Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair market value of the tangible assets at $315,000 at the date of acquisition. Required eBook Ask a. Compute the amount of goodwill acquired. Print b. Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the acquisition is shown in the following statements model. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of goodwill acquired. (Amounts to be deducted should be indicated with minus sign.) Acquisition Price Cash paid Liabilities assumed Total FMV of assets Goodwill < Required A Required B > Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair market value of the tangible assets at $315,000 at the date of acquisition. eBook Required Ask a. Compute the amount of goodwill acquired. Print b. Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the acquisition is shown in the following statements model. Complete this question by entering your answers in the tabs below. Required A Required B Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the acquisition is shown model. (In the Cash Flow column, use OA to designate operating activity, IA for investment activity, or FA for financing activity. If the element is no the cell blank. Enter any decreases to account balances and cash outflows with a minus sign.) ARIZONA CORP. Horizontal Statements Model Balance Sheet Income Statement Statement of Cash Event Assets Liabilities + Equity Expense Net Flows Revenue Cash Assets + Goodwill Income 550,000 + 550,000 Acquisition

Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair market value of the tangible assets at $315,000 at the date of acquisition. Required eBook Ask a. Compute the amount of goodwill acquired. Print b. Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the acquisition is shown in the following statements model. Complete this question by entering your answers in the tabs below. Required A Required B Compute the amount of goodwill acquired. (Amounts to be deducted should be indicated with minus sign.) Acquisition Price Cash paid Liabilities assumed Total FMV of assets Goodwill < Required A Required B > Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair market value of the tangible assets at $315,000 at the date of acquisition. eBook Required Ask a. Compute the amount of goodwill acquired. Print b. Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the acquisition is shown in the following statements model. Complete this question by entering your answers in the tabs below. Required A Required B Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the acquisition is shown model. (In the Cash Flow column, use OA to designate operating activity, IA for investment activity, or FA for financing activity. If the element is no the cell blank. Enter any decreases to account balances and cash outflows with a minus sign.) ARIZONA CORP. Horizontal Statements Model Balance Sheet Income Statement Statement of Cash Event Assets Liabilities + Equity Expense Net Flows Revenue Cash Assets + Goodwill Income 550,000 + 550,000 Acquisition

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 37E: During 20X1, Craig Company had the following transactions: a. Purchased 300,000 of 10-year bonds...

Related questions

Question

Having an issue with this problem.

Thank you

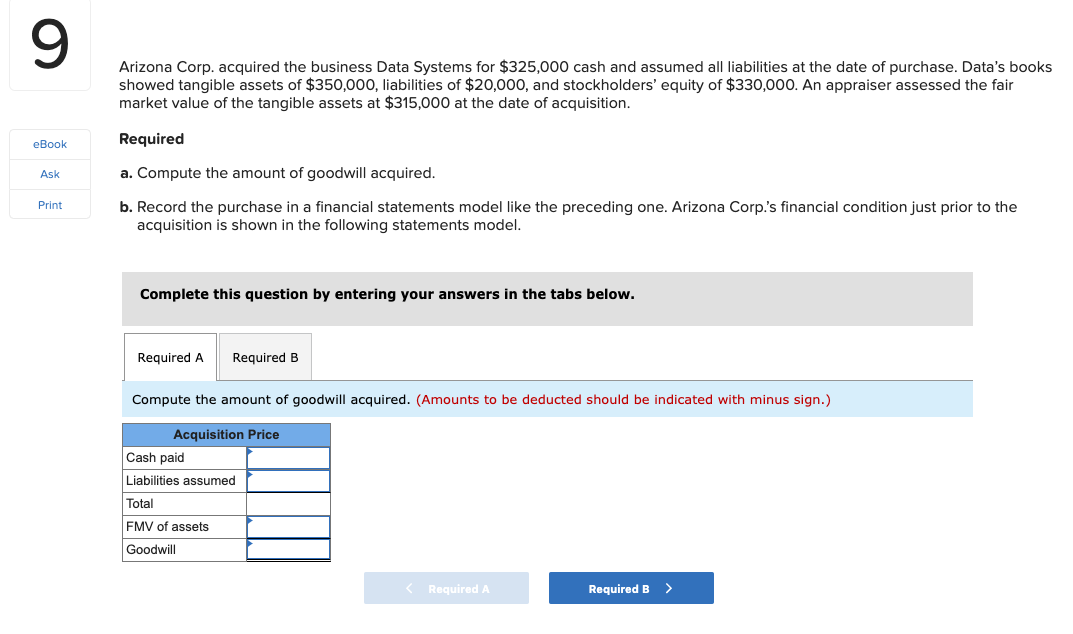

Transcribed Image Text:Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books

showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair

market value of the tangible assets at $315,000 at the date of acquisition.

Required

eBook

Ask

a. Compute the amount of goodwill acquired.

Print

b. Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the

acquisition is shown in the following statements model.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute the amount of goodwill acquired. (Amounts to be deducted should be indicated with minus sign.)

Acquisition Price

Cash paid

Liabilities assumed

Total

FMV of assets

Goodwill

< Required A

Required B >

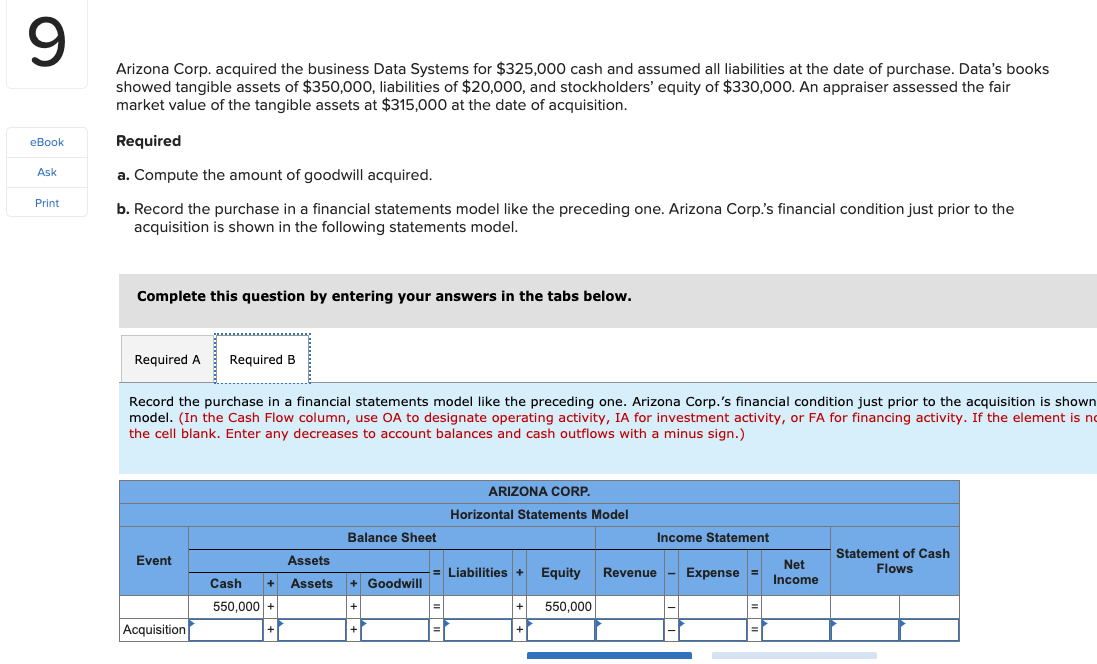

Transcribed Image Text:Arizona Corp. acquired the business Data Systems for $325,000 cash and assumed all liabilities at the date of purchase. Data's books

showed tangible assets of $350,000, liabilities of $20,000, and stockholders' equity of $330,000. An appraiser assessed the fair

market value of the tangible assets at $315,000 at the date of acquisition.

eBook

Required

Ask

a. Compute the amount of goodwill acquired.

Print

b. Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the

acquisition is shown in the following statements model.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Record the purchase in a financial statements model like the preceding one. Arizona Corp.'s financial condition just prior to the acquisition is shown

model. (In the Cash Flow column, use OA to designate operating activity, IA for investment activity, or FA for financing activity. If the element is no

the cell blank. Enter any decreases to account balances and cash outflows with a minus sign.)

ARIZONA CORP.

Horizontal Statements Model

Balance Sheet

Income Statement

Statement of Cash

Event

Assets

Liabilities +

Equity

Expense

Net

Flows

Revenue

Cash

Assets

+ Goodwill

Income

550,000 +

550,000

Acquisition

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning