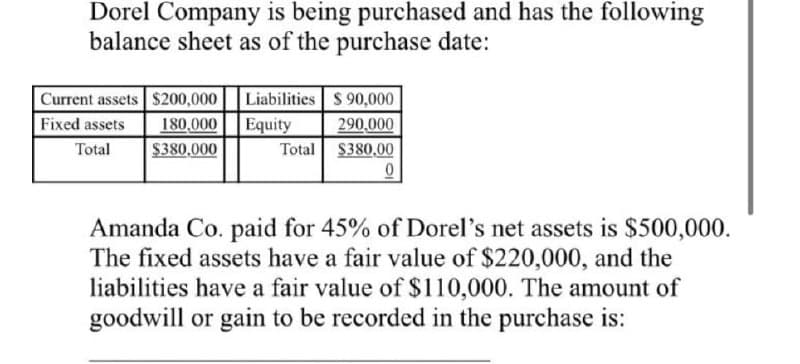

Dorel Company is being purchased and has the following balance sheet as of the purchase date: Current assets $200,000 Liabilities $ 90,000 Fixed assets 180,000 Equity 290,000 Total $380,000 Total $380,00 Amanda Co. paid for 45% of Dorel's net assets is $500,000. The fixed assets have a fair value of $220,000, and the liabilities have a fair value of $110,000. The amount of goodwill or gain to be recorded in the purchase is:

Dorel Company is being purchased and has the following balance sheet as of the purchase date: Current assets $200,000 Liabilities $ 90,000 Fixed assets 180,000 Equity 290,000 Total $380,000 Total $380,00 Amanda Co. paid for 45% of Dorel's net assets is $500,000. The fixed assets have a fair value of $220,000, and the liabilities have a fair value of $110,000. The amount of goodwill or gain to be recorded in the purchase is:

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 9RE

Related questions

Question

answer quickly

Transcribed Image Text:Dorel Company is being purchased and has the following

balance sheet as of the purchase date:

Current assets $200,000

Liabilities S 90,000

Equity

Total $380,00

Fixed assets

180,000

290,000

Total

$380.000

Amanda Co. paid for 45% of Dorel's net assets is $500,000.

The fixed assets have a fair value of $220,000, and the

liabilities have a fair value of $110,000. The amount of

goodwill or gain to be recorded in the purchase is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub