Arnold Industries has pretax accounting income of $160 million for the year ended December 31, 2024. The tax rate is 25%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inception of the lease was December 28, 2024. An $136 million advance rent payment at the inception of the lease is tax-deductible in 2024 but, for financial reporting purposes, represents prepaid rent expense to be recognized equally over the four-year lease term.

Arnold Industries has pretax accounting income of $160 million for the year ended December 31, 2024. The tax rate is 25%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inception of the lease was December 28, 2024. An $136 million advance rent payment at the inception of the lease is tax-deductible in 2024 but, for financial reporting purposes, represents prepaid rent expense to be recognized equally over the four-year lease term.

Chapter14: Taxes On The Financial Statements

Section: Chapter Questions

Problem 20CE

Related questions

Question

Arnold Industries has pretax accounting income of $160 million for the year ended December 31, 2024. The tax rate is 25%. The only difference between accounting income and taxable income relates to an operating lease in which Arnold is the lessee. The inception of the lease was December 28, 2024. An $136 million advance rent payment at the inception of the lease is tax-deductible in 2024 but, for financial reporting purposes, represents prepaid rent expense to be recognized equally over the four-year lease term.

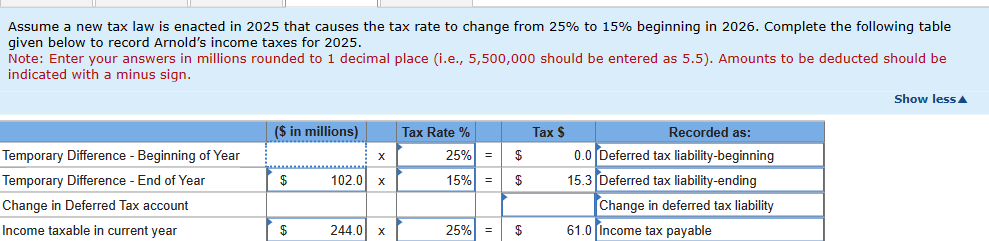

Transcribed Image Text:Assume a new tax law is enacted in 2025 that causes the tax rate to change from 25% to 15% beginning in 2026. Complete the following table

given below to record Arnold's income taxes for 2025.

Note: Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5). Amounts to be deducted should be

indicated with a minus sign.

Temporary Difference - Beginning of Year

Temporary Difference - End of Year

Change in Deferred Tax account

Income taxable in current year

($ in millions)

$

$

X

102.0 x

244.0 X

Tax Rate %

25% =

15% =

25% =

$

$

$

Tax $

Recorded as:

0.0 Deferred tax liability-beginning

15.3 Deferred tax liability-ending

Change in deferred tax liability

61.0 Income tax payable

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT