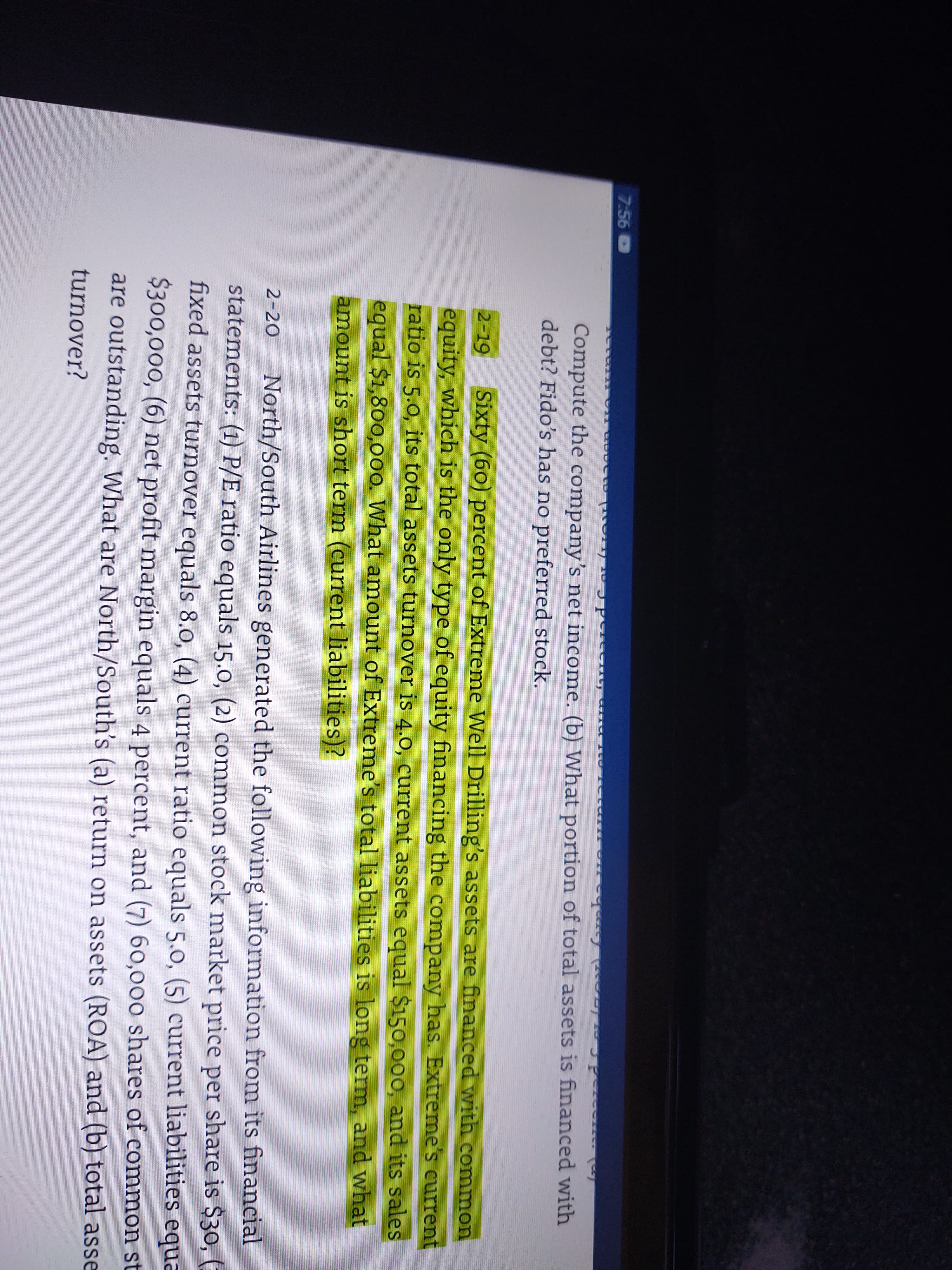

assets are financed with common he company has. Extreme's currer Issets equal $150,000, and its sales liabilities is long term, and what

assets are financed with common he company has. Extreme's currer Issets equal $150,000, and its sales liabilities is long term, and what

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 7P: Your division is considering two investment projects, each of which requires an up-front expenditure...

Related questions

Question

100%

Help

Transcribed Image Text:assets are financed with common

he company has. Extreme's currer

Issets equal $150,000, and its sales

liabilities is long term, and what

Expert Solution

Step 1

“Hey, as a particular question is highlighted, it is assumed that you are asking help for this question and so only that question is being answered.”

Step 2

Liabilities:

Liabilities are referred to as the obligation of the business towards the creditors for operating the business. Liabilities may be short-term or long-term depending upon the time duration in which it is paid back to the creditors.

Ratio analysis:

It is the financial analysis tool for measuring the profitability, liquidity, capability and overall performance of a company.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT