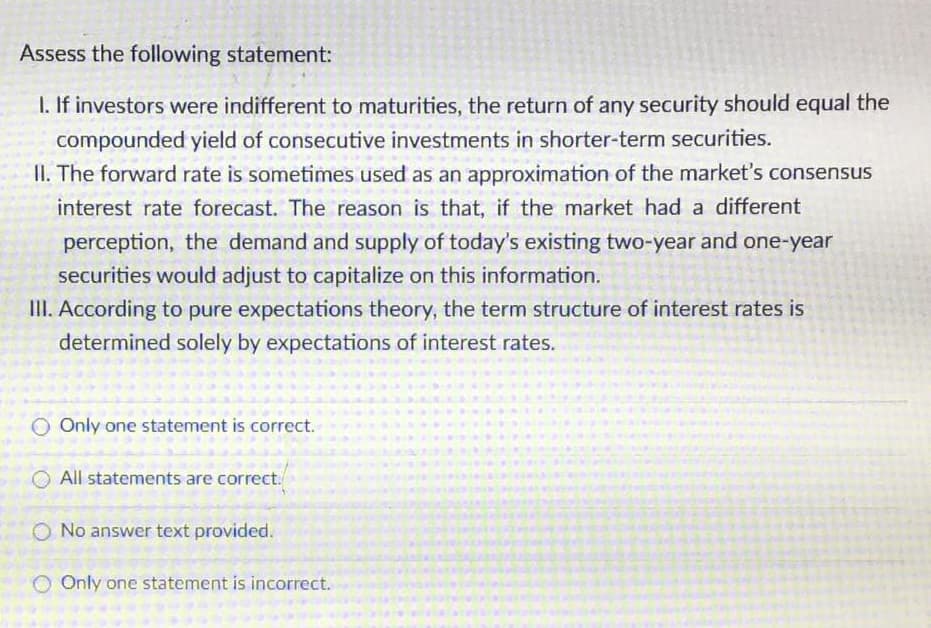

Assess the following statement: 1. If investors were indifferent to maturities, the return of any security should equal the compounded yield of consecutive investments in shorter-term securities. II. The forward rate is sometimes used as an approximation of the market's consensus interest rate forecast. The reason is that, if the market had a different perception, the demand and supply of today's existing two-year and one-year securities would adjust to capitalize on this information. III. According to pure expectations theory, the term structure of interest rates is determined solely by expectations of interest rates. O Only one statement is correct. All statements are correct. O No answer text provided. Only one statement is incorrect.

Assess the following statement: 1. If investors were indifferent to maturities, the return of any security should equal the compounded yield of consecutive investments in shorter-term securities. II. The forward rate is sometimes used as an approximation of the market's consensus interest rate forecast. The reason is that, if the market had a different perception, the demand and supply of today's existing two-year and one-year securities would adjust to capitalize on this information. III. According to pure expectations theory, the term structure of interest rates is determined solely by expectations of interest rates. O Only one statement is correct. All statements are correct. O No answer text provided. Only one statement is incorrect.

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 6BIC

Related questions

Question

Transcribed Image Text:Assess the following statement:

1. If investors were indifferent to maturities, the return of any security should equal the

compounded yield of consecutive investments in shorter-term securities.

II. The forward rate is sometimes used as an approximation of the market's consensus

interest rate forecast. The reason is that, if the market had a different

perception, the demand and supply of today's existing two-year and one-year

securities would adjust to capitalize on this information.

III. According to pure expectations theory, the term structure of interest rates is

determined solely by expectations of interest rates.

O Only one statement is correct.

All statements are correct.

O No answer text provided.

O Only one statement is incorrect.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you