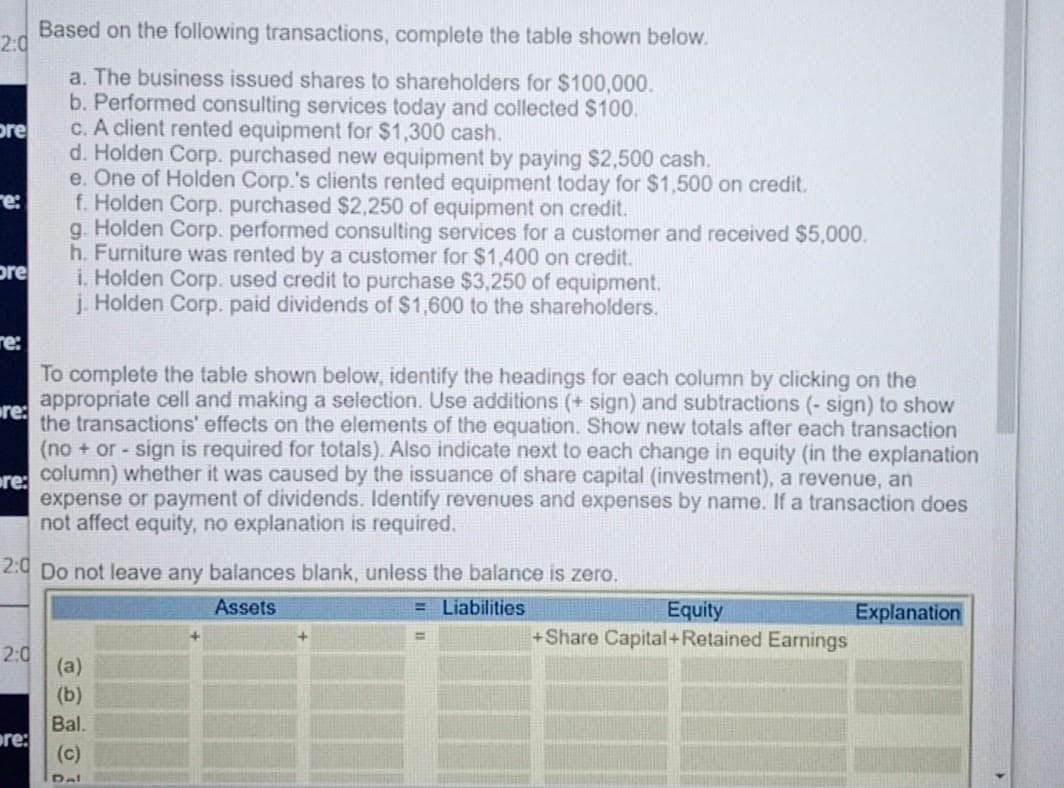

ased on the following transactions, complete the table shown below. a. The business issued shares to shareholders for $100,000. b. Performed consulting services today and collected $100. C. A client rented equipment for $1,300 cash. d. Holden Corp. purchased new equipment by paying $2,500 cash. e. One of Holden Corp.'s clients rented equipment today for $1,500 on credit. f. Holden Corp. purchased $2,250 of equipment on credit. g. Holden Corp. performed consulting services for a customer and received $5,000. h. Furniture was rented by a customer for $1,400 on credit. i. Holden Corp. used credit to purchase $3,250 of equipment. j. Holden Corp. paid dividends of $1,600 to the shareholders.

ased on the following transactions, complete the table shown below. a. The business issued shares to shareholders for $100,000. b. Performed consulting services today and collected $100. C. A client rented equipment for $1,300 cash. d. Holden Corp. purchased new equipment by paying $2,500 cash. e. One of Holden Corp.'s clients rented equipment today for $1,500 on credit. f. Holden Corp. purchased $2,250 of equipment on credit. g. Holden Corp. performed consulting services for a customer and received $5,000. h. Furniture was rented by a customer for $1,400 on credit. i. Holden Corp. used credit to purchase $3,250 of equipment. j. Holden Corp. paid dividends of $1,600 to the shareholders.

Chapter3: Analyzing And Recording Transactions

Section: Chapter Questions

Problem 11PA: The following information is provided for the first month of operations for Legal Services Inc.: A....

Related questions

Question

Transcribed Image Text:Based on the following transactions, complete the table shown below.

2:0

a. The business issued shares to shareholders for $100,000.

b. Performed consulting services today and collected $100.

C. A client rented equipment for $1,300 cash.

pre

d. Holden Corp. purchased new equipment by paying $2,500 cash.

e. One of Holden Corp.'s clients rented equipment today for $1,500 on credit.

f. Holden Corp. purchased $2,250 of equipment on credit.

g. Holden Corp. performed consulting services for a customer and received $5,000.

h. Furniture was rented by a customer for $1,400 on credit.

i. Holden Corp. used credit to purchase $3,250 of equipment.

j. Holden Corp. paid dividends of $1,600 to the shareholders.

re:

pre

re:

To complete the table shown below, identify the headings for each column by clicking on the

appropriate cell and making a selection. Use additions (+ sign) and subtractions (- sign) to show

re:

the transactions' effects on the elements of the equation. Show new totals after each transaction

(no + or- sign is required for totals). Also indicate next to each change in equity (in the explanation

re:

column) whether it was caused by the issuance of share capital (investment), a revenue, an

expense or payment of dividends. Identify revenues and expenses by name. If a transaction does

not affect equity, no explanation is required.

2:0 Do not leave any balances blank, unless the balance is zero.

Assets

= Liabilities

Equity

+Share Capital+Retained Earnings

Explanation

2:0

(a)

(b)

Bal.

pre:

(c)

Del

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning