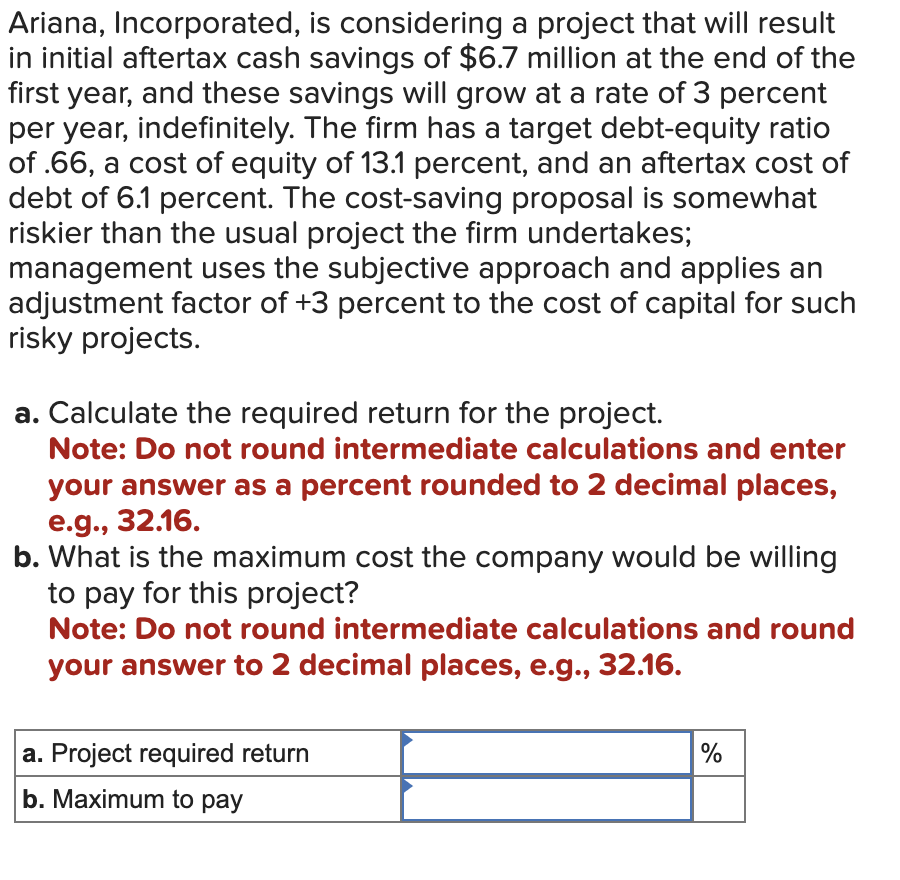

Ariana, Incorporated, is considering a project that will result in initial aftertax cash savings of $6.7 million at the end of the first year, and these savings will grow at a rate of 3 percent per year, indefinitely. The firm has a target debt-equity ratio of .66, a cost of equity of 13.1 percent, and an aftertax cost of debt of 6.1 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of +3 percent to the cost of capital for such risky projects. a. Calculate the required return for the project. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the maximum cost the company would be willing to pay for this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. Project required return b. Maximum to pay %

Ariana, Incorporated, is considering a project that will result in initial aftertax cash savings of $6.7 million at the end of the first year, and these savings will grow at a rate of 3 percent per year, indefinitely. The firm has a target debt-equity ratio of .66, a cost of equity of 13.1 percent, and an aftertax cost of debt of 6.1 percent. The cost-saving proposal is somewhat riskier than the usual project the firm undertakes; management uses the subjective approach and applies an adjustment factor of +3 percent to the cost of capital for such risky projects. a. Calculate the required return for the project. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the maximum cost the company would be willing to pay for this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a. Project required return b. Maximum to pay %

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 21P: Your division is considering two investment projects, each of which requires an up-front expenditure...

Related questions

Question

Transcribed Image Text:Ariana, Incorporated, is considering a project that will result

in initial aftertax cash savings of $6.7 million at the end of the

first year, and these savings will grow at a rate of 3 percent

per year, indefinitely. The firm has a target debt-equity ratio

of .66, a cost of equity of 13.1 percent, and an aftertax cost of

debt of 6.1 percent. The cost-saving proposal is somewhat

riskier than the usual project the firm undertakes;

management uses the subjective approach and applies an

adjustment factor of +3 percent to the cost of capital for such

risky projects.

a. Calculate the required return for the project.

Note: Do not round intermediate calculations and enter

your answer as a percent rounded to 2 decimal places,

e.g., 32.16.

b. What is the maximum cost the company would be willing

to pay for this project?

Note: Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.

a. Project required return

b. Maximum to pay

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,