit

32,500

Discount on notes receivable

Sales revenue

2

December 31, 202 Cash

Discount on notes receivable

Notes receivable

000

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College