Arjay purchases a bond, newly issued by Amalgamated Corporation, for $5,000. The bond pays $200 to its holder at the end of the first few years and pays $5.200 upon its maturity at the end of the 5 years a What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond? Instructions: Enter your responses as whole numbers. Principal amount $ Term years Coupon rate: % Coupon payment $| b. After receiving the seron

Arjay purchases a bond, newly issued by Amalgamated Corporation, for $5,000. The bond pays $200 to its holder at the end of the first few years and pays $5.200 upon its maturity at the end of the 5 years a What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond? Instructions: Enter your responses as whole numbers. Principal amount $ Term years Coupon rate: % Coupon payment $| b. After receiving the seron

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 3P

Related questions

Question

5

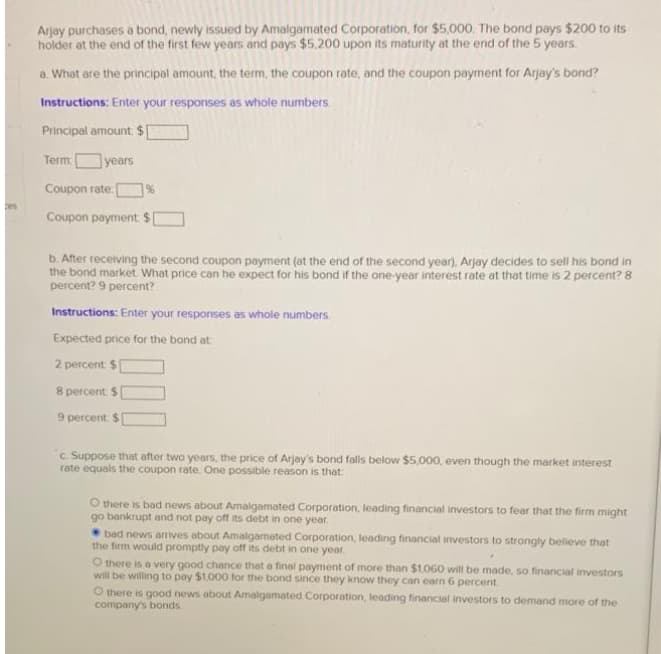

Transcribed Image Text:Arjay purchases a bond, newly issued by Amalgamated Corporation, for $5,000. The bond pays $200 to its

holder at the end of the first few years and pays $5.200 upon its maturity at the end of the 5 years.

a. What are the principal amount, the term, the coupon rate, and the coupon payment for Arjay's bond?

Instructions: Enter your responses as whole numbers.

Principal amount $

Term

years

Coupon rate:

%

Coupon payment $

b. After receiving the second coupon payment (at the end of the second year), Arjay decides to sell his bond in

the bond market What price can he expect for his bond if the one-year interest rate at that time is 2 percent? 8

percent? 9 percent?

Instructions: Enter your responses as whole numbers.

Expected price for the bond at

2 percent $

8 percent $

9 percent: $

c. Suppose that after two years, the price of Arjay's bond falls below $5,000, even though the market interest

rate equals the coupon rate. One possible reason is that

O there is bad news about Amalgamated Corporation, leading financial investors to fear that the firm might

go bankrupt and not pay off its debt in one year.

bad news arrives about Amalgamated Corporation, leading financial investors to strongly beleve that

the firm would promptly pay off its debt in one year.

O there is a very good chance that a final payment of more than $1,060 will be made, so financial investors

will be willing to pay $1,000 for the bond since they know they can earn 6 percent

O there is good news about Amalgamated Corporation, leading financial investors to demand more of the

company's bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College