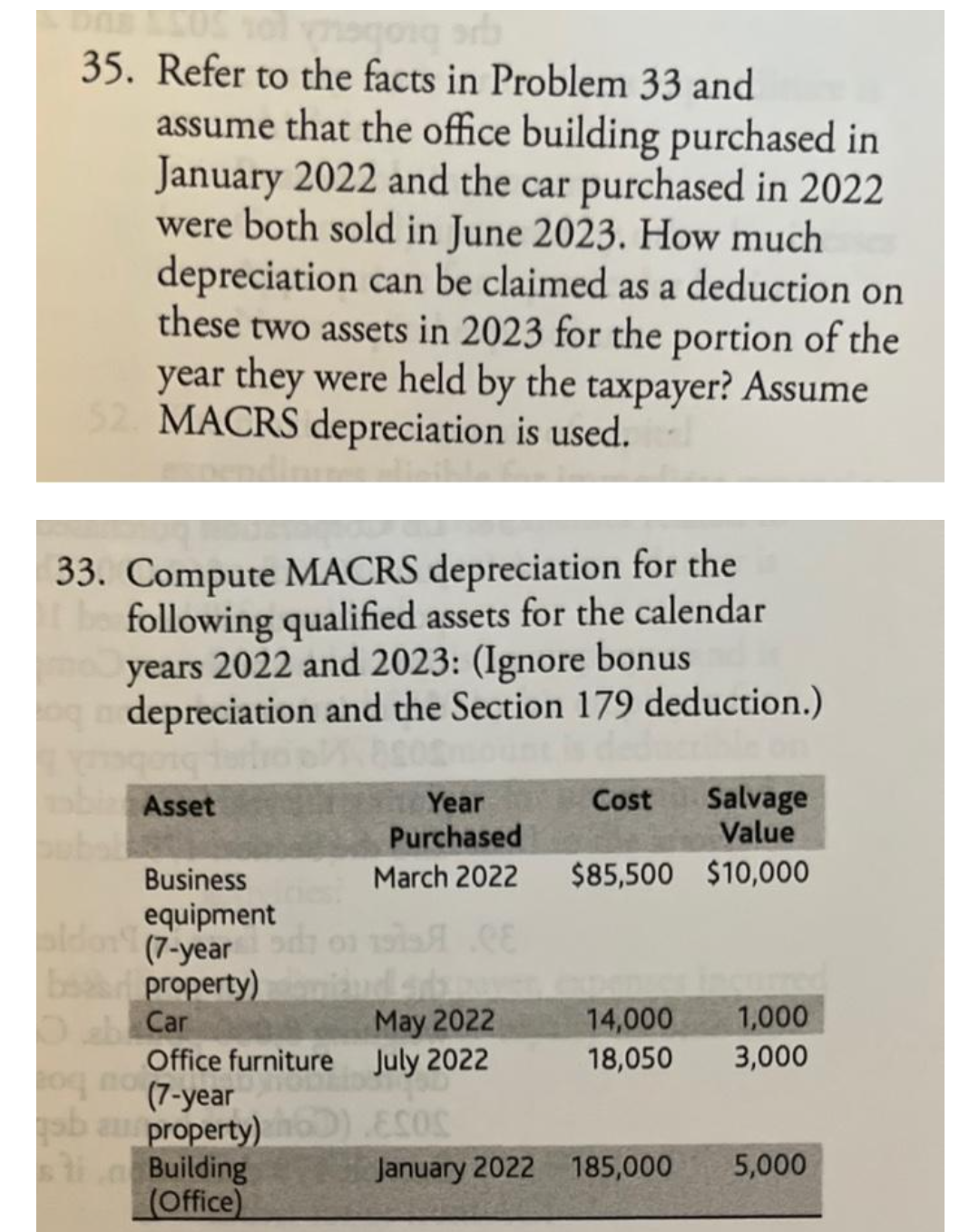

33. Compute MACRS depreciation for the following qualified assets for the calendar mo years 2022 and 2023: (Ignore bonus oq depreciation and the Section 179 deduction.) Asset Year Cost Purchased March 2022 Business equipment (7-year 5101 191. CE stia Building (Office) bar property) omiad sds abCar O May 2022 Office furniture OVE July 2022 204no (7-year gab aur property) h6D) ECOS ob Salvage Value $85,500 $10,000 14,000 18,050 1,000 3,000 January 2022 185,000 5,000

33. Compute MACRS depreciation for the following qualified assets for the calendar mo years 2022 and 2023: (Ignore bonus oq depreciation and the Section 179 deduction.) Asset Year Cost Purchased March 2022 Business equipment (7-year 5101 191. CE stia Building (Office) bar property) omiad sds abCar O May 2022 Office furniture OVE July 2022 204no (7-year gab aur property) h6D) ECOS ob Salvage Value $85,500 $10,000 14,000 18,050 1,000 3,000 January 2022 185,000 5,000

Chapter8: Depreciation And Sale Of Business Property

Section: Chapter Questions

Problem 5MCQ: Which of the following statements with respect to the depreciation of property under MACRS is...

Related questions

Question

please answer both parts within 30 minutes..

Transcribed Image Text:35. Refer to the facts in Problem 33 and

assume that the office building purchased in

January 2022 and the car purchased in 2022

were both sold in June 2023. How much

depreciation can be claimed as a deduction on

these two assets in 2023 for the portion of the

year they were held by the taxpayer? Assume

52. MACRS depreciation is used.

33. Compute MACRS depreciation for the

following qualified assets for the calendar

years 2022 and 2023: (Ignore bonus

oq n depreciation and the Section 179 deduction.)

Asset

Year

Purchased

March 2022

ACE

Business

equipment

(7-year do

bear property)omiandsda

DrabCar

May 2022

Office furniture July 2022

(7-year

SOMER

20q

sb aur property) h60) ESOS

stia Building

(Office)

January 2022

Salvage

Value

$85,500 $10,000

Cost

14,000

1,000

18,050 3,000

185,00

5,000

0005

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT