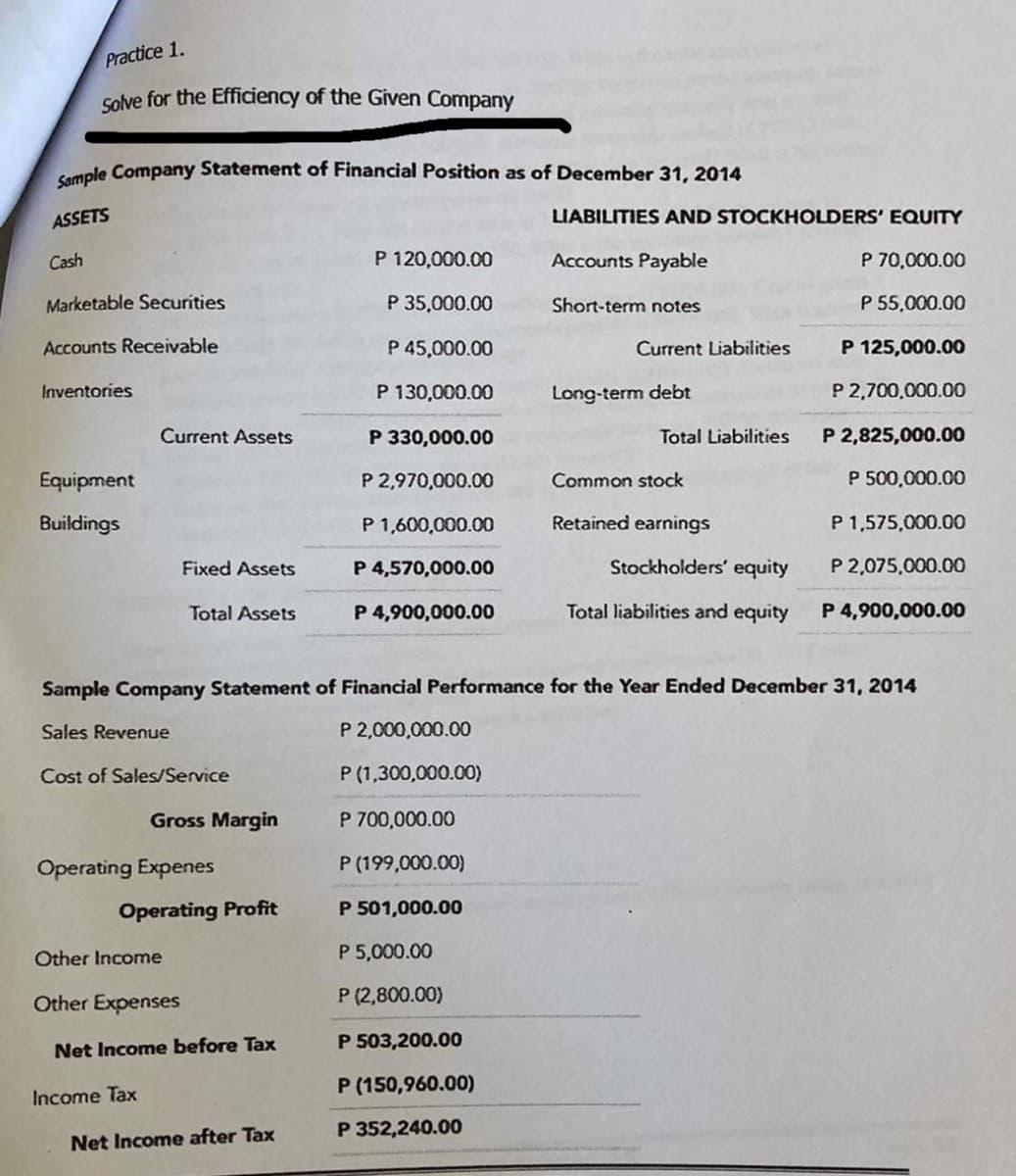

Practice 1. solve for the Efficiency of the Given Company aple Company Statement of Financial Position as of December 31, 2014 ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY Cash P 120,000.00 Accounts Payable P 70,000.00 Marketable Securities P 35,000.00 Short-term notes P 55,000.00 Accounts Receivable P 45,000.00 Current Liabilities P 125,000.00 Inventories P 130,000.00 Long-term debt P 2,700,000.00 Current Assets P 330,000.00 Total Liabilities P 2,825,000.00 Equipment P 2,970,000.00 Common stock P 500,000.00 Buildings P 1,600,000.00 Retained earnings P 1,575,000.00 Fixed Assets P 4,570,000.00 Stockholders' equity P 2,075,000.00 Total Assets P 4,900,000.00 Total liabilities and equity P 4,900,000.00 Sample Company Statement of Financial Performance for the Year Ended December 31, 2014 Sales Revenue P 2,000,000.00 Cost of Sales/Service P (1,300,000.00) Gross Margin P 700,000.00 Operating Expenes P (199,000.00) Operating Profit P 501,000.00 Other Income P 5,000.00 Other Expenses P (2,800.00) Net Income before Tax P 503,200.00 P (150,960.00) Income Tax P 352,240.00 Net Income after Tax

Practice 1. solve for the Efficiency of the Given Company aple Company Statement of Financial Position as of December 31, 2014 ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY Cash P 120,000.00 Accounts Payable P 70,000.00 Marketable Securities P 35,000.00 Short-term notes P 55,000.00 Accounts Receivable P 45,000.00 Current Liabilities P 125,000.00 Inventories P 130,000.00 Long-term debt P 2,700,000.00 Current Assets P 330,000.00 Total Liabilities P 2,825,000.00 Equipment P 2,970,000.00 Common stock P 500,000.00 Buildings P 1,600,000.00 Retained earnings P 1,575,000.00 Fixed Assets P 4,570,000.00 Stockholders' equity P 2,075,000.00 Total Assets P 4,900,000.00 Total liabilities and equity P 4,900,000.00 Sample Company Statement of Financial Performance for the Year Ended December 31, 2014 Sales Revenue P 2,000,000.00 Cost of Sales/Service P (1,300,000.00) Gross Margin P 700,000.00 Operating Expenes P (199,000.00) Operating Profit P 501,000.00 Other Income P 5,000.00 Other Expenses P (2,800.00) Net Income before Tax P 503,200.00 P (150,960.00) Income Tax P 352,240.00 Net Income after Tax

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter12: Valuation: Cash-flow Based Approaches

Section: Chapter Questions

Problem 2EIC

Related questions

Question

Transcribed Image Text:Practice 1.

Solve for the Efficiency of the Given Company

Cample Company Statement of Financial Position as of December 31, 2014

ASSETS

LIABILITIES AND STOCKHOLDERS' EQUITY

Cash

P 120,000.00

Accounts Payable

P 70,000.00

Marketable Securities

P 35,000.00

Short-term notes

P 55,000.00

Accounts Receivable

P 45,000.00

Current Liabilities

P 125,000.00

Inventories

P 130,000.00

Long-term debt

P 2,700,000.00

Current Assets

P 330,000.00

Total Liabilities

P 2,825,000.00

Equipment

P 2,970,000.00

Common stock

P 500,000.00

Buildings

P 1,600,000.00

Retained earnings

P 1,575,000.00

Fixed Assets

P 4,570,000.00

Stockholders' equity

P 2,075,000.00

Total Assets

P 4,900,000.00

Total liabilities and equity

P 4,900,000.00

Sample Company Statement of Financial Performance for the Year Ended December 31, 2014

Sales Revenue

P 2,000,000.00

Cost of Sales/Service

P (1,300,000.00)

Gross Margin

P 700,000.00

Operating Expenes

P (199,000.00)

Operating Profit

P 501,000.00

Other Income

P 5,000.00

Other Expenses

P (2,800.00)

Net Income before Tax

P 503,200.00

P (150,960.00)

Income Tax

P 352,240.00

Net Income after Tax

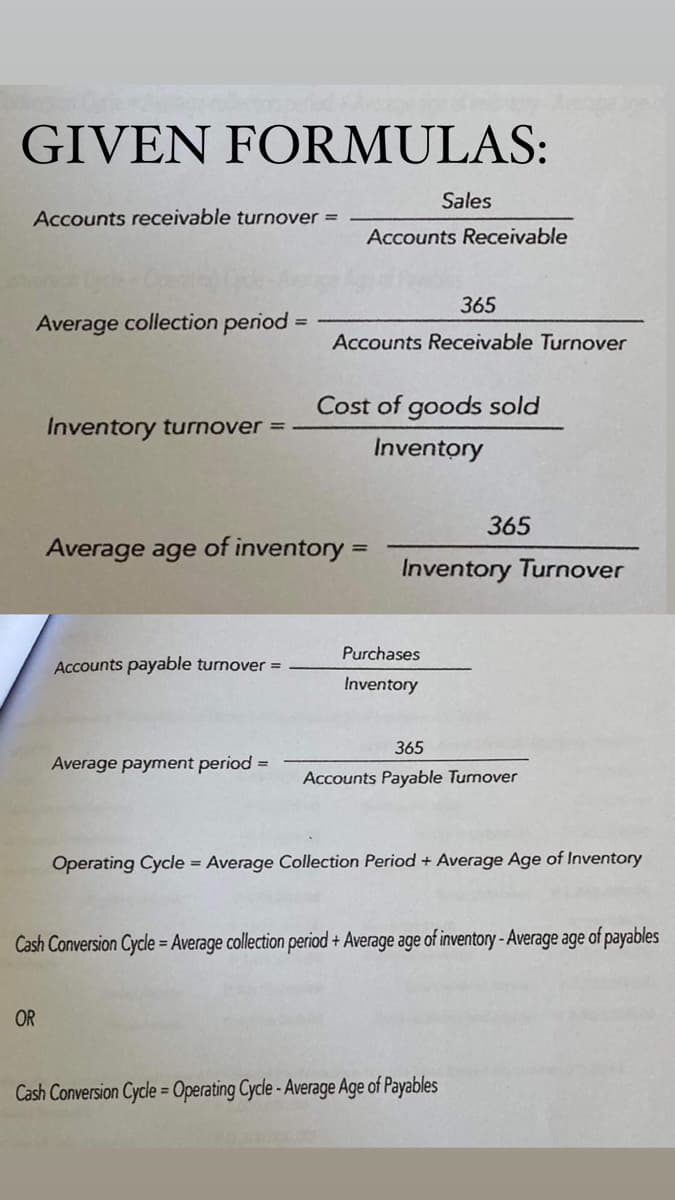

Transcribed Image Text:GIVEN FORMULAS:

Sales

Accounts receivable turnover =

Accounts Receivable

365

Average collection period =

Accounts Receivable Turnover

Cost of goods sold

Inventory turnover =

Inventory

365

Average age of inventory =

Inventory Turnover

Purchases

Accounts payable turnover =

Inventory

365

Average payment period =

Accounts Payable Turnover

Operating Cycle = Average Collection Period + Average Age of Inventory

Cash Conversion Cycle = Average collection period + Average age of inventory -Average age of payables

OR

Cash Conversion Cycle = Operating Cycle -Average Age of Payables

%3D

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning