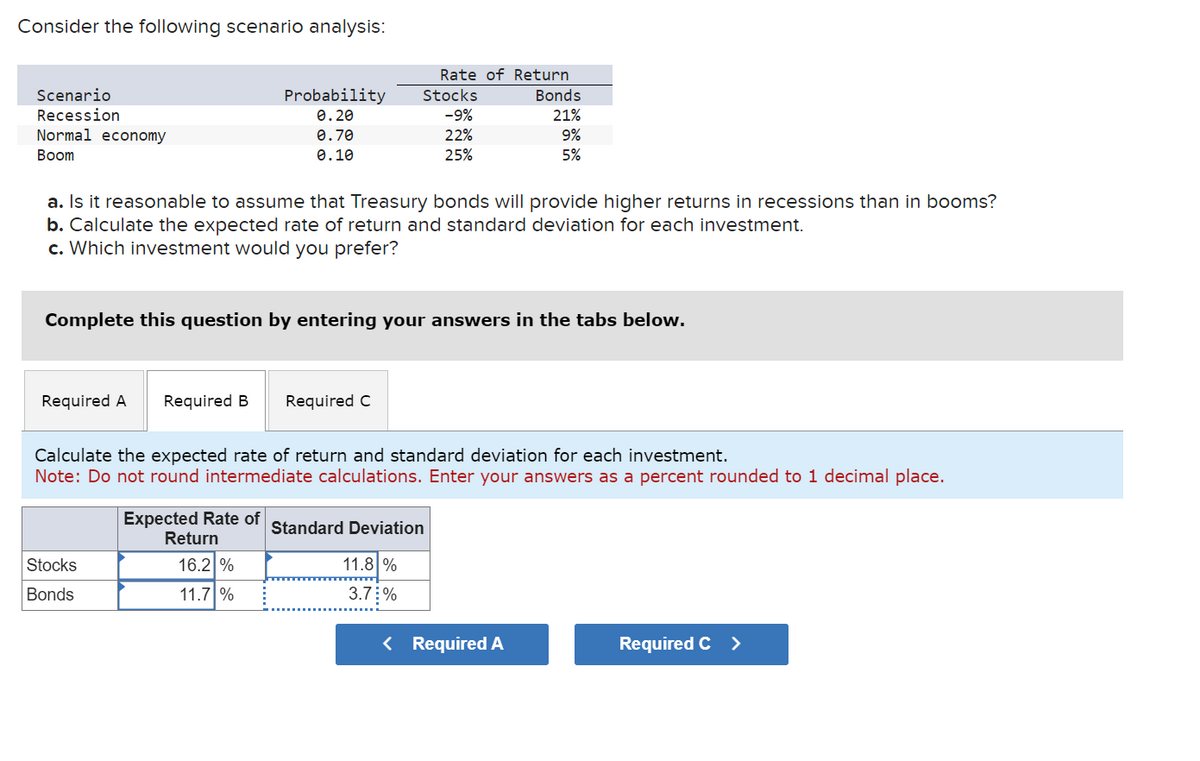

Consider the following scenario analysis: Rate of Return Scenario Recession Normal economy Boom Probability 0.20 Stocks Bonds -9% 21% 0.70 0.10 22% 9% 25% 5% a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the expected rate of return and standard deviation for each investment. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal place. Expected Rate of Standard Deviation Return Stocks 16.2% Bonds 11.7 % 11.8 % 3.7% < Required A Required C >

Consider the following scenario analysis: Rate of Return Scenario Recession Normal economy Boom Probability 0.20 Stocks Bonds -9% 21% 0.70 0.10 22% 9% 25% 5% a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms? b. Calculate the expected rate of return and standard deviation for each investment. c. Which investment would you prefer? Complete this question by entering your answers in the tabs below. Required A Required B Required C Calculate the expected rate of return and standard deviation for each investment. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal place. Expected Rate of Standard Deviation Return Stocks 16.2% Bonds 11.7 % 11.8 % 3.7% < Required A Required C >

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter15: Decision Analysis

Section: Chapter Questions

Problem 4P: Investment advisors estimated the stock market returns for four market segments: computers,...

Related questions

Question

- Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?

- Calculate the expected

rate of return and standard deviation for each investment. - Which investment would you prefer?

Transcribed Image Text:Consider the following scenario analysis:

Rate of Return

Scenario

Recession

Normal economy

Boom

Probability

0.20

Stocks

Bonds

-9%

21%

0.70

0.10

22%

9%

25%

5%

a. Is it reasonable to assume that Treasury bonds will provide higher returns in recessions than in booms?

b. Calculate the expected rate of return and standard deviation for each investment.

c. Which investment would you prefer?

Complete this question by entering your answers in the tabs below.

Required A

Required B Required C

Calculate the expected rate of return and standard deviation for each investment.

Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal place.

Expected Rate of Standard Deviation

Return

Stocks

16.2%

Bonds

11.7 %

11.8 %

3.7%

< Required A

Required C >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning