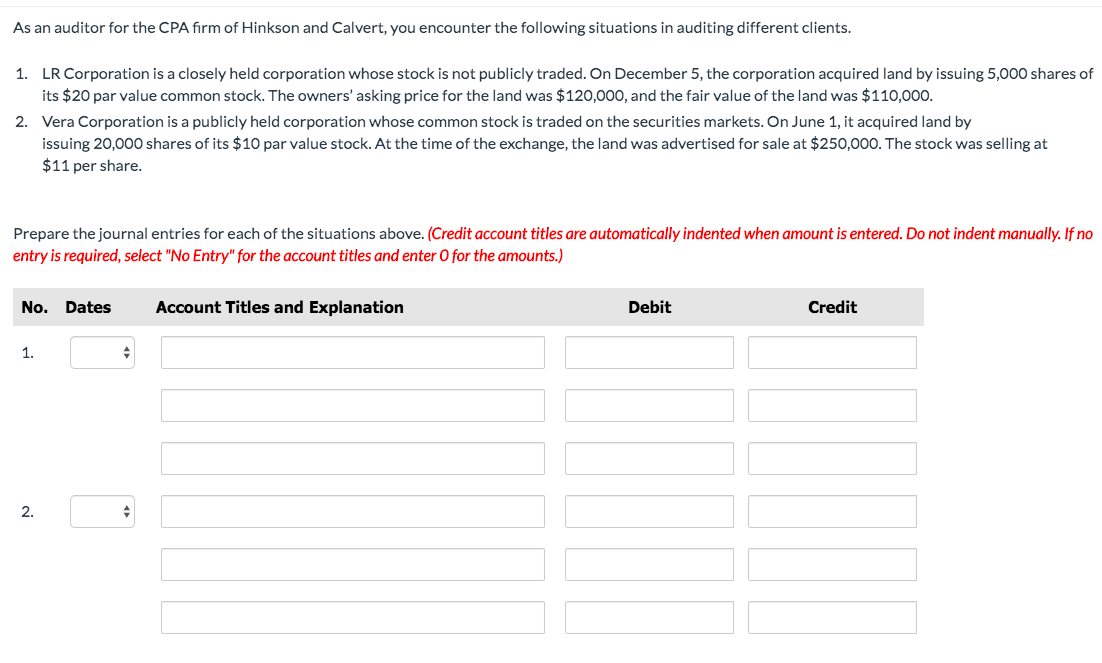

As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients. 1. LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of its $20 par value common stock. The owners' asking price for the land was $120,000, and the fair value of the land was $110,000. 2. Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $250,000. The stock was selling at $11 per share. Prepare the journal entries for each of the situations above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Dates Account Titles and Explanation Debit Credit 1. 2.

As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients. 1. LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of its $20 par value common stock. The owners' asking price for the land was $120,000, and the fair value of the land was $110,000. 2. Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $250,000. The stock was selling at $11 per share. Prepare the journal entries for each of the situations above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) No. Dates Account Titles and Explanation Debit Credit 1. 2.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter13: Auditing Debt, Equity, And Long-term Liabilities Requiring Management Estimates

Section: Chapter Questions

Problem 15RQSC

Related questions

Question

As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients.

| 1. | LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of its $20 par value common stock. The owners’ asking price for the land was $120,000, and the fair value of the land was $110,000. | |

| 2. | Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $250,000. The stock was selling at $11 per share. |

Prepare the

Transcribed Image Text:As an auditor for the CPA firm of Hinkson and Calvert, you encounter the following situations in auditing different clients.

1. LR Corporation is a closely held corporation whose stock is not publicly traded. On December 5, the corporation acquired land by issuing 5,000 shares of

its $20 par value common stock. The owners' asking price for the land was $120,000, and the fair value of the land was $110,000.

2. Vera Corporation is a publicly held corporation whose common stock is traded on the securities markets. On June 1, it acquired land by

issuing 20,000 shares of its $10 par value stock. At the time of the exchange, the land was advertised for sale at $250,000. The stock was selling at

$11 per share.

Prepare the journal entries for each of the situations above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no

entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

No. Dates

Account Titles and Explanation

Debit

Credit

1.

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub