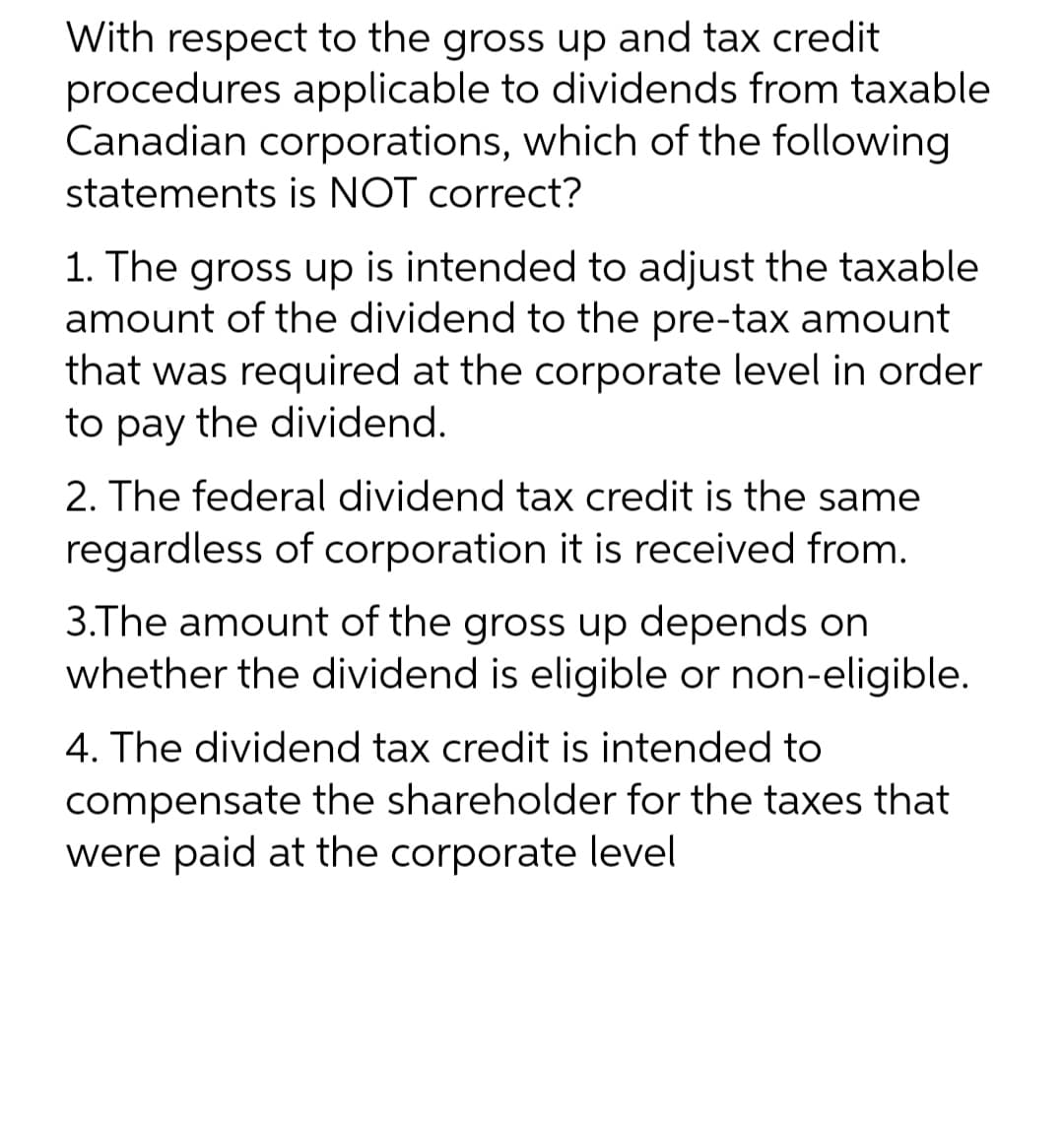

With respect to the gross up and tax credit procedures applicable to dividends from taxable Canadian corporations, which of the following statements is NOT correct?

With respect to the gross up and tax credit procedures applicable to dividends from taxable Canadian corporations, which of the following statements is NOT correct?

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 8BCRQ

Related questions

Question

Transcribed Image Text:With respect to the gross up and tax credit

procedures applicable to dividends from taxable

Canadian corporations, which of the following

statements is NOT correct?

1. The gross up is intended to adjust the taxable

amount of the dividend to the pre-tax amount

that was required at the corporate level in order

to pay the dividend.

2. The federal dividend tax credit is the same

regardless of corporation it is received from.

3.The amount of the gross up depends on

whether the dividend is eligible or non-eligible.

4. The dividend tax credit is intended to

compensate the shareholder for the taxes that

were paid at the corporate level

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you