n October 2010 Reese acquired 100%

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 35P

Related questions

Question

Ef 352.

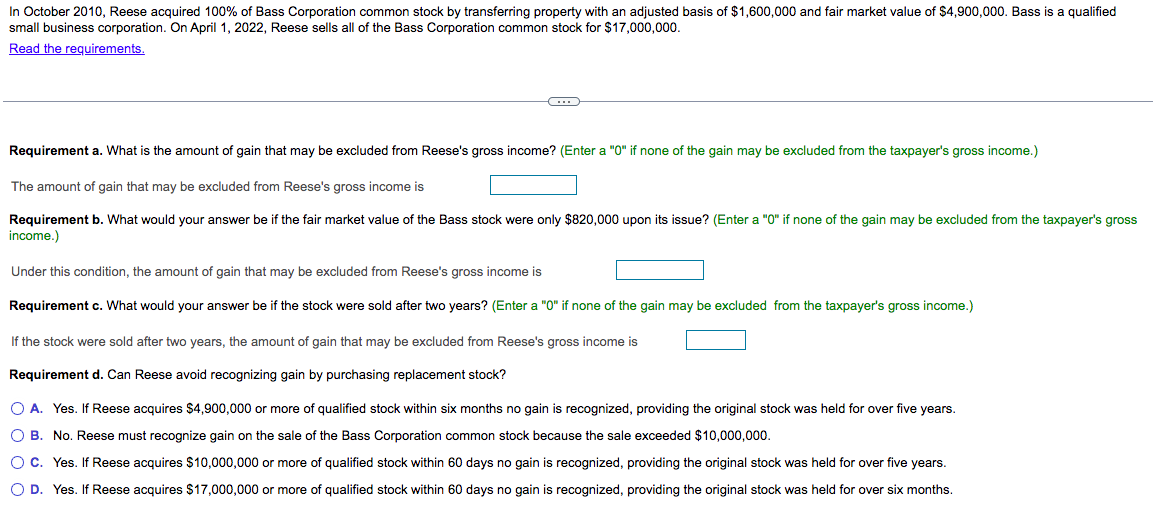

Transcribed Image Text:In October 2010, Reese acquired 100% of Bass Corporation common stock by transferring property with an adjusted basis of $1,600,000 and fair market value of $4,900,000. Bass is a qualified

small business corporation. On April 1, 2022, Reese sells all of the Bass Corporation common stock for $17,000,000.

Read the requirements.

C

Requirement a. What is the amount of gain that may be excluded from Reese's gross income? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.)

The amount of gain that may be excluded from Reese's gross income is

Requirement b. What would your answer be if the fair market value of the Bass stock were only $820,000 upon its issue? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross

income.)

Under this condition, the amount of gain that may be excluded from Reese's gross income is

Requirement c. What would your answer be if the stock were sold after two years? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.)

If the stock were sold after two years, the amount of gain that may be excluded from Reese's gross income is

Requirement d. Can Reese avoid recognizing gain by purchasing replacement stock?

O A. Yes. If Reese acquires $4,900,000 or more of qualified stock within six months no gain is recognized, providing the original stock was held for over five years.

O B. No. Reese must recognize gain on the sale of the Bass Corporation common stock because the sale exceeded $10,000,000.

O C. Yes. If Reese acquires $10,000,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over five years.

O D. Yes. If Reese acquires $17,000,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over six months.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT