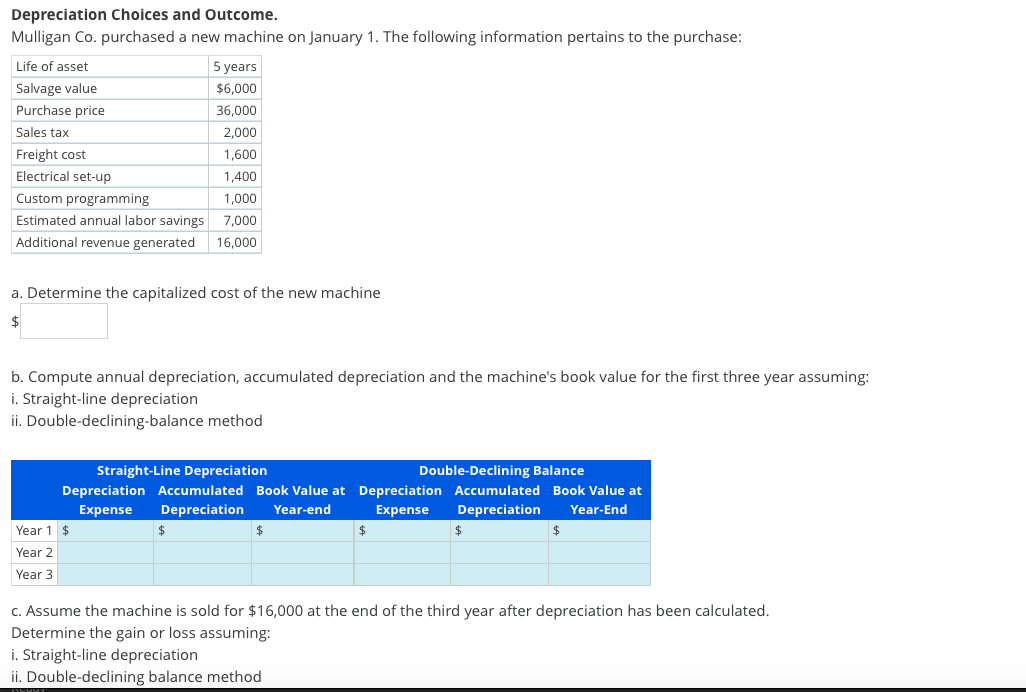

Depreciation Choices and Outcome. Mulligan Co. purchased a new machine on January 1. The following information pertains to the purchase: 5 years $6,000 36,000 Sales tax 2,000 Freight cost 1,600 Electrical set-up 1,400 Custom programming 1,000 Estimated annual labor savings 7,000 Additional revenue generated 16,000 Life of asset Salvage value Purchase price a. Determine the capitalized cost of the new machine $ b. Compute annual depreciation, accumulated depreciation and the machine's book value for the first three year assuming: i. Straight-line depreciation ii. Double-declining-balance method Year 1 Year 2 Year 3 Straight-Line Depreciation Double-Declining Balance Depreciation Accumulated Book Value at Depreciation Accumulated Book Value at Expense Depreciation Year-end Expense Depreciation Year-End $ $ c. Assume the machine is sold for $16,000 at the end of the third year after depreciation has been calculated. Determine the gain or loss assuming: i. Straight-line depreciation ii. Double-declining balance method

Depreciation Choices and Outcome. Mulligan Co. purchased a new machine on January 1. The following information pertains to the purchase: 5 years $6,000 36,000 Sales tax 2,000 Freight cost 1,600 Electrical set-up 1,400 Custom programming 1,000 Estimated annual labor savings 7,000 Additional revenue generated 16,000 Life of asset Salvage value Purchase price a. Determine the capitalized cost of the new machine $ b. Compute annual depreciation, accumulated depreciation and the machine's book value for the first three year assuming: i. Straight-line depreciation ii. Double-declining-balance method Year 1 Year 2 Year 3 Straight-Line Depreciation Double-Declining Balance Depreciation Accumulated Book Value at Depreciation Accumulated Book Value at Expense Depreciation Year-end Expense Depreciation Year-End $ $ c. Assume the machine is sold for $16,000 at the end of the third year after depreciation has been calculated. Determine the gain or loss assuming: i. Straight-line depreciation ii. Double-declining balance method

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 15PB: Urquhart Global purchases a building to house its administrative offices for $500,000. The best...

Related questions

Question

N1

Transcribed Image Text:Depreciation Choices and Outcome.

Mulligan Co. purchased a new machine on January 1. The following information pertains to the purchase:

5 years

$6,000

36,000

Sales tax

2,000

Freight cost

1,600

Electrical set-up

1,400

Custom programming

1,000

Estimated annual labor savings

7,000

Additional revenue generated 16,000

Life of asset

Salvage value

Purchase price

a. Determine the capitalized cost of the new machine

$

b. Compute annual depreciation, accumulated depreciation and the machine's book value for the first three year assuming:

i. Straight-line depreciation

ii. Double-declining-balance method

Year 1

Year 2

Year 3

Straight-Line Depreciation

Double-Declining Balance

Depreciation Accumulated Book Value at Depreciation Accumulated Book Value at

Expense Depreciation Year-end

Expense Depreciation Year-End

$

$

c. Assume the machine is sold for $16,000 at the end of the third year after depreciation has been calculated.

Determine the gain or loss assuming:

i. Straight-line depreciation

ii. Double-declining balance method

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning