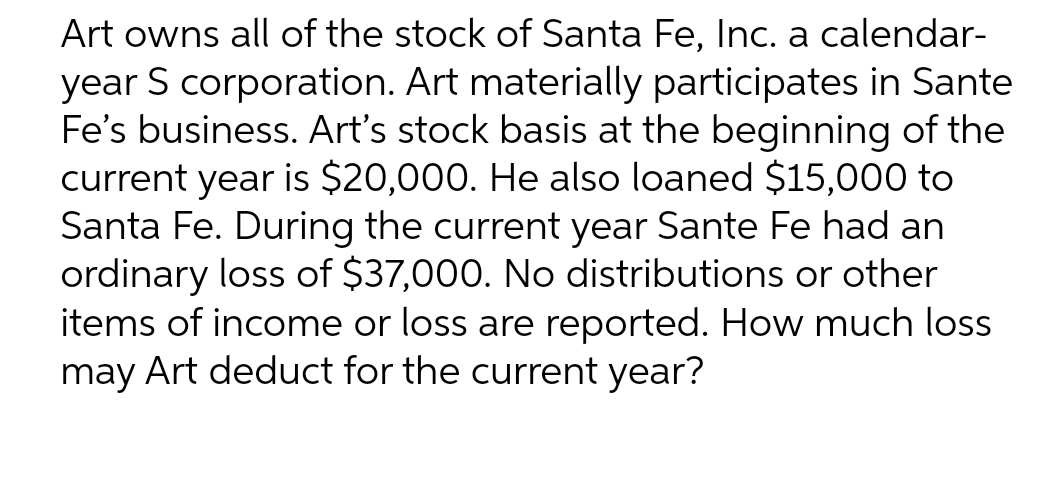

Art owns all of the stock of Santa Fe, Inc. a calendar- year S corporation. Art materially participates in Sante Fe's business. Art's stock basis at the beginning of the current year is $20,000. He also loaned $15,000 to Santa Fe. During the current year Sante Fe had an ordinary loss of $37,000. No distributions or other items of income or loss are reported. How much loss may Art deduct for the current year?

Art owns all of the stock of Santa Fe, Inc. a calendar- year S corporation. Art materially participates in Sante Fe's business. Art's stock basis at the beginning of the current year is $20,000. He also loaned $15,000 to Santa Fe. During the current year Sante Fe had an ordinary loss of $37,000. No distributions or other items of income or loss are reported. How much loss may Art deduct for the current year?

Chapter15: Taxing Business Income

Section: Chapter Questions

Problem 2DQ

Related questions

Question

please answer within 30 minutes .,..,

Transcribed Image Text:Art owns all of the stock of Santa Fe, Inc. a calendar-

year S corporation. Art materially participates in Sante

Fe's business. Art's stock basis at the beginning of the

current year is $20,000. He also loaned $15,000 to

Santa Fe. During the current year Sante Fe had an

ordinary loss of $37,000. No distributions or other

items of income or loss are reported. How much loss

may Art deduct for the current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you