Arnina established a service business to be known as Arnina Photography on July 1, 2021. During the first month, the following transactions occurred: July 1: Arnina transferred cash of P300,000 from her personal bank account to an account to be used for her business. She also invested the following: digital camera, P45,000; manual camera, P25,000; desktop computer, P28,000; photo papers and ink, P14,000. July 4: paid six-month advance rent to Cyrene Commercial Complex, P30,000 July 6: Received a statement of account from Brian News for advertising this month, P5,500. July 8: Bought photo enhancing and editing equipment from Mirzi Outlet for P40,000. Arnina paid 30% down payment and the balances on account. July 12: Hired office assistant with a monthly salary of P6,000. The office assistant officially started on July 16, 2014. July 13: Photography services rendered totaled P180,000. Terms 25% cash and the balance settled on account. July 14: Purchased office sofa set from Renzo Designs for P30,000 on account. July 15: Paid various operating expenses during the month: Meeting potential clients, P4,000; Electricity, P23,000; Telephone expense, P6,000; and Repair and Maintenance expense, P2,500. July 18: Photography services rendered totaled P185,000, of which 25% was settled with an interest-bearing note and balance on account. July 20: Received photography advances from a couple for a prenuptial coverage to be rendered next month, P60,000 July 22: Collected 90% of the outstanding receivable from July 13 transaction. July 24: Paid in full statement of account received last July 6. July 26: Paid 80% of the outstanding obligation to Mirzi Outlet, she issued an interest-bearing note. July 28: Paid half of the outstanding obligation to Renzo Design. July 31: Paid salary of the office assistant for 16 days, P3,097.

Arnina established a service business to be known as Arnina Photography on July 1, 2021. During the first month, the following transactions occurred: July 1: Arnina transferred cash of P300,000 from her personal bank account to an account to be used for her business. She also invested the following: digital camera, P45,000; manual camera, P25,000; desktop computer, P28,000; photo papers and ink, P14,000. July 4: paid six-month advance rent to Cyrene Commercial Complex, P30,000 July 6: Received a statement of account from Brian News for advertising this month, P5,500. July 8: Bought photo enhancing and editing equipment from Mirzi Outlet for P40,000. Arnina paid 30% down payment and the balances on account. July 12: Hired office assistant with a monthly salary of P6,000. The office assistant officially started on July 16, 2014. July 13: Photography services rendered totaled P180,000. Terms 25% cash and the balance settled on account. July 14: Purchased office sofa set from Renzo Designs for P30,000 on account. July 15: Paid various operating expenses during the month: Meeting potential clients, P4,000; Electricity, P23,000; Telephone expense, P6,000; and Repair and Maintenance expense, P2,500. July 18: Photography services rendered totaled P185,000, of which 25% was settled with an interest-bearing note and balance on account. July 20: Received photography advances from a couple for a prenuptial coverage to be rendered next month, P60,000 July 22: Collected 90% of the outstanding receivable from July 13 transaction. July 24: Paid in full statement of account received last July 6. July 26: Paid 80% of the outstanding obligation to Mirzi Outlet, she issued an interest-bearing note. July 28: Paid half of the outstanding obligation to Renzo Design. July 31: Paid salary of the office assistant for 16 days, P3,097.

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter3: Journalizing Transactions

Section3.3: Transactions Affecting Owner’s Equity And Asset Accounts

Problem 1OYO

Related questions

Question

Arnina established a service business to be known as Arnina Photography on July 1, 2021. During the first month, the following transactions occurred:

- July 1: Arnina transferred cash of P300,000 from her personal bank account to an account to be used for her business. She also invested the following: digital camera, P45,000; manual camera, P25,000; desktop computer, P28,000; photo papers and ink, P14,000.

- July 4: paid six-month advance rent to Cyrene Commercial Complex, P30,000

- July 6: Received a statement of account from Brian News for advertising this month, P5,500.

- July 8: Bought photo enhancing and editing equipment from Mirzi Outlet for P40,000. Arnina paid 30% down payment and the balances on account.

- July 12: Hired office assistant with a monthly salary of P6,000. The office assistant officially started on July 16, 2014.

- July 13: Photography services rendered totaled P180,000. Terms 25% cash and the balance settled on account.

- July 14: Purchased office sofa set from Renzo Designs for P30,000 on account.

- July 15: Paid various operating expenses during the month: Meeting potential clients, P4,000; Electricity, P23,000; Telephone expense, P6,000; and Repair and Maintenance expense, P2,500.

- July 18: Photography services rendered totaled P185,000, of which 25% was settled with an interest-bearing note and balance on account.

- July 20: Received photography advances from a couple for a prenuptial coverage to be rendered next month, P60,000

- July 22: Collected 90% of the outstanding receivable from July 13 transaction.

- July 24: Paid in full statement of

account received last July 6. - July 26: Paid 80% of the outstanding obligation to Mirzi Outlet, she issued an interest-bearing note.

- July 28: Paid half of the outstanding obligation to Renzo Design.

- July 31: Paid salary of the office assistant for 16 days, P3,097.

Required:

- Journalize the foregoing transaction

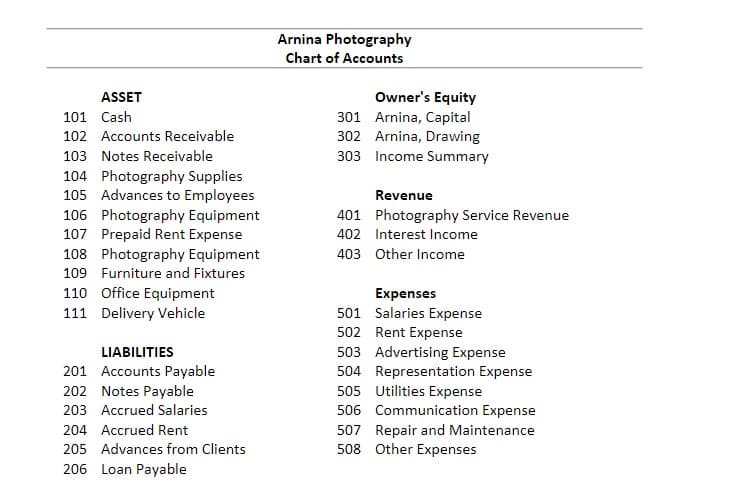

Transcribed Image Text:Arnina Photography

Chart of Accounts

ASSET

Owner's Equity

301 Arnina, Capital

302 Arnina, Drawing

303 Income Summary

101 Cash

102 Accounts Receivable

103 Notes Receivable

104 Photography Supplies

105 Advances to Employees

106 Photography Equipment

107 Prepaid Rent Expense

108 Photography Equipment

109 Furniture and Fixtures

Revenue

401 Photography Service Revenue

402 Interest Income

403 Other Income

110 Office Equipment

111 Delivery Vehicle

Expenses

501 Salaries Expense

502 Rent Expense

LIABILITIES

503 Advertising Expense

201 Accounts Payable

202 Notes Payable

504 Representation Expense

505 Utilities Expense

506 Communication Expense

203 Accrued Salaries

204 Accrued Rent

507 Repair and Maintenance

508 Other Expenses

205 Advances from Clients

206 Loan Payable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you