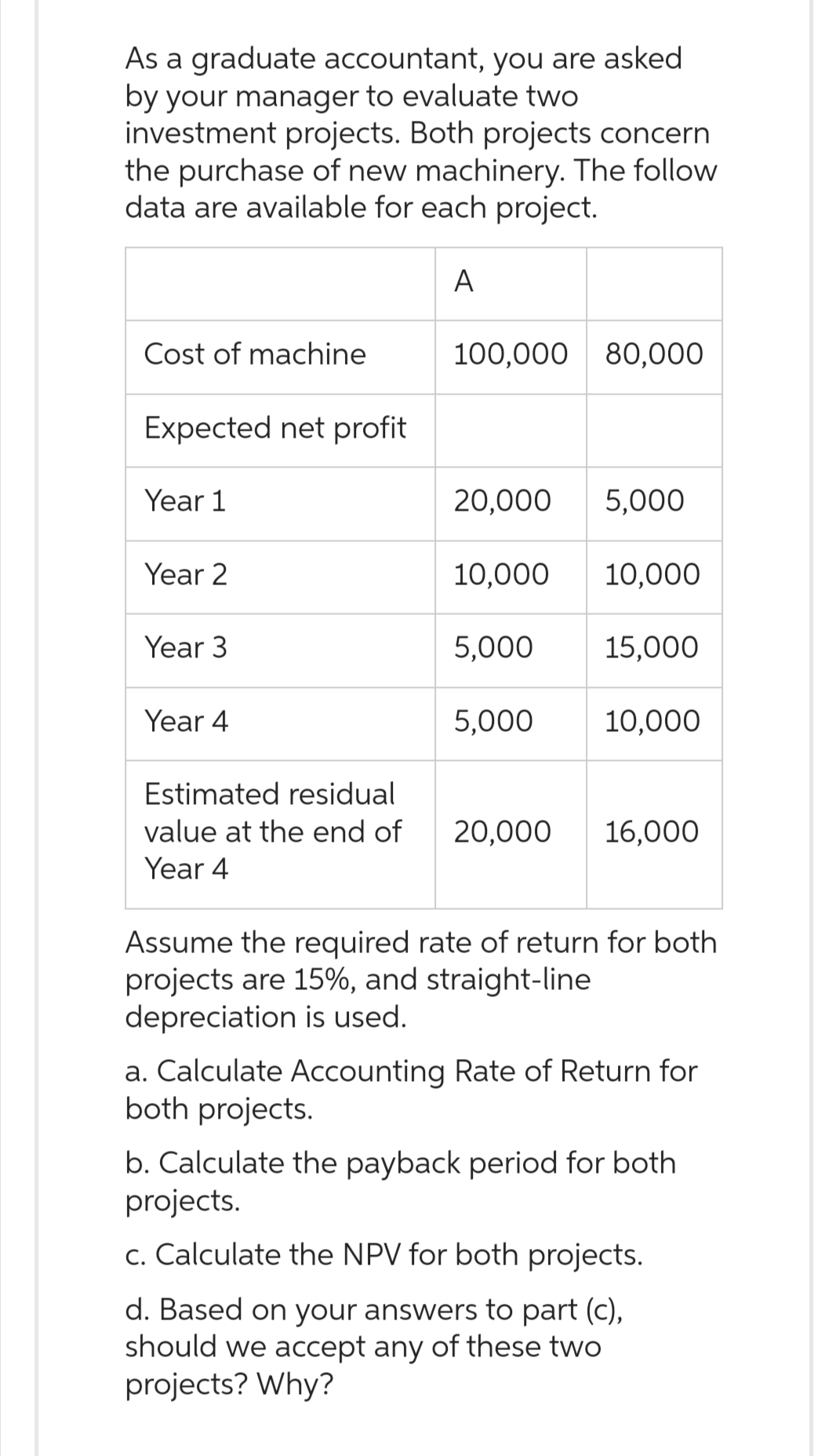

As a graduate accountant, you are asked by your manager to evaluate two investment projects. Both projects concern the purchase of new machinery. The follow data are available for each project. A

Q: mdicate, by matching the relevant amounts, the original acquisition cost and enhancement expenditure…

A: When an amount of expenditure is incurred on an asset for the purpose to enhance the value of the…

Q: 10. Choose the options to correctly complete the following statement. Some balance sheet and income…

A: Sales refer to the total amount of revenue generated by a business through the sale of goods or…

Q: If possible, please calculate using excel and show formulas. The spot interest rates in the…

A: price of the bond = Present value of future cashflows

Q: Consider a 10-year zero coupon bond with a face value F = 100 000. The risk free rate is 0.005. The…

A: Face value (F): $100,000 Risk-free rate (r): 0.005 (0.5%) Credit spread: 125 basis points (1.25%)

Q: A 15-year maturity bond with par value of $1,000 makes semiannual coupon payments at a coupon rate…

A: Bond equivalent YTM is calculated using 'Rate' function of excel where inputs as period (Nper), bond…

Q: A mortgage of P500,000 is to be paid in monthly payments for 3 years. If the rate of interest is 9%…

A: Loans are paid by equal fixed monthly payments and these monthly payments carry payment for interest…

Q: Floopy Co has decided to purchase new equipment. They are in the 38% tax bracket. The desired…

A: ParticularsAmountEquipment cost 77,000Interest12%Tax rate38%Loan payments…

Q: What is a bank syndicate? How is syndication supposed to work/function? What is the difference…

A: A bank syndicate is a group of banks or financial institutions that collaboratively provide funding…

Q: Axis Wells and Excavation(AWE) currently generates 55,000 in annual sales. AWE sells on terms of net…

A: The days' sales outstanding refers to the time it takes for a company to receive payment for their…

Q: Suppose the term structure of annualized interest rate is flat at 5%. Consider the following three…

A: Bonds are the debt obligations of a business on which it requires to pay regular interest to the…

Q: Your storage firm has been offered $99,500 in one year to store some goods for one year. Assume your…

A: Net present value will be calculated as difference between the present value of future cash inflows…

Q: Frosty, Inc. presently has an outstanding 5 percent, $1,000 convertible bond. The bond can be…

A: A bond refers to a debt instrument through which the government and companies raise funds from the…

Q: Your firm is considering an investment that will cost $920,000 today. The investment will produce…

A: Net Present Value (NPV): This technique calculates the present value of future cash flows from an…

Q: Bond A has a coupon rate of 10.18 percent, a yield-to-maturity of 14.22 percent, and a face value of…

A: Bonds refer to the financial instrument that the government issues for raising funds to the general…

Q: What semiannually compounded rate is equivalent to 6% compounded: a. Annually? (Do not round the…

A: The idea of the time value of money (TVM) holds that a quantity of money is valued currently more…

Q: 1. A company is considering whether to purchase a new machine. Machines A and B are available for…

A: Net present value and internal rate of return are the modern method of capital budgeting that is…

Q: Bonds issued by the Tyler Food chain have a par value of $1,000, are selling for $1,360, and have 20…

A: A bond is a kind of debt security issued by the government and private companies for raising funds…

Q: On January 1, the total market value of the Tysseland Company was $60 million. During the year, the…

A: Proportion of Equity Capital = 3,000,000/6,000,000 = 0.50Proportion of Debt Capital =…

Q: A company has $2.5 million of sales today, SG&A costs of $2 million excluding depreciation, annual…

A: The break-even point is where all costs are covered including variable costs and fixed costs and…

Q: Wool Express (WE) has a capital structure of 30% debt and 70% equity. WE is considering a project…

A: The WACC refers to the average return that the company provides to all its stakeholders for…

Q: All else being equal, rising interest rates and tightening credit have what impact on Accounts…

A: Company gives credit to the customers and customers pay late and due to this amount is due with…

Q: The management of California Corporation is considering the purchase of a new machine costing…

A: The PVI of a project refers to the measure of the efficiency of the project by finding the ratio of…

Q: You have an opportunity to invest $49,200 now in return for $60,900 in one year. If your cost of…

A: Net Present Value(NPV) is one of the modern techniques of capital budgeting which considers the time…

Q: Why might individuals purchase futures contracts rather than the underlying asset? What is the…

A: The concept of future contact is associated with management of risk or uncertainty of business…

Q: Temple Corp. is considering a new project whose data are shown below. The equipment that would be…

A: Net present value (NPV) is the value of all the cash flow of the investment (positive and negative)…

Q: A 5-year Treasury bond has a 4.15% yield. A 10-year Treasury bond yields 6%, and a 10-year corporate…

A: Corporate Bond:It represents a debt instrument issued by a company for the purpose of raising…

Q: Calculate the monthly payment by table lookup and formula. (Answers will not be exact due to…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: Consider a student loan of $22,500 at a fixed APR of 12% for 30 years. a. Calculate the monthly…

A:

Q: A corporation began the year with total assets of $125,000 and stockholders' equity of $40,000.…

A: We know as per accounting equation ASSETS = EQUITIES + LIABILITIES.

Q: Your storage firm has been offered $98,100 in one year to store some goods for one year. Assume your…

A: Net present value is the modern methods of capital budgeting that is used to determine the present…

Q: .r.w.a.n. .F.o.o.t.w.e.a.r. .w.i.s.h.e.s. .t.o. .a.s.s.e.s.s. .t.h.e.. .v.a.l.u.e. .o.f. .i.t.s.…

A: The value of the company can be found out as present value of free cash flow of the company and…

Q: Aziz and Bo are planning a big graduation party for their friends in exactly four years. They decide…

A: Here,APR on Investment in 3%Fund Required is $10,000Time Period of Investment is 4 yearsCompounding…

Q: Mention and explain Six Principles of Finance ?

A: Finance is the process of collection of resources (funds) and deployment of that resources into…

Q: IMPORTANT: PLEASE SAVE ALL YOUR HAND CALCULATIONS IN A FILE SO THAT YOU CAN SUBMIT THEM IF REQUIRED…

A: Depreciation determined using the straight-line technique is all that constitutes annual capital…

Q: Mack Aroni, a bank robber, is worried about his retirement. He decides to start a savings account.…

A: Future value is the estimation of the future worth of an investment which is likely to be received…

Q: In December 2020, a pound of lemons cost $1.52, while a pound of bananas cost $1.16. Two years…

A: A pound of Lemon cost (2020) = $1.52A pound of Banana cost (2020) = $1.162 years prior lemon cost =…

Q: 15-year maturity bond with par value of $1,000 makes semiannual coupon payments at a coupon rate of…

A: A bond is a kind of debt security issued by the government and private companies for raising funds…

Q: Red Lizard Co loan payment O A rate equ A rate les: O A rate equ O A rate equ O A rate equ 20000

A: The effective annual rate refers to the interest rate that is being charged on the borrowing amount…

Q: If each motorcycle requires a fan belt that costs $2.000 and between 1.500 and 2,000 motorcycles are…

A: Fixed costs are those costs which will not change with change in activity level. Variable costs…

Q: Calculate the duration and convexity of a bond, 20 years to maturity bond and 6% coupon rate. Assume…

A: The duration and the convexity of the bond are measures of the sensitivity analysis of the bond. The…

Q: As connoisseurs of elegant fast food cuisine, we are interested in making a bid for the Greens-to-Go…

A: The unlevered beta refers to the measurement of the market risk of the company without the impact of…

Q: Harry who has a salary of 150000 invested 1675 in his sons RESP in the year 2023. How much CESG…

A: CESG grant is the benefit provided by the government when a person invests in the RESP funds for the…

Q: what about in terms of present value?

A: Present value helps us know the value of future cash flows in the present time. A higher interest…

Q: Accounting M11-8 (Algo) Calculating Net Present Value, Predicting Internal Rate of Return [LO 11-3,…

A: NPV : Npv is also known as Net present Value. It is a capital budgeting techniques which help in…

Q: Suppose that many stocks are traded in the market and that it is possible to borrow at the risk-free…

A: StockExpected ReturnStandard DeviationA8%55%B4%45%Correlation -1

Q: Fast pls solve this question correctly in 5 min pls I will give u like for sure Svtrik Stock in…

A: When the company receives profits and distributes them among the shareholders. That share of profit…

Q: The common shares of Twitter, Incorporated (TWTR) recently traded on the NYSE for $97 per share. You…

A: An option refers to a derivative instrument that provides the option holder the choice of…

Q: A factory costs $840,000. You estimate that it will produce an inflow after operating costs of…

A: The investment's entire financial benefit or profitability is shown by the net present value. A…

Q: Warehouse Year Operating Income 1 $ 61,400 2 51,400 36,400 26,400 (3,600) $172,000 3 4 5 Total Year…

A: Capital budgeting refers to the process of evaluating and selecting long-term investment projects or…

Q: Find a portfolio with payoff at time T equal to if 0 ≤ S(T) ≤ 10, if 10 ≤S(T) ≤ 30, if 30 ≤S(T). VT…

A: To construct a portfolio with the desired payoff, we can break it down into three different regions…

Please do not give solution in image format thanku

Step by step

Solved in 6 steps with 4 images

- Calculate the following: The first year of depreciation on a residential rental building costing $250,000 purchased June 2,2019. $_____________ The second year (2020) of depreciation on a computer costing $5,000 purchased in May 2019, using the half-year convention and accelerated depreciation considering any bonus depreciation taken. $______________ The first year of depreciation on a computer costing $2,800 purchased in May 2019, using the half-year convention and straight-line depreciation with no bonus depreciation. $______________ The third year of depreciation on business furniture costing $10,000 purchased in March 2017, using the half-year convention and accelerated depreciation but no bonus depreciation. $______________The organization you are employed by is investing in new machinery for their warehouse. The $1.2 million initial investment is made. In year 1, the annual maintenance expenditures are $42,000, and they rise by $3,000 annually after that. In the first year, the revenues are $118,000, and they rise by 6% annually. After the equipment's 12-year useful life, a $25,000 salvage value will be obtained.a) The rate of return company made during progressb) If the desired MARR is 5%, is this a good investment?The Dammon Corp. has the following investment opportunities: Machine A Machine B Machine C ($10,000 cost) ($22,500 cost) ($35,500 cost) Inflows Inflows Inflows year 1 $ 6,000 year 1 $ 12,000 year 1 $ -0- year 2 3,000 year 2 7,500 year 2 30,000 year 3 3,000 year 3 1,500 year 3 5,000 year 4 -0- year 4 1,500 year 4 20,000 Under the payback method and assuming these machines are mutually exclusive, which machine(s) would Dammon Corp. choose?

- On December 31 Y1, the Company ARL develop a Product: Master 3D. The disbursement associate to the Product are the following: Research $6,000,000 and Development $4,000,000. The criteria have been met for recognition of the development costs as an asset. Product Master D will be in the market in Year 2 and is expected to marketable for 5 years. Total sales of the product are estimated at $100,000,000. Instructions: Using IAS 38, determine the effect of the Research & Development costs have on Company’s Net Income. Answer the following questions. 1. Choose one and explain Net Income using IFRS will be in Year 1: a. Higher by $________ larger than U.S. GAAP income. b. Lower by $________ larger than U.S. GAAP income. c. Both will be the same. 2. Explanation: 3. Year 3 (ending balance) Determine the Book Value of the asset 4. Explanation:On December 31 Y1, the Company ARL develop a Product: Master 3D. The disbursement associate to the Product are the following: Research $6,000,000 and Development $4,000,000. The criteria have been met for recognition of the development costs as an asset. Product Master D will be in the market in Year 2 and is expected to marketable for 5 years. Total sales of the product are estimated at $100,000,000. Instructions: Using IAS 38, determine the effect of the Research & Development costs have on Company’s Net Income. Answer the following questions. 1. Choose one and explain Net Income using IFRS will be in Year 1: a. Higher by $________ larger than U.S. GAAP income. b. Lower by $________ larger than U.S. GAAP income. c. Both will be the same. 2. Explanation: 3. Year 3 (ending balance) Determine the Book Value of the asset 4. Explanation: Show you computations.Assume that management is evaluating the purchase of a new machine as follows: Cost of new machine: $800,000 Residual value: $0 Estimated total income from machine: $300,000 Expected useful life: 5 years The average rate of return of a new equipment is _____.

- In a cost center, the manager has responsibility and authority for making decisions that affect a. costs b. investments in assets c. both costs and revenues d. revenues Keating Co. is considering disposing of equipment with a cost of $68,000 and accumulated depreciation of $47,600. Keating Co. can sell the equipment through a broker for $27,000 less 8% commission. Alternatively, Gunner Co. has offered to lease the equipment for five years for a total of $46,000. Keating will incur repair, insurance, and property tax expenses estimated at $10,000 over the five-year period. At lease-end, the equipment is expected to have no residual value. The net differential income from the lease alternative is a. $11,160 b. $7,812 c. $16,740 d. $13,392 If sales are $828,000, variable costs are 68% of sales, and operating income is $278,000, what is the contribution margin ratio? a. 64% b. 36% c. 68% d. 32%Quary Company is considering an investment in machinery with the following information. Initial investment $ 308,000 Materials, labor, and overhead (except depreciation) $ 69,300 Useful life 9 years Depreciation—Machinery 32,000 Salvage value $ 20,000 Selling, general, and administrative expenses 7,700 Expected sales per year 15,400 units Selling price per unit $ 10 (a) Compute the investment’s annual income and annual net cash flow.(b) Compute the investment’s payback period. Please also help with what I need to use to fill in the blanks on the first image. "Required A"He receives a base salary plus a 25% bonus of his salary if he meets certain income goals. The information he has available for the analysis is shown here: cost of the machine 2,000,000 income to be generated by the machine 1,000,000 income without the new machine 7,000,000 beginning of the year capital assets (without the machine) 8,000,000 end of year capital assests (without the machine) 8,400,000 tax rate 30% minimum required rate of return 15% weighted average cost of capital 9% sales revenue without the machine 18,000,000 sales revenue with the machine 19,400,000 The manager is looking at several different measures to evaluate this decision. Answer the following questions: 1.How would ROI be affected if the invested capital were measured at gross book value, and the gross book values of the beginning and end of the year assets without the new machine were ?11,000,000 and ?11,800,000, respectively?

- Your company has been presented with a decision on replacing a piece of equipment for a new computerized version that promotes efficiency for the upcoming year. As manager you will need to decide whether or not the purchase of the new equipment is a worthwhile investment and to communicate your recommendations to Executive Management for a final decision. To be convincing, sufficient support for your recommendations must be provided in order to be considered valid and accepted. Existing EquipmentOriginal Cost60,000Present Book Value30,000Annual Cash Operating Costs145,000Current Market Value15,000Market Value in Ten Years0Remaining useful Life10 years Replacement EquipmentCost600,000Annual Cash Operating Costs50,000Market Value in Ten Years0Useful Life10 years Other Information Cost of Capital10%Payback requirement6 years In this assignment, use the information above to develop a comprehensive analysis using NPV, Payback Method, and IRR to develop a recommendation on replacing…I need help filling out the empty fields. Can you please include the formulas: Laurman, Incorporated is considering the following project: Required investment in equipment $2,205,000 Project life 7 Salvage value 225,000 The project would provide net operating income each year as follows: Sales $2,750,000 Variable expenses 1,600,000 Contribution margin $1,150,000 Fixed expenses: Salaries, rent and other fixed out-of pocket costs $520,000 Depreciation 350,000 Total fixed expenses 870,000 Net operating income $280,000 Company discount rate 18% Required: (Use cells A4 to C18 from the given information, as well as B24, and A30 to D46 to complete this question. Negative amounts or amounts to be deducted should be input as negative values and will display in…You are considering two types of machines fora manufacturing process.◼◼ Machine A has a first cost of $75,200, and itssalvage value at the end of six years of estimatedservice life is $21,000. The operating costs ofthis machine are estimated to be $6,800 per year.Extra income taxes are estimated at $2,400 peryear.◼◼ Machine B has a first cost of $44,000, and itssalvage value at the end of six years’ service isestimated to be negligible. The annual operatingcosts will be $11,500.Compare these two mutually exclusive alternativesby the present-worth method at i = 13%