ass corporation as defined) with a 31 March 2022 year of assessment. Calculate the tax inv(loss) for the current year of assessment taking the BELOW information into account. ation pertaining to assets disposed of during the year: Events D Date disposed of Capital gain/(loss) me 1-disposed 21 October 2021 65 000 ne 2-disposed 17 500 15 February 2022 18 August 2021 ng-disposed (22 500) There is an assessed capital loss from 2021 year of assessment of R57 000. 148 000 R20 400 R2 400 RRR

ass corporation as defined) with a 31 March 2022 year of assessment. Calculate the tax inv(loss) for the current year of assessment taking the BELOW information into account. ation pertaining to assets disposed of during the year: Events D Date disposed of Capital gain/(loss) me 1-disposed 21 October 2021 65 000 ne 2-disposed 17 500 15 February 2022 18 August 2021 ng-disposed (22 500) There is an assessed capital loss from 2021 year of assessment of R57 000. 148 000 R20 400 R2 400 RRR

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 28P

Related questions

Question

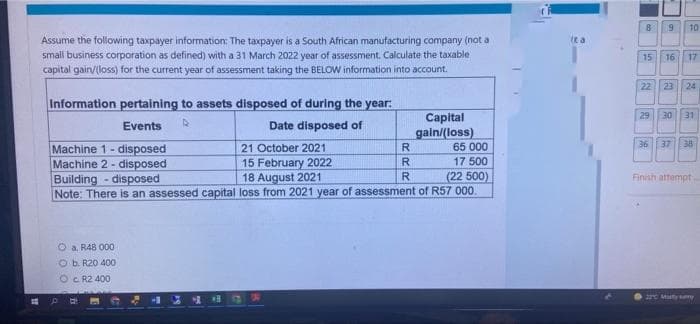

Transcribed Image Text:Assume the following taxpayer information: The taxpayer is a South African manufacturing company (not a

small business corporation as defined) with a 31 March 2022 year of assessment. Calculate the taxable

capital gain/(loss) for the current year of assessment taking the BELOW information into account.

Information pertaining to assets disposed of during the year:

Events R

Date disposed of

Capital

gain/(loss)

Machine 1-disposed

21 October 2021

65 000

Machine 2- disposed

15 February 2022

17 500

Building - disposed

18 August 2021

(22 500)

Note: There is an assessed capital loss from 2021 year of assessment of R57 000.

O a R48 000

O b. R20 400

OC R2 400

34

*B135

KRR

(t a

8

9

10

15 16 17

22 23 24

29

30 31

36 37 38

Finish attempt

22°C Maity Ty

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT