As of December 31, 2022, 380 lots were sold and the market value of each lot had increased to P270,000. On this date, the company decided to transfer the remaining unsold lots into investment property that is to be carried under the fair value model. What amount of gain should San Jose Realty recognize as a result of the transfer from inventory to investment property? P5,400,000 P4,500,000 P4,050,000 P1,350,000 a. b. C. d.

As of December 31, 2022, 380 lots were sold and the market value of each lot had increased to P270,000. On this date, the company decided to transfer the remaining unsold lots into investment property that is to be carried under the fair value model. What amount of gain should San Jose Realty recognize as a result of the transfer from inventory to investment property? P5,400,000 P4,500,000 P4,050,000 P1,350,000 a. b. C. d.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8MC: On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was...

Related questions

Question

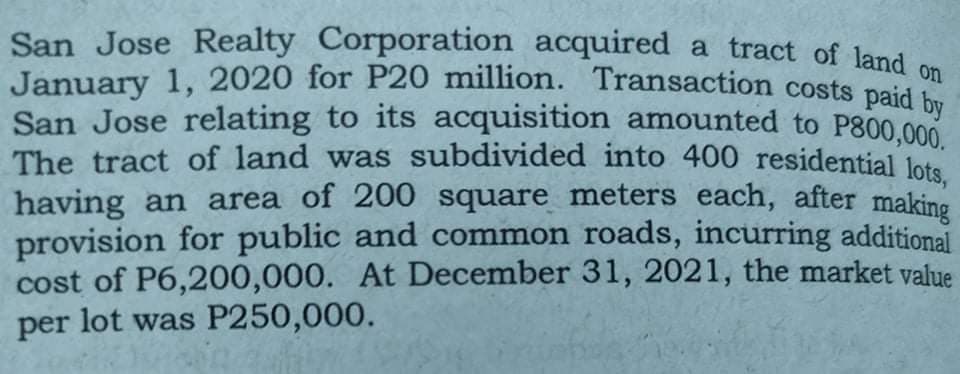

Transcribed Image Text:San Jose Realty Corporation acquired a tract of land on

January 1, 2020 for P20 million. Transaction costs paid

San Jose relating to its acquisition amounted to P800.000

The tract of land was subdivided into 400 residential lots

having an area of 200 square meters each, after making

provision for public and common roads, incurring additional

cost of P6,200,000. At December 31, 2021, the market value

per lot was P250,000.

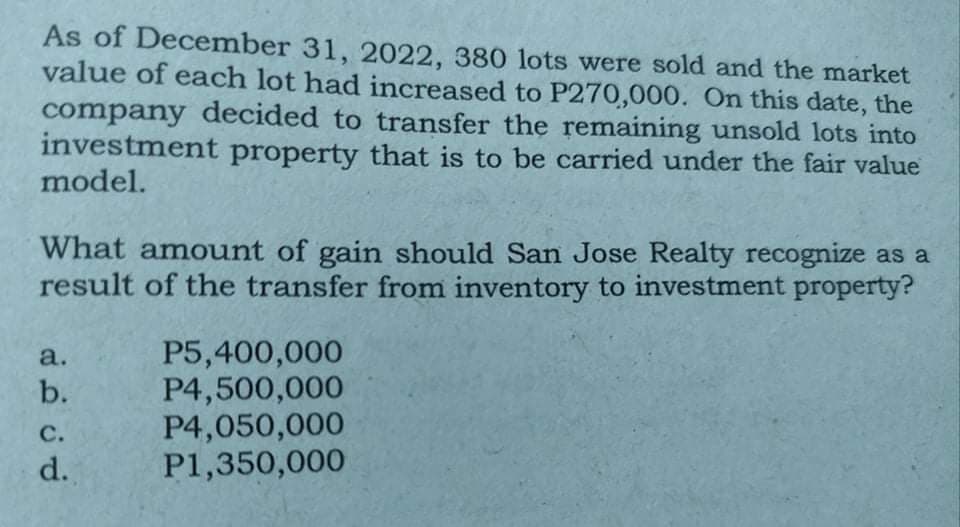

Transcribed Image Text:As of December 31, 2022, 380 lots were sold and the market

value of each lot had increased to P270,000. On this date, the

company decided to transfer the remaining unsold lots into

investment property that is to be carried under the fair value

model.

What amount of gain should San Jose Realty recognize as a

result of the transfer from inventory to investment property?

P5,400,000

P4,500,000

P4,050,000

P1,350,000

a.

b.

с.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning