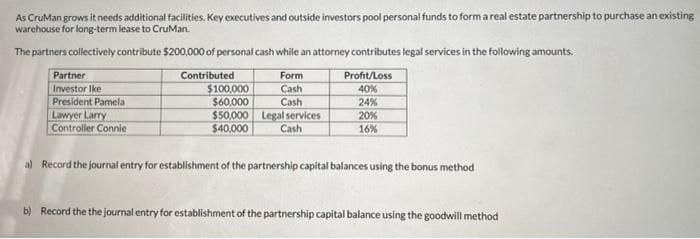

As CruMan grows it needs additional facilities. Key executives and outside investors pool personal funds to form a real estate partnership to purchase an existing warehouse for long-term lease to CruMan. The partners collectively contribute $200,000 of personal cash while an attorney contributes legal services in the following amounts. Contributed Form Cash Cash Partner Investor Ike President Pamela Lawyer Larry Controller Connie $100,000 $60,000 $50,000 Legal services $40,000 Cash Profit/Loss 40% 24% 20% 16% al Record the journal entry for establishment of the partnership capital balances using the bonus method b) Record the the journal entry for establishment of the partnership capital balance using the goodwill method

Partnership Accounting

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings, admission of a new partner, etc.

Partner Admission and Withdrawal

A partnership is a kind of arrangement between two or more people whereby they agree to manage the business operations and share its profits and losses in an agreed ratio between them. The agreement that is drafted and signed by the partners of the firm is termed as a partnership deed and contains various important clauses agreed between the partners such as profit/loss sharing, interest on capital, remuneration allocation of each partner, drawings of a partner, etc.

Step by step

Solved in 2 steps with 6 images