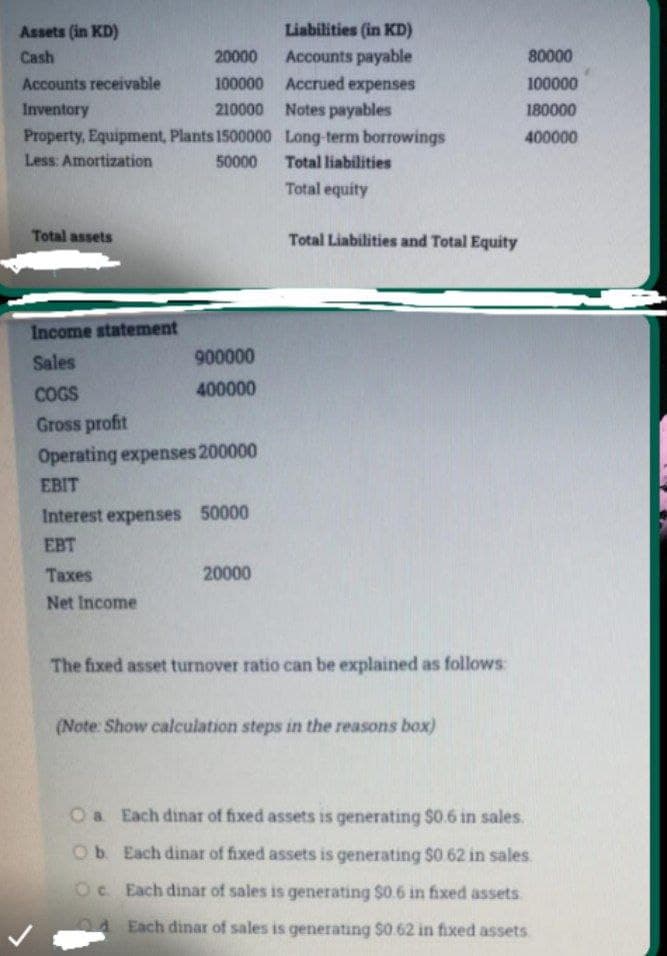

Assets (in KD) Liabilities (in KD) Cash 20000 Accounts payable 80000 100000 Accrued expenses 210000 Notes payables Property, Equipment, Plants 1500000 Long-term borrowings Accounts receivable 100000 Inventory 180000 400000 Less: Amortization 50000 Total liabilities Total equity Total assets Total Liabilities and Total Equity Income statement Sales 900000 COGS 400000 Gross profit Operating expenses 200000 EBIT Interest expenses 50000 EBT Тахes 20000 Net Income The fixed asset turnover ratio can be explained as follows (Note: Show calculation steps in the reasons box)

Assets (in KD) Liabilities (in KD) Cash 20000 Accounts payable 80000 100000 Accrued expenses 210000 Notes payables Property, Equipment, Plants 1500000 Long-term borrowings Accounts receivable 100000 Inventory 180000 400000 Less: Amortization 50000 Total liabilities Total equity Total assets Total Liabilities and Total Equity Income statement Sales 900000 COGS 400000 Gross profit Operating expenses 200000 EBIT Interest expenses 50000 EBT Тахes 20000 Net Income The fixed asset turnover ratio can be explained as follows (Note: Show calculation steps in the reasons box)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter12: Fainancial Statement Analysis

Section: Chapter Questions

Problem 16MCQ

Related questions

Topic Video

Question

Transcribed Image Text:Assets (in KD)

Liabilities (in KD)

Cash

20000

Accounts payable

80000

Accounts receivable

100000 Accrued expenses

100000

210000 Notes payables

Property, Equipment, Plants 1500000 Long-term borrowings

Inventory

180000

400000

Less: Amortization

50000

Total liabilities

Total equity

Total assets

Total Liabilities and Total Equity

Income statement

Sales

900000

COGS

400000

Gross profit

Operating expenses 200000

EBIT

Interest expenses 50000

EBT

Taxes

20000

Net Income

The fixed asset turnover ratio can be explained as follows:

(Note: Show calculation steps in the reasons box)

Oa Each dinar of fixed assets is generating $0.6 in sales.

Ob Each dinar of fixed assets is generating $0.62 in sales

Oc Each dinar of sales is generating $0.6 in fixed assets

04 Each dinar of sales is generating $0.62 in fixed assets.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning