As a healthcare insurance provider, you sell health insurance for a yearly premium. The probability that a randomly selected person who buys health insurance from you will get sick and charge \$6,000 per year is 40\%. If the yearly insurance premium is \$12,000 then who do you think wins, the insurance provider or

As a healthcare insurance provider, you sell health insurance for a yearly premium. The probability that a randomly selected person who buys health insurance from you will get sick and charge \$6,000 per year is 40\%. If the yearly insurance premium is \$12,000 then who do you think wins, the insurance provider or

Chapter9: Sequences, Probability And Counting Theory

Section9.7: Probability

Problem 1SE: What term is used to express the likelihood of an event occurring? Are there restrictions on its...

Related questions

Question

As a healthcare insurance provider, you sell health insurance for a yearly premium. The probability that a randomly selected person who buys health insurance from you will get sick and charge \$6,000 per year is 40\%. If the yearly insurance premium is \$12,000 then who do you think wins, the insurance provider or the insurance buyer, that is, find the expected return for the policy?

Transcribed Image Text:Safari

Archivo

Edición

Visualización

Historial

Marcadores

Ventana

Ayuda

Sáb nov. 20 11:33 p. m.

math.suflek.com

Suflek | Welcome!

b My Questions | bartleby

B Brainly.com - For students. By students.

Sorry, your answer is wrong (but saved). Better luck next time!

A Check Answer/Save

O Step-By-Step Example

C Live Help

STEP-BY-STEP EXAMPLE

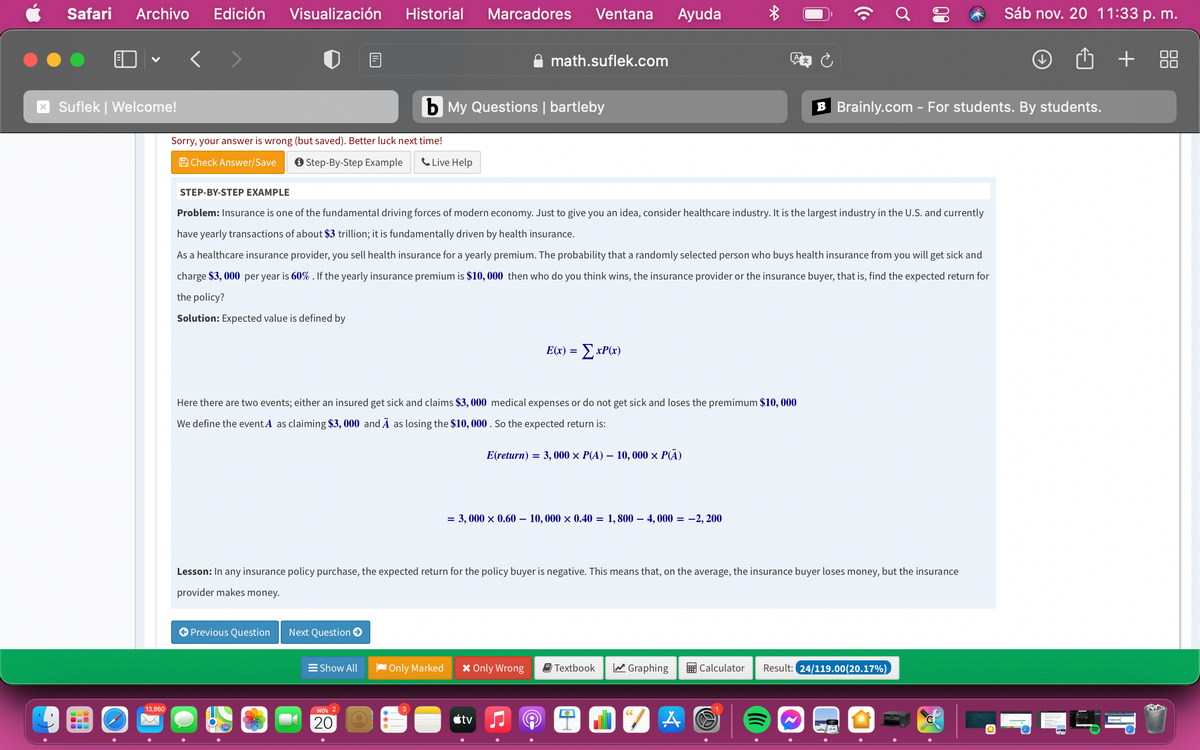

Problem: Insurance is one of the fundamental driving forces of modern economy. Just to give you an idea, consider healthcare industry. It is the largest industry in the U.S. and currently

have yearly transactions of about $3 trillion; it is fundamentally driven by health insurance.

As a healthcare insurance provider, you sell health insurance for a yearly premium. The probability that a randomly selected person who buys health insurance from you will get sick and

charge $3, 000 per year is 60% . If the yearly insurance premium is $10, 000 then who do you think wins, the insurance provider or the insurance buyer, that is, find the expected return for

the policy?

Solution: Expected value is defined by

E(x) =

ExP(x)

Here there are two events; either an insured get sick and claims $3, 000 medical expenses or do not get sick and loses the premimum $10, 000

We define the event A as claiming $3, 000 and Ā as losing the $10, 000 . So the expected return is:

E(return) = 3, 000 × P(A) – 10, 000 × P(A)

= 3, 000 x 0.60 – 10,000 × 0.40 = 1,800 – 4, 000 = -2, 200

Lesson: In any insurance policy purchase, the expected return for the policy buyer is negative. This means that, on the average, the insurance buyer loses money, but the insurance

provider makes money.

O Previous Question

Next Question O

E Show All

Only Marked

X Only Wrong

E Textbook

a Graphing

E Calculator

Result: 24/119.00(20.17%)

13,860

NOV 2

étv

...

20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you