INSTRUCTIONS 1. Record the transactions in the proper journal. Use 7 as the page number for the sales journal and 11 as the page number for the general journal. 2. Immediately after recording each transaction, post to the accounts receivable ledger. 3. Post the amounts from the general journal daily. Post the sales journal amount as a total at the end of the month. 4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule. Analyze: Damaged goods decreased sales by what dollar amount? By what percentage

INSTRUCTIONS 1. Record the transactions in the proper journal. Use 7 as the page number for the sales journal and 11 as the page number for the general journal. 2. Immediately after recording each transaction, post to the accounts receivable ledger. 3. Post the amounts from the general journal daily. Post the sales journal amount as a total at the end of the month. 4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable control account with the total of the schedule. Analyze: Damaged goods decreased sales by what dollar amount? By what percentage

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 1MP

Related questions

Question

Problem 7.4A Recording sales transactions, posting to the accounts receivable ledger, and preparing a schedule of accounts receivable. The Problem is attached.

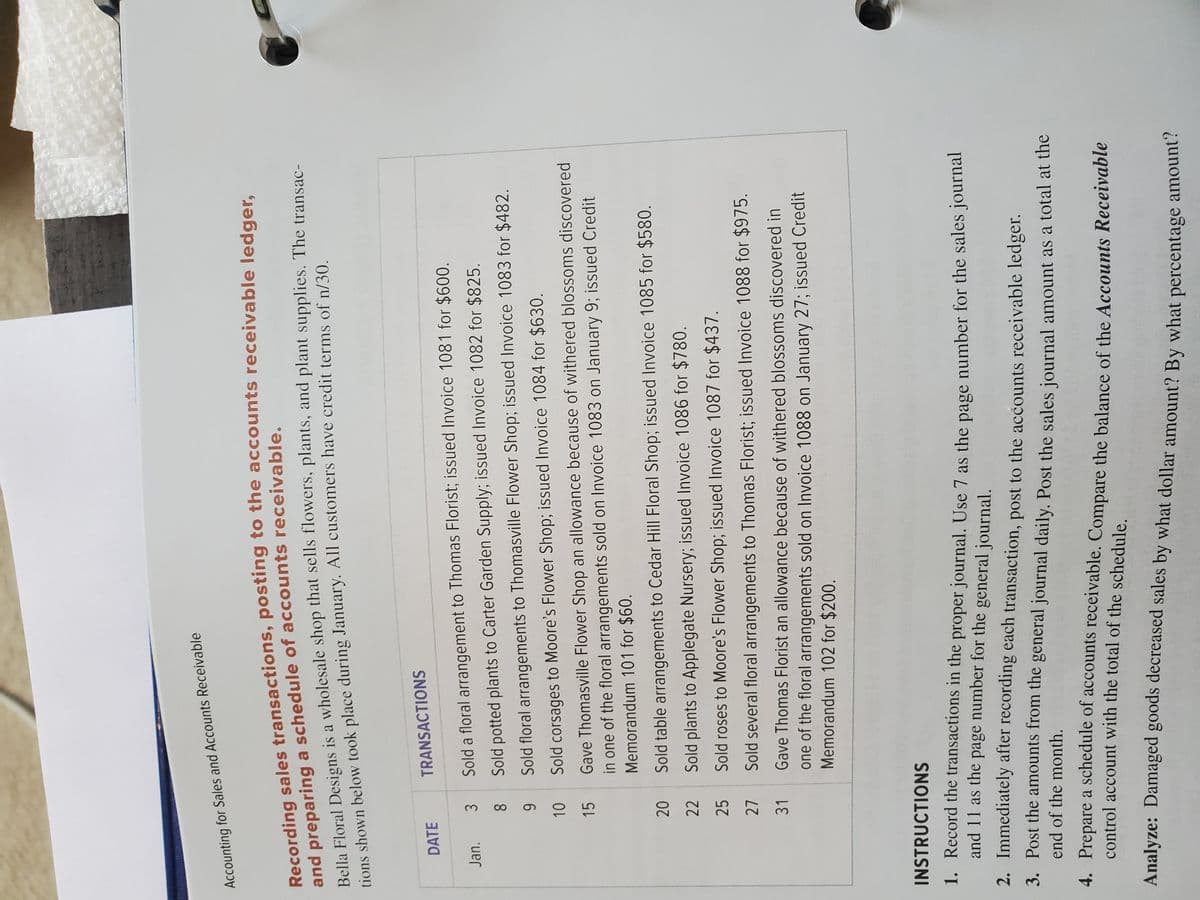

Transcribed Image Text:Accounting for Sales and Accounts Receivable

Recording sales transactions, posting to the accounts receivable ledger,

and preparing a schedule of accounts receivable.

Bella Floral Designs is a wholesale shop that sells flowers, plants, and plant supplies. The transac-

tions shown below took place during January. All customers have credit terms of n/30.

DATE

Jan.

3

8

9

10

15

20

22

25

27

31

TRANSACTIONS

Sold a floral arrangement to Thomas Florist; issued Invoice 1081 for $600.

Sold potted plants to Carter Garden Supply; issued Invoice 1082 for $825.

Sold floral arrangements to Thomasville Flower Shop; issued Invoice 1083 for $482.

Sold corsages to Moore's Flower Shop; issued Invoice 1084 for $630.

Gave Thomasville Flower Shop an allowance because of withered blossoms discovered

in one of the floral arrangements sold on Invoice 1083 on January 9; issued Credit

Memorandum 101 for $60.

Sold table arrangements to Cedar Hill Floral Shop; issued Invoice 1085 for $580.

Sold plants to Applegate Nursery; issued Invoice 1086 for $780.

Sold roses to Moore's Flower Shop; issued Invoice 1087 for $437.

Sold several floral arrangements to Thomas Florist; issued Invoice 1088 for $975.

Gave Thomas Florist an allowance because of withered blossoms discovered in

one of the floral arrangements sold on Invoice 1088 on January 27; issued Credit

Memorandum 102 for $200.

INSTRUCTIONS

1. Record the transactions in the proper journal. Use 7 as the page number for the sales journal

and 11 as the page number for the general journal.

2. Immediately after recording each transaction, post to the accounts receivable ledger.

3. Post the amounts from the general journal daily. Post the sales journal amount as a total at the

end of the month.

4. Prepare a schedule of accounts receivable. Compare the balance of the Accounts Receivable

control account with the total of the schedule.

Analyze: Damaged goods decreased sales by what dollar amount? By what percentage amount?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning