Date Placed in Service MACRS Cost Buse Property Class Asset Type Machine tools $5,000 3 уears 7 years 39 years March 17 CNC machine May 25 $125,000 Warehouse June 19 $335,000

Q: how much Depreciation Expense should Bean record in total for all of it's long-term assets on…

A: Depreciation Cost The purpose of providing the depreciation cost is to know actual net value of the…

Q: Reverend Company acquired a new processing machine at the beginning of the current year: Invoice…

A: On a company's balance sheet, a capitalized cost is an item that is added to the cost base of a…

Q: The cost and estimated useful life of accounts under Property, Plant and Equipment of FDNACCT Co.…

A: Introduction: Property, plant, and equipment: Property, plant, and equipment is the balance sheet's…

Q: Wickland Company installs a manufacturing machine in its production facility at the beginning of the…

A: Under units of production method : Depreciation Expense = (Original cost of asset-salvage…

Q: Hidd copier on April 30, purchases a machine for BD 55,000. The machine is expected to last ten…

A: The depreciation is the decrease in value of an asset with the passage of time.

Q: Computer equipment purchased 6 1/2 years ago for $170,000 with an estimated life of 8 years and a…

A: A journal entry is used to record day-to-day transactions of the business by debiting and crediting…

Q: Martin Company purchases a machine at the beginning of the year at a cost of $63,000. The machine is…

A: Book value of the machine at the end of the estimated useful life is its salvage value.

Q: A building maintenance bought a pump set for 90,000. Installation cost amounted to P10,000. The pump…

A: Depreciation is the non-cash expense which is recorded in the books in order to report the regular…

Q: The pertinent information about a piece of construction equiptment follows: cost $75,000 Estimated…

A: Double declining balance method is used in charging depreciation on assets. Under this method, the…

Q: Depreciation Choices and Outcome. Mulligan Co. purchased a new machine on January 1. The following…

A: Cost to be capitalise all expenses incurred to acquire an asset to get asset ready to use.…

Q: engineering department at factory, acquired new piece of equipment for its labs. The equipment has…

A: Declining Balance Method - It is method of depreciation in which the depreciation expense declines…

Q: Jan. 6. Purchased a new truck for $60,000, paying cash. Apr. 1. Sold the used truck for $14,000.…

A: Depreciation: Depreciation Cost is the cost that is allocated over its life and it is charged as an…

Q: i have tried to get this problem correct but i am getting confused with the dates and how to write…

A: Prepare the journal entry for year 1:

Q: Machinery was purchased on January 1 for $72,000. The machinery has an estimated life of 7 years and…

A: Depreciation for Year 1 = $72,000 * 2/7 = $20,571.43

Q: Prepare journal entries to record the machine's disposal under each separate situation: (a) it is…

A: As per AS-10 "Accounting for Fixed Assets", expenses incurred on acquiring the asset and expenses…

Q: Determine the cost of the a. Land b. New building c. Land improvement

A: Cost of fixed assets shall include it's Purchase cost and all cost incurred to bring the asset to…

Q: Keaubie Co. purchased machinery at a cost of $175,000 cash. Other costs included: taxes,…

A: In bookkeeping, depreciation alludes to two parts of a similar idea: first, the real diminishing of…

Q: The cost and estimated useful life of accounts under Property, Plant and Equipment of FDNACCT Co.…

A: Plant, Property & Equipment: PP&E stands for "property, plant, and equipment," which refers…

Q: Cost of asset: $120,000, purchased on the first day of Year 1. Estimated Useful life: 7 years…

A: Annual Depreciation=Cost-Salvage valueUseful life=$120,000-$15,0007=$15,000

Q: Martin Company purchases a machine at the beginning of the year at a cost of $155,000. The machine…

A: Thus, depreciation is the decrease in asset value as well as the technique utilized to reallocate,…

Q: Onslow Co. purchased a used machine for $178,000 cash on January 2. On January 3, Onslow paid $2,840…

A:

Q: On January 1, Walker purchased a used machine for $150,000. On January 4, Walker paid $3,510 to wire…

A: Straight line method depreciation: = ( cost of asset - salvage value ) / number of useful years…

Q: Sabel Company purchased assembly equipment for $594,000 on January 1, Year 1. Sabel's financial…

A: The depreciation expense is charged on fixed assets as reduction in the value of fixed assets with…

Q: Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the…

A:

Q: Turtle Co. purchased equipment on January 2, 20x1, for ₱50,000. The equipment had an estimated…

A: Depreciation expense is related to the drop in the value of an asset periodically because of the…

Q: An industrial plant bought a generator set for ₱90,000. Other expenses including installation…

A: Sum-of-the-years'-digits = 1+2+3+4+5+6+7+8+9+10+11+12+13+14+15+16+17…

Q: Mohr Company purchases a machine at the beginning of the year at a cost of $36,000. The machine is…

A: Answer) Calculation of depreciation expense for the year 2 Depreciation for Year 2 = Book value at…

Q: A company purchased new furniture at a cost of $33,000 on September 30. The furniture is estimated…

A: Depreciable cost =Cost-Salvage value=$33,000-$3,900=$29,100

Q: Mid Company purchased a building for $130,000 with an estimated useful life of 10 years and $10,000…

A: Formula for Depreciation Calculation using SLM (Cost of purchase - salvage value)/useful life…

Q: Computer equipment (office equipment) purchased 6 1/2 years ago for $170,000, with an estimated life…

A: Working Note: Annual Depreciation (straight line method) = (Cost of the assets - Residual value) /…

Q: Intangible Long-Term Assets Track Town Co. had the following transactions involving intangible…

A: Amortization - Amortization of intangibles is the expense incurred on the intangibles. Amortization…

Q: Orion Flour Mills purchased a new machine and made the following expenditures:…

A:

Q: Martin Company purchases a machine at the beginning of the year at a cost of $68,000. The machine is…

A: Introduction: Depreciation: Decreasing value of fixed assets over its useful life period called as…

Q: Exact Photo Service purchased a new color printer at the beginning of Year 1 for $42,400. The…

A: Depreciation represents the reduction in the value of an asset over a useful life of the asset.

Q: Martin Company purchases a machine at the beginning of the year at a cost of $155,000. The machine…

A: Depreciation is an accounting strategy that spreads the cost of a tangible or physical thing over…

Q: On January 1, Year 1, Wolly Company purchased a truck that cost $70,000. The truck had an expected…

A: Depreciation per unit (Units of production method) =(cost of Asset - salvage value ) / Estimated…

Q: Knife Edge Company purchased tool sharpening equipment on July 1, 20Y5, for $16,200. The equipment…

A: 1. Depreciation Expenses - Depreciation expense is the expense incurred by the company as a reason…

Q: On January 1 of the current year, the Jordan Morris Company purchased office machinery for $91,000.…

A: The expenses charged to income statement as estimated cost of using fixed asset is called…

Q: Plant Master Company purchased a delivery van for $35,000 on January 1. The van has an estimated…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: A company purchased a new truck at a cost of $42,000 on July 1. The truck is estimated to have a…

A: Depreciable cost = Original cost - Salvage value = $42,000 - $3,000 = $39,000

Q: Double-declining balance depreciation for the second year would be Select the correct answer.…

A: Answer: $14,489

Q: Onslow Company purchased a used machine for $192,000 cash on January 2. On January 3, Onslow palid…

A: Machinery is the non-current asset for an entity that can used for running the business operations.

Q: Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the…

A: Straight-Line Depreciation Choose Numerator: / Choose Denominator: = Annual Depreciation Expense…

Q: Mohr Company purchases a machine at the beginning of the year at a cost of $28,000. The machine is…

A: Depreciation: Depreciation means the reduction in the value of an asset over the life of the assets…

Q: Orion Flour Mills purchased a new machine and made the following expenditures: Purchase…

A: The cost of machinery includes expenses that are incurred for making machinery ready to use. It…

Q: Computer equipment purchased 6 1/2 years ago for $170,000 with an estimated life of 8 years and a…

A: The straight-line method is the simplest method for the calculation of the amount of depreciation…

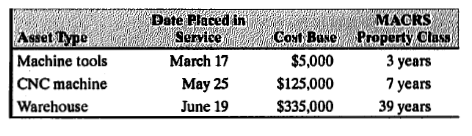

In 2012, three assets were purchased and placed in service by a firm:

Compute the

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

- Entity A acquires equipment on January 1, 20x1. Information on costs is as follows: Purchase price, gross of P10,000 trade discount 800,000 Non-refundable purchase taxes 20,000 Delivery and handling costs 40,000 Installation costs 30,000 Present value of decommissioning and restoration costs 10,000 1.) How much is the initial cost of the equipment? A. P 890,000 B. P 820,000 C. P 900,000 D. P 870,0001. ABC company purchased an equipmentfor P54.000 on 1980. Installation costamounting to P6,000. The equipment areexpected to have a useful life at the end of1996 with a salvage value of 10% of theoriginal cost. Determine the book value atthe end of 1992 by;Straight-line methoda. P 19.000b. P 19.500C. P 20.000d. P 20,500Sinking fund method at 12% interest.a. P 27.354c. P 29.520b. P 30,333d. P 41,200PQ16.04 Shaffer Company acquires land for $77,000 cash. Additional costs are as follows. Removal of shed $ 300 Filling and grading 1,500 Salvage value of lumber of shed 120 Broker commission 1,130 Paving of parking lot 10,000 Closing costs 560 Shaffer will record the acquisition cost of the land at?

- A $48,000 asset was purchased and classified as a Class 10 asset for CCA purposes. If the CCA rate is 30%, calculate UCC for the end of year 3. Select one: a. $15,800 b. $18,300 c. $19,992 d. $17,400 e. $16,660 ???Dr.Cr.(GH₵)(GH₵)Stated capital310Income surplus at 1 January 2017456Inventory at 1 January 2017236Turnover1,468Purchases856Salaries46Directors salaries (admin expense)116Land & building at cost550Plant & equipment at cost578Land & building- accumulated depreciation as at 1 January 2017154Plant & equipment –accumulated depreciation as at 1 January 2017266Bank interest received6Sundry expenses56Trade receivables110Trade payables122Accruals42Cash at bank43Dividends paid36Administrative expenses183Interest paid142,8242,824The following information is also relevant:(1) Inventory at 31st December 2017 is GH₵256(2) The tax liability for the year is estimated to be 20% of the profit before tax.4(3) The original cost of land and buildings is made up of GH₵100 land and GH₵450 buildings. Buildings are used in administration and depreciation is charged on a straight line basis over the estimated useful life of 50 years.(4) Plant & equipment are used in distribution and…help me Question 6The following trial balance was extracted from the ledger of Juliana at 31 December2020.JulianaTrial Balance as at 31 December 2020RM RMLand at cost 26,000Plant at cost 83,000Accumulated Depreciation at 1 January 2020- Plant 13,000Office Equipment 33,000Accumulated Depreciation at 1 January 2020Office Equipment 8,000Receivables 198,000Payables 52,000Sales 763,000Purchases 516,000Returns inwards 47,000Discount allowed 4,000Capital at 1st January 2020 230,000Drawings 14,000Provision for doubtful debts at 1 January 2020 23,000Salaries Expense 44,000Administration costs 38,000Bank 75,000Bad debts written off 77,000Inventory at 1 January 2020 84,0001,164,000 1,164,000Additional information: Closing inventory is RM74,000. Depreciation on plant is charged at 10% per annum on cost. Depreciationon office equipment is charged at 20% per annum using the reducingbalance method. Administration costs include insurance prepaid of RM3,000. Salary accrued amount to RM2,000. The…

- 1. The following information is from Direct to You Corp.’s (DYC) financial records for its year ended December 31, 2020: Select statement of financial position information: 2020 2019 Investments in financial assets (at fair value through profit or loss [FVPL]) 12,000 10,000 Inventory 575,000 498,000 Property, plant, and equipment (PPE) 1,984,000 1,396,000 Less: accumulated depreciation (650,400) (487,000) Copyright 126,000 135,000 Patents 564,000 417,000 Select statement of comprehensive income information: Depreciation of property, plant, and equipment (334,400) Amortization of patents (65,000) Interest expense (75,000) Impairment loss — copyright (9,000) Gain on sale of PPE 23,000 Additional information: PPE that originally cost $570,000 was sold during the year. 100,000 common shares were issued in 2020 to acquire $450,000 of property, plant, and equipment. DYC is subject to IFRS. What amount of net cash used…14 Majestic LLC purchased a factory for lump-sum of RO800,000 paid via bank. The fair value of each of component of the purchase is given below: Asset Fair Market value Land 85000 Building 155000 Equipment 460000 Calculate the amount at which each of the above components shall be recognized on purchase date and write the journal entry for recording purchase transaction. a. Dr Land Ac OMR 85000 Dr Building A/C 155000 Dr Equipment A/C 460000and Cr Cash A/C OMR 700000 b. Dr Land Ac OMR 97120 Dr Building A/C 177120 Dr Equipment A/C 525760 and Cr Cash A/C OMR 800000 c. None of the given options d. Dr Cash A/C OMR 800000 and Cr land A/c 97120 Cr Building A/C 177120 Equipment A/C 460000Dane ASA bothpurchases and constructs various equipment it uses in its operations. The followingitems for two different types of equipment were recorded in random order during thecalendar year 2019. PurchaseCash paid for equipment, including sales tax of €5,000 €105,000Freight and insurance cost while in transit 2,000Cost of moving equipment into place at factory 3,100Wage cost for technicians to test equipment 6,000Insurance premium paid during first year of operation on this equipment 1,500Special plumbing fixtures required for new equipment 8,000Repair cost incurred in first year of operations related to this equipment 1,300ConstructionMaterial and purchased parts (gross cost €200,000; failed to take 1% cashdiscount)€200,000Imputed interest on funds used during construction (share financing) 14,000Labor costs 190,000Allocated overhead costs (fixed—€20,000; variable—€30,000) 50,000Profit on self-construction 30,000Cost of installing equipment 4,400InstructionsCompute the total cost…

- A SE company has on its books for its proved property: P/P- tangible assets $50,000 Well and E&F $220,000 Accumulated DD&A $32,000 If the entire proved property is sold for $220,000, what will be any gain or loss? AccouintingThese are the books of Riya Distributers as at 28 February 2021.Equipment R20 000, Accumulated Depreciation R16 000. Depreciation is calculated at 20% p. a. ona diminishing method. An old equipment was disposed for R1 500 cash on 1 December 2020. Theequipment originally costed R3 000. The Accumulated depreciation is R 700.The depreciation for the disposed equipment isP12.1B (L0 1,2,3,5) (Correct Intangible Asset Account) Dolphin Co., organized in 2019, has set up a single account for all intangible assets. The following summary discloses the debit entries that have been recorded during 2020 and 2021: Instructions 3/1/2020 3/1/2020 4/1/2020 6/30/2020 9/1/2020 12/31/2020 6/30/2021 9/1/2021 Intangible Assets 10-year franchise agreement; expires 2/28/28 Organization costsAdvance payment for 2 years for office space Purchased a patent (8-year life) Cost to develop a patent (10-year life) Net operating loss for 2020Research and development costsLegal fee to successfully defend internally developed patent $ 60,000 7,000 24,000 80,000 40,000 61,000 265,000 13,500 Prepare the necessary entries to clear the Intangible Assets account and to set up separate accounts for distinct types of intangibles. Make the entries as of December 31, 2021, recording any necessary amortization and reflecting all balances accurately as of that date. (Ignore…