Asset valuation and risk Personal Finance Problem Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $3,100 for each of the next 4 years and S17,399 in 5 years. Her research indicates that she must earn 5% on low-risk assets, 9% on average-risk assets, and 14% on high-risk assets. a. Determine what is the most Laura should pay for the asset if it is classified as (1) low-risk, (2) average-risk, and (3) high-risk. b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, what is the most she should pay? Why? c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. a. (1) The most Laura should pay for the asset if it is classified as low-risk is $. (Round to the nearest cent.) (2) The most Laura should pay for the asset if it is classified as average-risk is S. (Round to the nearest cent.) (3) The most Laura should pay for the asset if it is classified as high-risk is $. (Round to the nearest cent.)

Asset valuation and risk Personal Finance Problem Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $3,100 for each of the next 4 years and S17,399 in 5 years. Her research indicates that she must earn 5% on low-risk assets, 9% on average-risk assets, and 14% on high-risk assets. a. Determine what is the most Laura should pay for the asset if it is classified as (1) low-risk, (2) average-risk, and (3) high-risk. b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, what is the most she should pay? Why? c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. a. (1) The most Laura should pay for the asset if it is classified as low-risk is $. (Round to the nearest cent.) (2) The most Laura should pay for the asset if it is classified as average-risk is S. (Round to the nearest cent.) (3) The most Laura should pay for the asset if it is classified as high-risk is $. (Round to the nearest cent.)

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 5FPE

Related questions

Question

Question screenshotted below

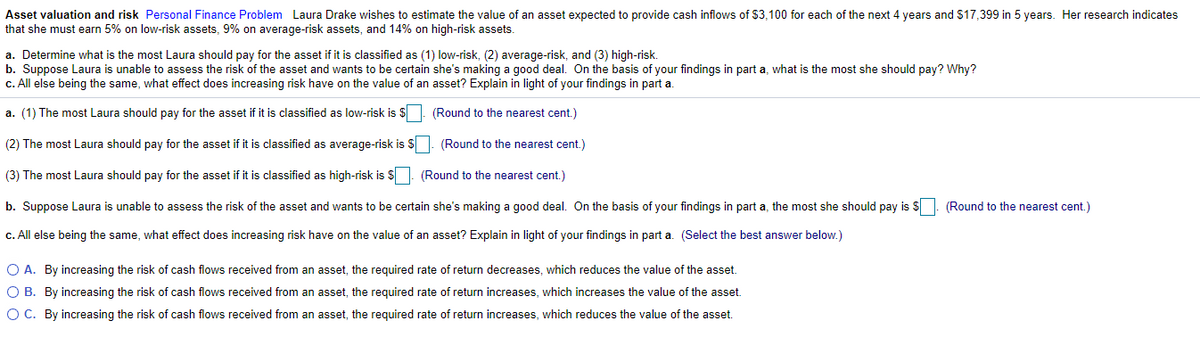

Transcribed Image Text:Asset valuation and risk Personal Finance Problem Laura Drake wishes to estimate the value of an asset expected to provide cash inflows of $3,100 for each of the next 4 years and $17,399 in 5 years. Her research indicates

that she must earn 5% on low-risk assets, 9% on average-risk assets, and 14% on high-risk assets.

a. Determine what is the most Laura should pay for the asset if it is classified as (1) low-risk, (2) average-risk, and (3) high-risk.

b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, what is the most she should pay? Why?

c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a.

a. (1) The most Laura should pay for the asset if it is classified as low-risk is $ | (Round to the nearest cent.)

(2) The most Laura should pay for the asset if it is classified as average-risk is $. (Round to the nearest cent.)

(3) The most Laura should pay for the asset if it is classified as high-risk is $. (Round to the nearest cent.)

b. Suppose Laura is unable to assess the risk of the asset and wants to be certain she's making a good deal. On the basis of your findings in part a, the most she should pay is $

(Round to the nearest cent.)

c. All else being the same, what effect does increasing risk have on the value of an asset? Explain in light of your findings in part a. (Select the best answer below.)

O A. By increasing the risk of cash flows received from an asset, the required rate of return decreases, which reduces the value of the asset.

O B. By increasing the risk of cash flows received from an asset, the required rate of return increases, which increases the value of the asset.

O C. By increasing the risk of cash flows received from an asset, the required rate of return increases, which reduces the value of the asset.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning