arek receives 3000 euros as an inheritance, all the money is invested in starting a business. To be able to provide business: a warehouse building was bought for 2000 euros, only half was paid at the time of purchase; materials for warehouse repair were bought for 1000 euros, which were not paid for a car was bought for which 1500 euros was paid 300 euros were lent to another company. etermine the total amount of capital and equity of Marek's firm. Reflect the solution of the tasks in the form of a balance sheet (active, passive) Active Passive

arek receives 3000 euros as an inheritance, all the money is invested in starting a business. To be able to provide business: a warehouse building was bought for 2000 euros, only half was paid at the time of purchase; materials for warehouse repair were bought for 1000 euros, which were not paid for a car was bought for which 1500 euros was paid 300 euros were lent to another company. etermine the total amount of capital and equity of Marek's firm. Reflect the solution of the tasks in the form of a balance sheet (active, passive) Active Passive

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 5BCRQ

Related questions

Question

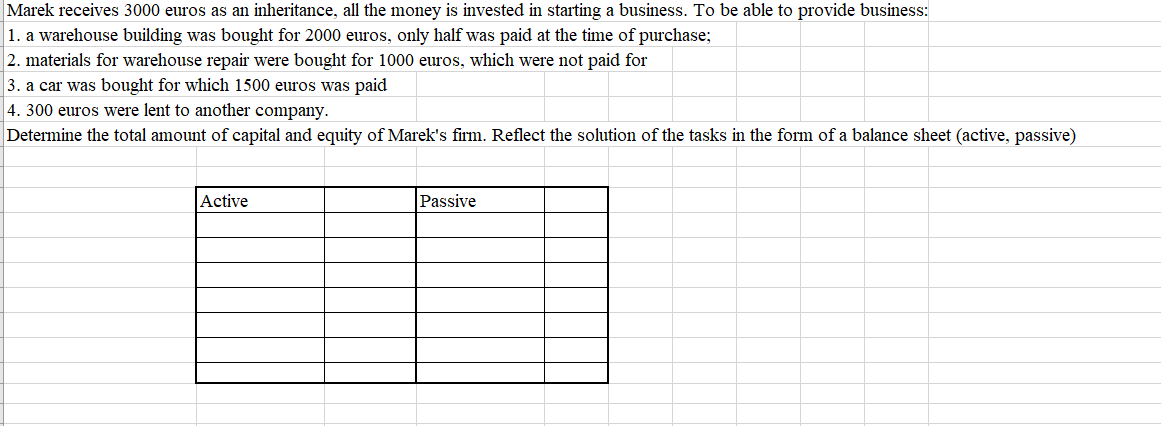

Transcribed Image Text:Marek receives 3000 euros as an inheritance, all the money is invested in starting a business. To be able to provide business:

1. a warehouse building was bought for 2000 euros, only half was paid at the time of purchase;

2. materials for warehouse repair were bought for 1000 euros, which were not paid for

3. a car was bought for which 1500 euros was paid

4. 300 euros were lent to another company.

Determine the total amount of capital and equity of Marek's firm. Reflect the solution of the tasks in the form of a balance sheet (active, passive)

Active

Passive

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT