You were able to gather the following during your audit: a. To acquire land and building, the company paid P98,000 cash and 10,000 shares of its 9% cumulative preferred shares, P100 par value per share. The shares were then selling at P120. b. Legal fees covered the following: Cost of incorporation P 9,500 Examination of title covering purchase of the land 4,000 Legal work in connection with construction contract 1,500 P 15,000 c. Because of a general increase in construction costs after entering into the building contract, the board of directors increased the value of the building by P500,000, believing such increase is justified to reflect current market value at the time the building was completed. Retained earnings was credited for this amount. d. Estimated useful life of the building is 25 years. REQUIRED: 1. Prepare the necessary adjusting journal entries as of December 31, 2019. 2. Determine the adjusted balances of the following as of December 31, 2019: a. Land and building b. Land c. Carrying value of building d. Organization cost, net (presented under Noncurrent Assets)

You were able to gather the following during your audit: a. To acquire land and building, the company paid P98,000 cash and 10,000 shares of its 9% cumulative preferred shares, P100 par value per share. The shares were then selling at P120. b. Legal fees covered the following: Cost of incorporation P 9,500 Examination of title covering purchase of the land 4,000 Legal work in connection with construction contract 1,500 P 15,000 c. Because of a general increase in construction costs after entering into the building contract, the board of directors increased the value of the building by P500,000, believing such increase is justified to reflect current market value at the time the building was completed. Retained earnings was credited for this amount. d. Estimated useful life of the building is 25 years. REQUIRED: 1. Prepare the necessary adjusting journal entries as of December 31, 2019. 2. Determine the adjusted balances of the following as of December 31, 2019: a. Land and building b. Land c. Carrying value of building d. Organization cost, net (presented under Noncurrent Assets)

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 38P

Related questions

Question

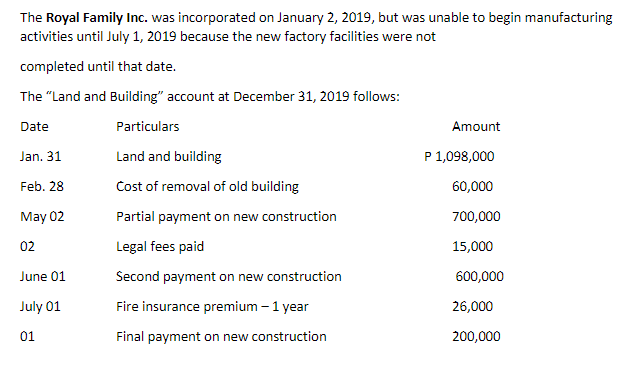

Transcribed Image Text:The Royal Family Inc. was incorporated on January 2, 2019, but was unable to begin manufacturing

activities until July 1, 2019 because the new factory facilities were not

completed until that date.

The "Land and Building" account at December 31, 2019 follows:

Date

Particulars

Amount

Jan. 31

Land and building

P 1,098,000

Feb. 28

Cost of removal of old building

60,000

May 02

Partial payment on new construction

700,000

02

Legal fees paid

15,000

June 01

Second payment on new construction

600,000

July 01

Fire insurance premium – 1 year

26,000

01

Final payment on new construction

200,000

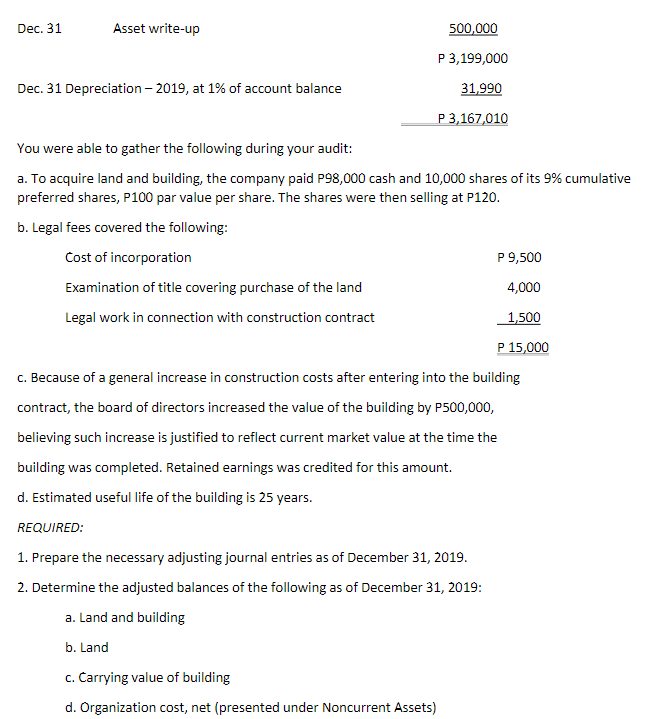

Transcribed Image Text:Dec. 31

Asset write-up

500,000

P 3,199,000

Dec. 31 Depreciation – 2019, at 1% of account balance

31,990

P 3,167,010

You were able to gather the following during your audit:

a. To acquire land and building, the company paid P98,000 cash and 10,000 shares of its 9% cumulative

preferred shares, P100 par value per share. The shares were then selling at P120.

b. Legal fees covered the following:

Cost of incorporation

P 9,500

Examination of title covering purchase of the land

4,000

Legal work in connection with construction contract

1,500

P 15,000

c. Because of a general increase in construction costs after entering into the building

contract, the board of directors increased the value of the building by P500,000,

believing such increase is justified to reflect current market value :

the time the

building was completed. Retained earnings was credited for this amount.

d. Estimated useful life of the building is 25 years.

REQUIRED:

1. Prepare the necessary adjusting journal entries as of December 31, 2019.

2. Determine the adjusted balances of the following as of December 31, 2019:

a. Land and building

b. Land

c. Carying value of building

d. Organization cost, net (presented under Noncurrent Assets)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning