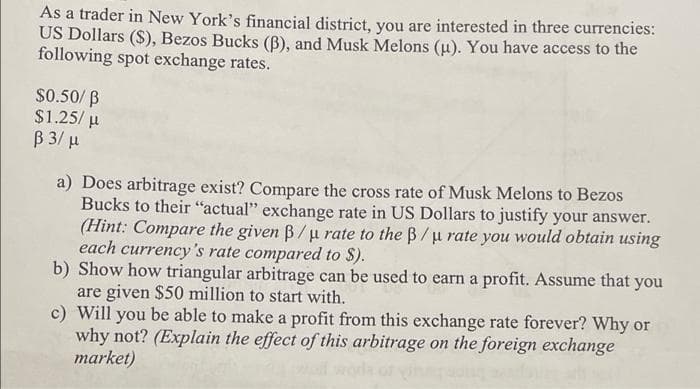

As a trader in New York's financial district, you are interested in three currencies: US Dollars ($), Bezos Bucks (B), and Musk Melons (u). You have access to the following spot exchange rates. $0.50/ B $1.25/ u B 3/ u a) Does arbitrage exist? Compare the cross rate of Musk Melons to Bezos Bucks to their "actual" exchange rate in US Dollars to justify your answer. (Hint: Compare the given B/u rate to the B/u rate you would obtain using each currency's rate compared to S). b) Show how triangular arbitrage can be used to earn a profit. Assume that you are given $50 million to start with. c) Will you be able to make a profit from this exchange rate forever? Why or why not? (Explain the effect of this arbitrage on the foreign exchange market)

As a trader in New York's financial district, you are interested in three currencies: US Dollars ($), Bezos Bucks (B), and Musk Melons (u). You have access to the following spot exchange rates. $0.50/ B $1.25/ u B 3/ u a) Does arbitrage exist? Compare the cross rate of Musk Melons to Bezos Bucks to their "actual" exchange rate in US Dollars to justify your answer. (Hint: Compare the given B/u rate to the B/u rate you would obtain using each currency's rate compared to S). b) Show how triangular arbitrage can be used to earn a profit. Assume that you are given $50 million to start with. c) Will you be able to make a profit from this exchange rate forever? Why or why not? (Explain the effect of this arbitrage on the foreign exchange market)

ChapterP2: Part 2: Exchange Rate Behavior

Section: Chapter Questions

Problem 1Q

Related questions

Question

8

Transcribed Image Text:As a trader in New York's financial district, you are interested in three currencies:

US Dollars ($), Bezos Bucks (B), and Musk Melons (u). You have access to the

following spot exchange rates.

$0.50/ B

$1.25/ u

B 3/ µ

a) Does arbitrage exist? Compare the cross rate of Musk Melons to Bezos

Bucks to their "actual" exchange rate in US Dollars to justify your answer.

(Hint: Compare the given B/u rate to the B/u rate you would obtain using

each currency's rate compared to S).

b) Show how triangular arbitrage can be used to earn a profit. Assume that you

are given $50 million to start with.

c) Will you be able to make a profit from this exchange rate forever? Why or

why not? (Explain the effect of this arbitrage on the foreign exchange

market)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning