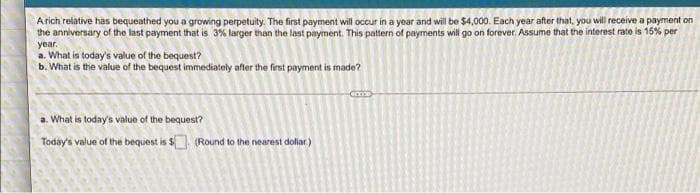

Arich relative has bequeathed you a growing perpetuity. The first payment will occur in a year and will be $4,000. Each year after that, you will receive a payment on the anniversary of the last payment that is 3% larger than the last payment. This pattern of payments will go on forever. Assume that the interest rate is 15% per year. a What is today's value of the bequest? b. What is the value of the bequest immediately afer the first payment is made? a What is loday's value of the bequest? Today's value of the bequest is $ (Round to the nearest dollar)

Arich relative has bequeathed you a growing perpetuity. The first payment will occur in a year and will be $4,000. Each year after that, you will receive a payment on the anniversary of the last payment that is 3% larger than the last payment. This pattern of payments will go on forever. Assume that the interest rate is 15% per year. a What is today's value of the bequest? b. What is the value of the bequest immediately afer the first payment is made? a What is loday's value of the bequest? Today's value of the bequest is $ (Round to the nearest dollar)

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 28P

Related questions

Question

Transcribed Image Text:Arich relative has bequeathed you a growing perpetuity. The first payment will occur in a year and will be $4,000. Each year after that, you will receive a payment on

the anniversary of the last payment that is 3% larger than the last payment. This pattern of payments will go on forever. Assume that the interest rate is 15% per

year.

a. What is today's value of the bequest?

b. What is the value of the bequest immediately after the first payment is made?

a. What is today's value of the bequest?

Today's value of the bequest is $ (Round to the nearest doliar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College