Your rich uncle bequests to you a continuous, constant income stream of $9000 per year for the next 10 years. terms of the bequest require that this income stream be paid continuously into a specific savings account that will not be available to you for 10 years. This account earns 5% interest, compounded continuously. What is the present value of the bequest? How much money would the bequest be worth (including all interest accrued) after 10 years? You discover that a bank is offering 5.5% interest compounded continuously on a certificate of deposit (CD) that matures in 10 years. What is the cost of a CD at the above interest rate that would provide the same amount of money as the bequest after 10 years? Because the CD earns more interest than the savings account specified in the will, you feel that you are losing out on interest. So you ask the executor of the estate to use funds from the estate to buy a CD that will be worth the same as the bequeathed income stream in 15 years. You ask her to pay you today the difference between the present value of the original bequest and the amount invested in the CD. How much should she pay you today?

Your rich uncle bequests to you a continuous, constant income stream of $9000 per year for the next 10 years. terms of the bequest require that this income stream be paid continuously into a specific savings account that will not be available to you for 10 years. This account earns 5% interest, compounded continuously. What is the present value of the bequest? How much money would the bequest be worth (including all interest accrued) after 10 years? You discover that a bank is offering 5.5% interest compounded continuously on a certificate of deposit (CD) that matures in 10 years. What is the cost of a CD at the above interest rate that would provide the same amount of money as the bequest after 10 years? Because the CD earns more interest than the savings account specified in the will, you feel that you are losing out on interest. So you ask the executor of the estate to use funds from the estate to buy a CD that will be worth the same as the bequeathed income stream in 15 years. You ask her to pay you today the difference between the present value of the original bequest and the amount invested in the CD. How much should she pay you today?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter4: Managing Your Cash And Savings

Section: Chapter Questions

Problem 7FPE: Calculating interest earned and future value of savings account. If you put 6,000 in a savings...

Related questions

Question

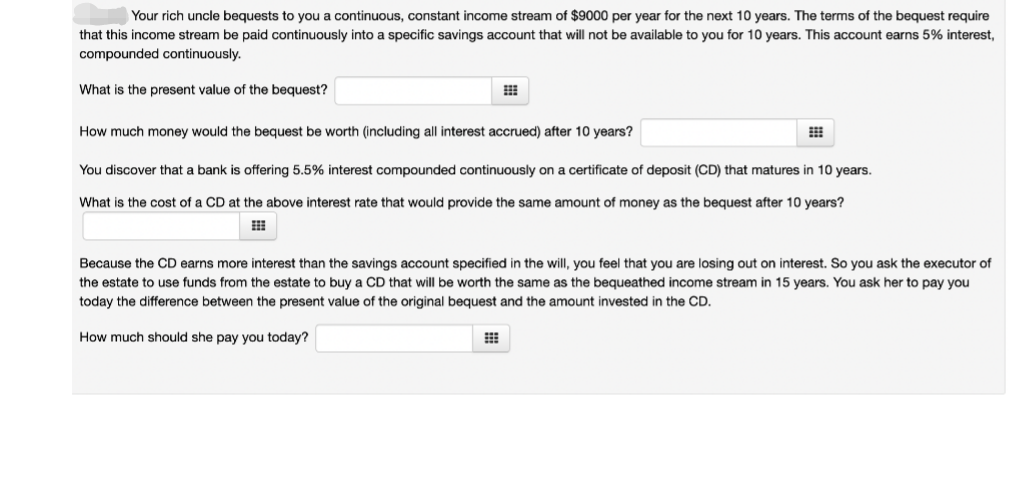

Transcribed Image Text:Your rich uncle bequests to you a continuous, constant income stream of $9000 per year for the next 10 years. The terms of the bequest require

that this income stream be paid continuously into a specific savings account that will not be available to you for 10 years. This account earns 5% interest,

compounded continuously.

What is the present value of the bequest?

How much money would the bequest be worth (including all interest accrued) after 10 years?

You discover that a bank is offering 5.5% interest compounded continuously on a certificate of deposit (CD) that matures in 10 years.

What is the cost of a CD at the above interest rate that would provide the same amount of money as the bequest after 10 years?

Because the CD earns more interest than the savings account specified in the will, you feel that you are losing out on interest. So you ask the executor of

the estate to use funds from the estate to buy a CD that will be worth the same as the bequeathed income stream in 15 years. You ask her to pay you

today the difference between the present value of the original bequest and the amount invested in the CD.

How much should she pay you today?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College